Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

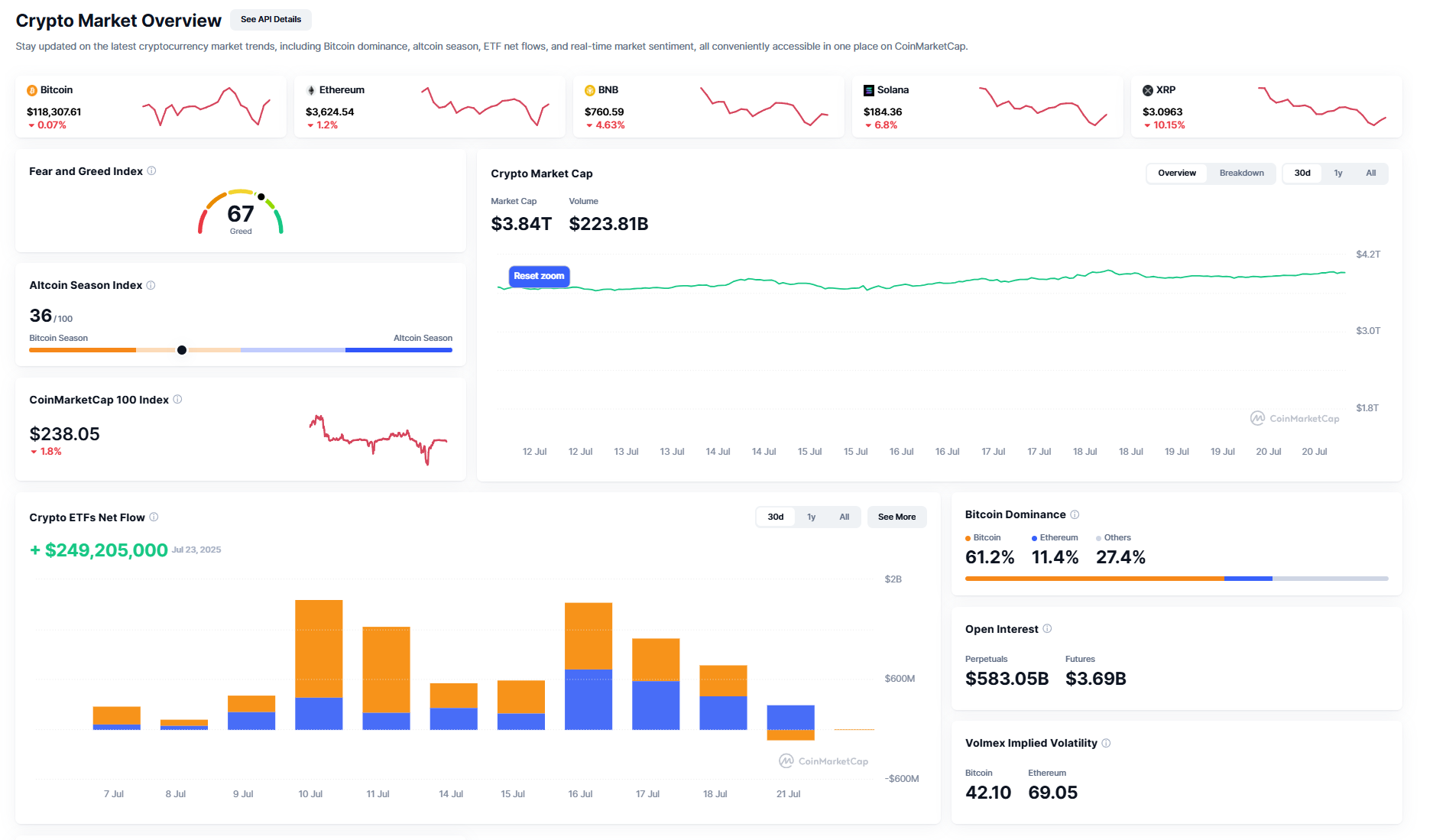

In a 24-hour period, the cryptocurrency market saw a dramatic and extensive correction, losing more than $200 billion in market capitalization. This decline coincides with a discernible drop in major digital assets such as Bitcoin, Ethereum, Solana, XRP and others, indicating a marketwide shakeout that is probably the result of sentiment shifts, overextension and profit-taking.

Bitcoin failed to maintain its hold above the $120,000 mark, falling to about $118,300. The daily chart shows that Bitcoin is technically forming a descending triangle pattern, which suggests possible downside unless it breaks upward. The price is still above the 50-day EMA, which serves as a temporary level of support at $110,000.

Since the RSI is still above 60, it appears that more cooling is possible without going into oversold territory. Even though Ethereum is still trading above $3,600, it is also declining after displaying impressive strength in recent weeks. Being able to withstand market shock without breaking important moving averages makes it one of the better performers.

Despite short-term selling the price action, ETH shows strong underlying accumulation, which is reinforced by recent large whale wallet inflows. However, the larger picture is more cautious. After several days of inflows, the total value of the cryptocurrency market fell to $3.84 trillion, according to CoinMarketCap data, with ETF net flows experiencing a sharp decline.

The Altcoin Season Index is still at 36, which is significantly below the level that denotes altcoin supremacy. With a dominance of 61.2%, Bitcoin is still the market leader, even though its stagnation may impede short-term growth. Implied volatility indicates ongoing uncertainty and is still high — particularly for Ethereum (69.05).

The Fear and Greed Index, on the other hand, is at 67 (greed), suggesting that people were overly optimistic before the correction. The $200 billion decline shows that the market was certainly getting too hot too quickly and needed a brief cool-off period.

For now, all eyes are on Bitcoin to hold above $114,000 and Ethereum to stay strong above $3,500. Further declines may be possible if these levels are broken. However, this might be a good start before another leg upward if they hold.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov