Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

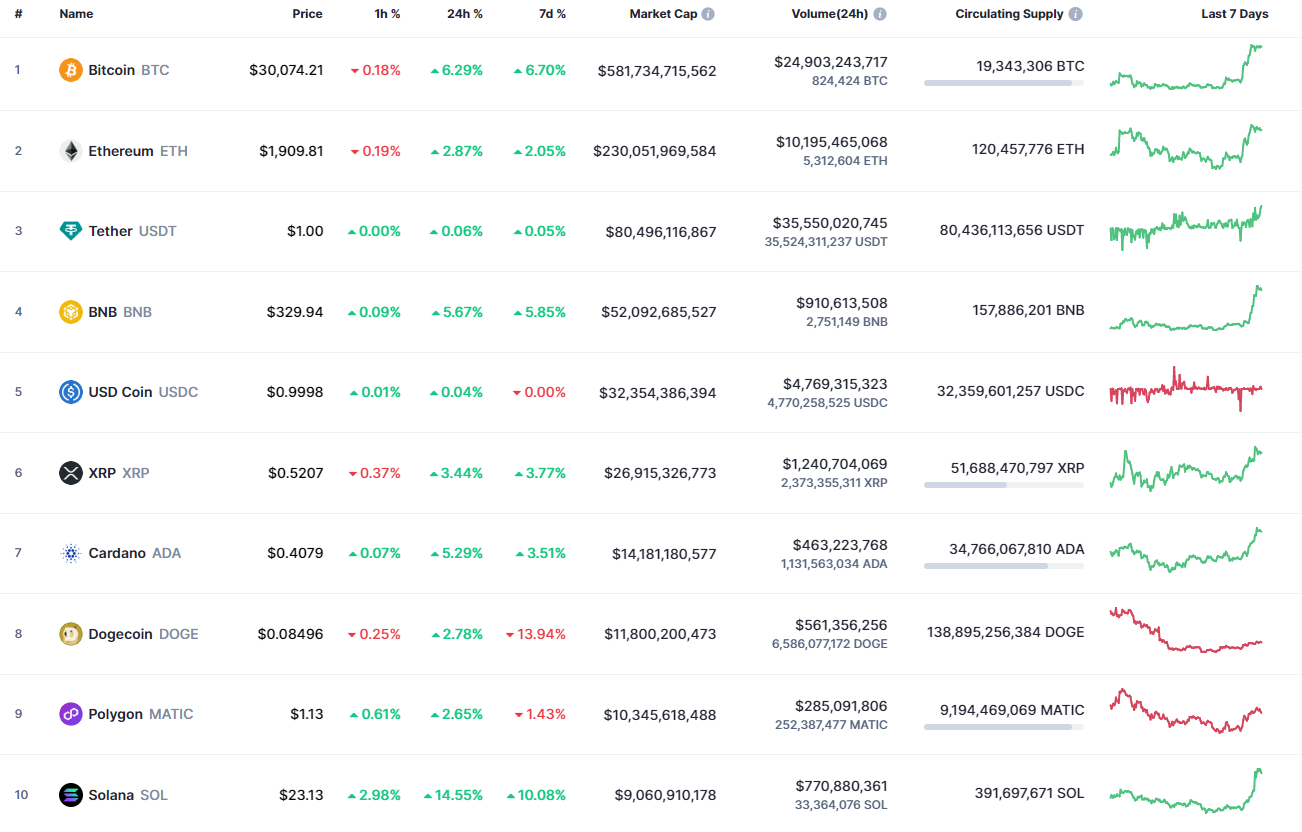

Buyers have managed to seize the initiative, as most of the coins have come back to the green zone.

BTC/USD

Bitcoin is one of the biggest gainers today, rising by 6.29%.

On the hourly chart, the price of Bitcoin (BTC) is trying to fix above the $30,000 mark. At the moment, traders should pay attention to the zone around that mark. If buyers can do that, the rise may continue to the $30,600 zone.

On the bigger chart, Bitcoin (BTC) has started to rise after sideways trading. However, there are low chances of seeing fast growth as the price might need more time to accumulate energy.

In this case, consolidation in the range of $29,500-$30,000 is the more likely scenario for the next few days.

From the midterm point of view, traders should pay attention to the $29,380 level. If buyers can hold the gained initiative, the rise may continue to the $31,000-$32,000 zone. Such a scenario is relevant until the end of the month.

Bitcoin is trading at $30,205 at press time.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin