As Bitcoin (BTC) almost revisited a three-month high above $30,000, cryptocurrency holders are getting more and more optimistic. Price action has been really brutal for bears in the last 24 hours: on Huobi and BitMex, shorts are responsible for more than 90% of liquidations.

Bitcoin (BTC) community close to entering "Greed" zone

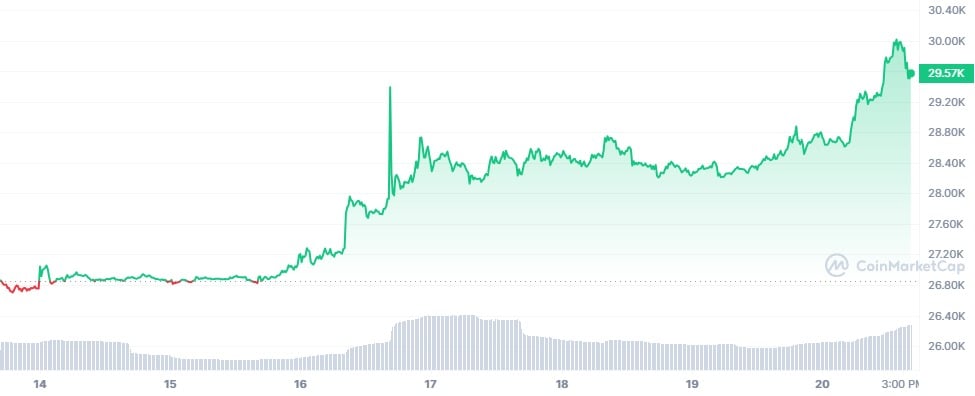

Today, Oct. 20, 2023, Bitcoin (BTC), the largest cryptocurrency, managed to briefly spike over the coveted level of $30,000. Theocal high was registered at $30,035 at 2:00 p.m. in the UTC timezone. In the last week, Bitcoin (BTC) has gained almost 10%.

Bitcoin (BTC) slightly outperformed the market: the net capitalization of cryptocurrencies segment added 2.83% while BTC price jumped by 4%.

Meanwhile, the sentiment of Bitcoin (BTC) investors become cautiously optimistic. Alternative's Fear and Greed Index increased to 53/100, which is close to the upper limit of the "Neutral" zone. The last time it was so big was in mid-August, data says.

The optimism of market paricipants can be explained by a major legal win by U.S. fintech Ripple over the SEC watchdog. As covered by U.Today previously, SEC was forced to dismiss the lawsuit against Chris Larsen and Brad Garlinghouse, two key executives of Ripple. However, the legal battle with Ripple Inc. itself still continues.

$110 million in longs and shorts liquidated

As the market is apathetic in Q3-Q4, 2023, the upsurge was totally unpredictable for futures traders. As a result, over $110 million in crypto positions were liquidated in the last 24 hours.

Largely, short positions are responsible for these monstrous losses. Per CoinGlass, over 71% of liquidations were lost by bears.

The largest single liquidation was registered on Binance: Bitcoin (BTC) bears lost $2.27 million in BTC/USDT contracts.

Ethereum (ETH) traders lost $15 million due to liquidations; over $12 million were shorts.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov