Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

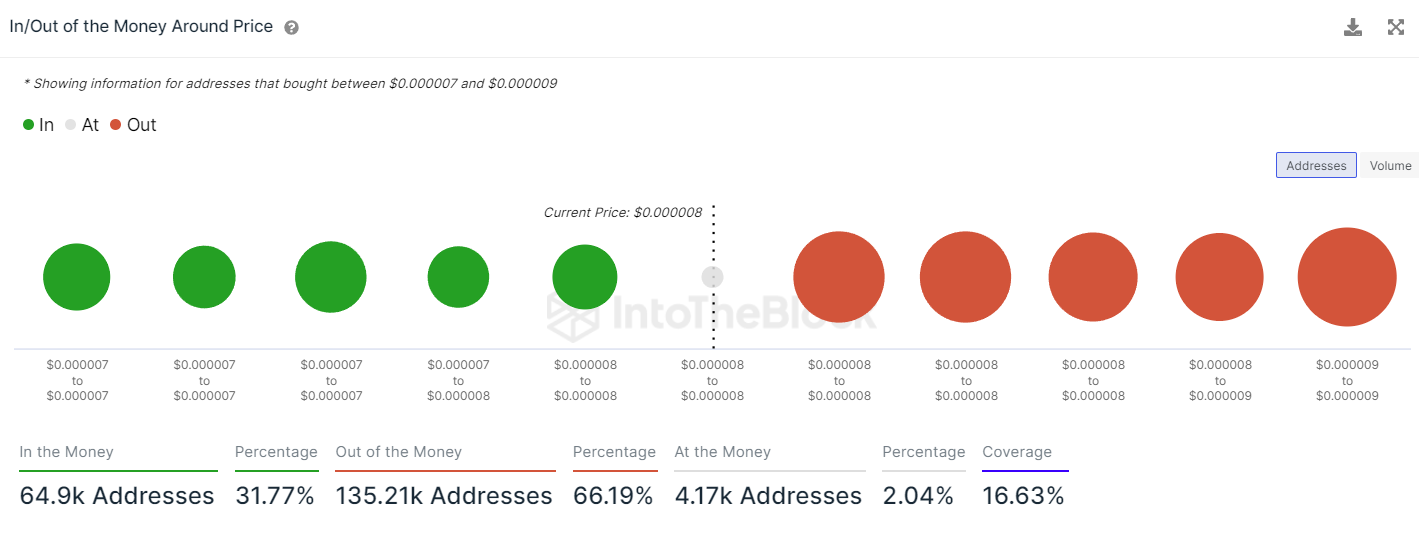

The world of cryptocurrencies is dynamic, and Shiba Inu (SHIB) is no exception. According to recent metrics, the In/Out Of Money Around Price (IOMAP) indicator points to a significant level at $0.000008, where approximately 26 trillion SHIB tokens are currently located.

The IOMAP indicator is a useful tool for understanding the distribution of a cryptocurrency across different price levels. It identifies the average cost at which tokens were purchased for any address with a balance. If the current price is higher than this average cost, the address is considered "In the Money." If the current price is lower, the address is "Out of the Money." The indicator analyzes clusters within a range of +/- 15% of the current price.

At present, SHIB's price level is hovering around $0.0000078. This means that to reach the $0.000008 price level where a massive amount of SHIB is located, Shiba Inu would need to overcome the substantial trading volume at this point. If it manages to breach this level, it would put a significant portion of SHIB holders in the "In the Money" category, which could potentially lead to increased market positivity and propel the price even further.

This significant amount of SHIB at the $0.000008 level can be seen as a form of "securing" this price level, as these investors may act as a potential barrier against price drops. However, it is important to note that the market is highly volatile and sentiment driven, and these dynamics can change quickly.

Should the price of SHIB rise above this level, it could trigger a surge of positive sentiment among investors, possibly leading to more buy orders and pushing the price even higher. Conversely, if the price struggles to surpass this level due to selling pressure, it could act as a firm resistance level in the short term.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov