In a press release published by PR Newswire, global remittance behemoth and Ripple partner, MoneyGram, spread the word about another major milestone reached this year.

150 percent growth in revenues and transactions

MoneyGram announced that, in October, the P2P payment platform's MGO service (direct-to-consumer digital business) brought a 150 percent year-over-year surge in revenues and transaction amounts.

This is the tenth month in a row in 2020 (which was mischievous for business but not for digital payment companies) in which MoneyGram has shown triple-digit growth.

MGO includes the company's mobile app, through which users can wire cash to their relatives, friends or whoever else, directly from their smartphones.

The importance of digital payments in 2020

The head of the remittance giant, CEO and founder Alex Holmes, believes that digital transactions are more important now than they have ever been before.

The pandemic that hit the world and the global economy hard this year, making a lot of small and medium businesses file for bankruptcy and many people lose their jobs (in the U.S., these figures have exceeded those seen during the Great Depression), has pushed digital payments to become one of the most popular and profitable industries.

Ripple's investments in MoneyGram were the key to success

The press release notes that MoneyGram's fast progress is due to high rates of consumer retention and strong demand from customers for the firm's major smartphone app.

Over the past few years, MoneyGram has raised the necessary funds, with blockchain decacorn Ripple among the investors, which enabled the company to rise to its current high level of operation and customer service.

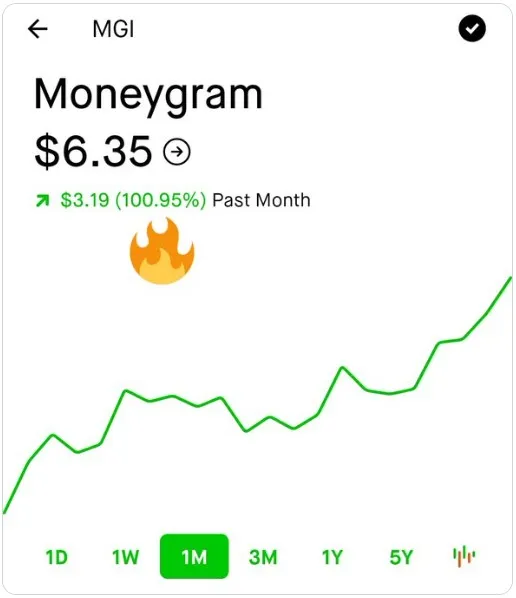

MoneyGram shares skyrocket

On Nov. 10, MoneyGram's shares printed a surge of over 100 percent within a month, trading at $6.35 on Nasdaq.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin