What is amazing about the decentralized finances (DeFi) scene is that these systems are offering their enthusiasts plenty of sophisticated unexplored economic scenarios unseen in the traditional finance space.

At least, the most common DeFi operations (lending/borrowing, “yield farming,” stablecoin minting, etc.) demonstrate unmatched speed and cost-efficiency compared to their traditional analogues. As such, which role precious metals can play in DeFi progress?

The Rise and Rise of DeFi

Decentralized finances (DeFis) are not as “novel” for the blockchain sphere as they may look in 2021. The first decentralized exchange (DEX), Etherdelta, which is now defunct, was launched in 2016, while some of the flagship modern DeFi protocols (Bancor, Kyber Network and so on) are fueled by money from the 2017 ICO euphoria.

What are DeFis?

Decentralized finances (DeFis) should be referred to on-chain instruments that allow users to perform basic financial operations with no intermediaries and zero counterparty risk. In DeFis, users interact between each other through nothing but smart contracts on the blockchain.

Modern DeFis are offering tools for liquidity provision, lending, borrowing, asset minting, protocol governance, portfolio management and so on.

DeFi protocols bring back the initial ideology of blockchain as they allow users to regain control over their finances and eliminate all third party interference.

Why are DeFis so popular?

In a nutshell, using DeFi is safer and much more profitable. DeFi users are less exposed to exit scams and watchdog attacks as no funds or assets are stored by centralized instruments. It is far more difficult to hack DeFi protocols due to their sophisticated designs and built-in attack-resistance logics.

Also, DeFis eliminate intermediaries from financial operations: thus, their users can obtain a meaningful share of the protocol’s revenue, whilst creating new avenues for value creation. The emerging concept of “yield farming” (generating rewards by providing liquidity and lending/borrowing operations) has no equivalent in the world of traditional finance.

Precious metals in finance: Old, but still gold?

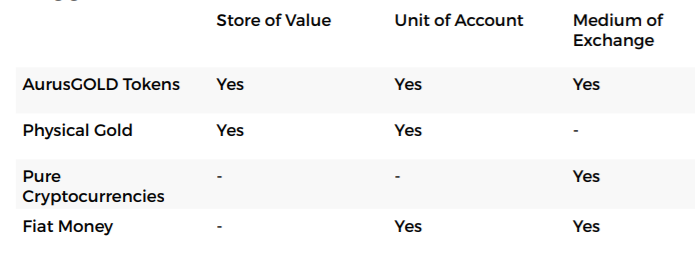

Being used as a medium of exchange and store of value since the days of Ancient Greece, precious metals retain their paramount importance for the investing and financial segments.

Ideologically, Gold was the first-ever DeFi instrument. Holders of Gold needed no intermediaries or custodies for their operations. Each of ‘Gold bugs’ has a precious and scarce physical asset outside of the traditional financial institutions.

This independence was taken away by the introduction of fiat money. Due to flexibility and transferability, fiat money (initially backed by Gold) became the next stage of the world's monetary system progress.

However, this system lacks transparency and empowers intermediaries and regulators with enormous power. During the most turbulent periods of world history, the fiat system proved to be unsustainable, fragile and prone to manipulations.

Precious metals: the basics

Precious metals should be referred to as a class of metals characterized by high economic value that is attributed to the scarcity of precious metals and their role in industry. Historically, all national currencies were literally minted from precious metals and, therefore, backed by them. Now they exist as separate investment and trading assets.

The most popular precious metals are Gold, Silver, Platinum, Palladium, and Rhodium. All of them are used in industry: in the segments of semiconductors, jewelry, medical products, dentistry and chemistry. At the same time, they retain their role as investment and value storage instruments.

Precious metals in investing

Typically, investors perceive precious metals - in particular, Gold - as a hedge against inflation that deteriorates the value of fiat currencies. Also, due to its low price volatility, Gold is popular among traders and investors. Gold investments are of paramount importance in times of market instability, financial or political crises and wars.

Besides owning physical precious metals (bullion bars and coins), enthusiasts of investing in precious metals can buy shares of Exchange-Traded Funds (ETFs) pegged to Gold or Silver, common stocks and funds shares.

A third way to invest in precious metals includes buying/selling futures on Gold or Silver prices. They are traded on multiple platforms even with no “know-your-customer” checks. Traders can experiment with buying/selling futures on precious metals, even with high leverage.

Meanwhile, all of these methods for gaining exposure to precious metals have major drawbacks. For instance, physically acquiring precious metals is often accompanied with logistic and liquidity issues, then storage can be very costly. While ETFs pose as a more convenient and liquid alternative, holders have no claim of the physical metal owned by the fund. Similarly to ETFs, options do not constitute physical ownership and cannot be physically redeemed.

This is where blockchain-based digital assets come into play.

Unlimited opportunities: Precious metals on the blockchain

Combining gold with crypto through tokenisation could solve the current incapability of using gold for making distance-payments without middle-men. Extending this concept into the power of smart contracts and DeFi systems could simply revolutionize the precious metals market as we know it, if done right.

The flaw of centralization in tokenization

Not unlike the majority of stablecoins, the first and most liquid digital assets are backed by centralized entities. Tether Gold (XAUT) by iFinex (the “mother” company of Bitfinex crypto exchange and issuer of Tether Limited stablecoin) and Paxos Gold (PAXG) by Paxos Global are well-known leaders of the segment as token issuers.

However, their design is not aligned with the very concept of cryptocurrencies. In a nutshell, the “don’t-trust-verify” mantra of crypto advocates does not apply to “centralized” asset-backed stablecoins: to accept PAXG or XAUT, users must trust that they are backed by corresponding amount of gold controlled by Paxos or iFinex. This is essentially a second generation of ETFs where blockchain is used only as an instrument to transfer IoUs between holders. Though, such control puts their sustainability into question.

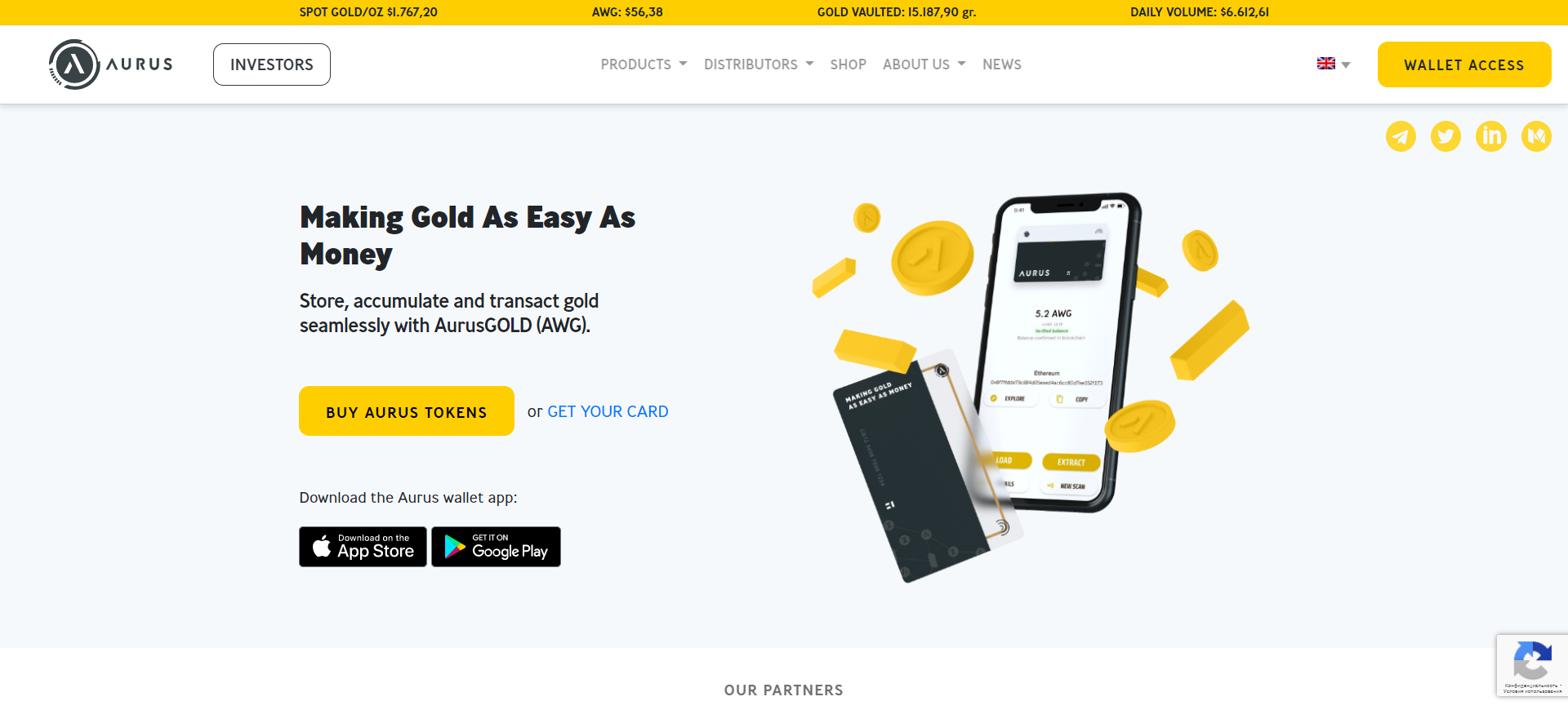

Introducing Aurus: Bringing precious metals to DeFi

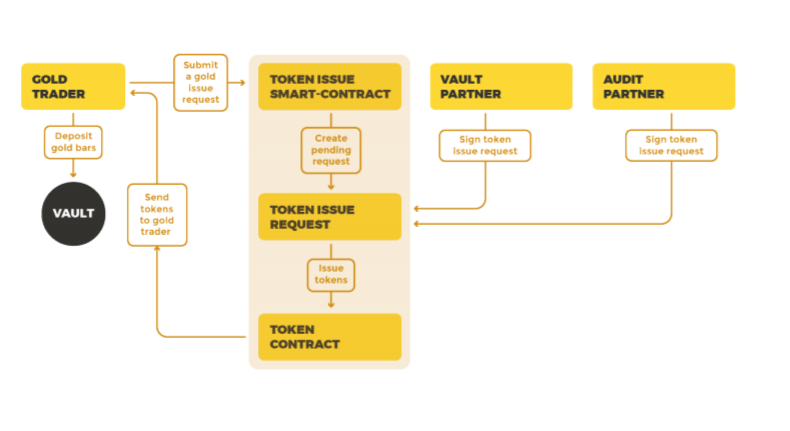

Aurus is a global U.K.-incorporated fintech company focused on building decentralized financial infrastructure around Gold-, Silver-, and Platinum-pegged digital assets. The Aurus Ecosystem is a network of independent precious metals providers, vaults and distributors that work in synergy to the mint and distribute their own precious metals-backed tokens. Meanwhile, the company itself isn’t involved in the tokenization process: users don’t need to trust Aurus to trust its tokens.

Namely, the company integrated established liquidity providers that physically store metals at Aurus partnered vaults around the globe: Brinks, Loomis and Malca-Amit. As its network of vaults is well diversified, it does not rely on a single point of failure. Vaults are regularly audited by an independent external auditing firm.

Aurus' business model is decentralized “by default”: a system that functions on free market principles, and cannot be controlled by one single entity. Through its open-blockchain platform, it connects precious metals industry players to DeFi structures and instruments. At the same time, all assets minted by Aurus can be redeemed for “real-world” Gold, Silver and Platinum.

Family of Aurus tokens

The Aurus Ecosystem consists of four tokens: AurusGOLD (AWG), AurusSILVER (AWS), AurusPLATINUM (AWP) and AurusDeFi (AWX). The first three tokens are decentralized assets backed by corresponding vaults that are integrated into the Aurus network. They are independently minted by precious metals industry actors: refineries, vaults, brokers. For instance, one AWG represents full ownership and redeemable for one gram of 99.99% LBMA-accredited Gold.

AurusDeFi (AWX) token is designed to implement a decentralized model of revenue sharing. Each holder of this token receives a share of the platform’s income: this option combined with rewards for partners turns Aurus into a self-sustaining mechanism.

As a result, both businesses and enthusiasts of DeFi and precious metals are incentivized economically to participate in the Aurus Ecosystem. Businesses can become “their own” financial services leveraging the potential of tokenized metals. Each of them can launch staking, “yield farming” programs and more. Thus, Aurus partners are able to introduce global liquidity, instant transfers and low premiums to their clients.

At the same time, DeFi-focused holders and traders can hedge their portfolios against market volatility.

In general, integrating Aurus assets to DeFi tools brilliantly democratizes many segments of financial services that address the precious metals sphere.

How crypto holders can benefit from using Aurus

Despite its early stage of development, Aurus has already introduced a variety of use cases aimed at retail users.

DeFi-era services

The Aurus team is laser-focused on further establishing the ecosystem to guarantee the inflow of liquidity whilst expanding retail accessibility, and, therefore increasing revenue for partners and AWX holders. Right now, according to CoinMarketCap, AWX is available on three well-known centralized exchanges (CEX.IO, WhiteBit, BiKi). More listing announcements are yet to come.

An upcoming update will allow users to stake (“lock”) their metal-backed assets into a particular vault or liquidity pool to earn periodic rewards. This opportunity of added utility for precious metals is truly ground-breaking. In contrast, most investors today pay storage fees for their gold and silver to gather dust, while with Aurus you can get paid for your precious metals holdings.

Also, AWG, AWS, and AWP may be listed on derivatives exchanges for trading with high leverage. Besides that, decentralized trading of such assets opens enormous opportunities for industry participants and traders alike.

AWX: the ultimate hedge against market volatility

bringing diversity to the portfolio of every investor, Silver- and Platinum-backed tokens demonstrate higher volatility relative to Gold. They are thus even more suitable for derivatives trading in both directions.

Because AWX derives its revenue from AWG, AWS, AWP transaction fees, holders benefit from the increasing volatility of markets. Every AWX enthusiast will enjoy periodic rewards from the ecosystem’s trading activity, which are paid out in AWG, AWS and AWP.

As the Aurus Ecosystem grows in terms of users number and activity, so will the fees generated towards AWX token holders. Thus, it is one of the smartest bets amidst the bearish reversal of the majority of cryptocurrencies.

Bottom line

As Uniswap (UNI) reshaped Ethereum-based decentralized trading, Aurus is attempting to modernise the precious metals industry with its one-of-a-kind DeFi-inspired blockchain platform. A system which could ultimately lead to a more inclusive and efficient market.

First, Aurus embodies the future concept of precious metals ownership: offering a highly transferable, liquid, and easy-to-store digital representation of gold, silver, and platinum.

Then, Aurus changes the game in the tokenization of assets segment. Precious metals-pegged tokens by Aurus are decentralized and powered by on-chain logics solely.

Finally, Aurus implemented a fair DeFi-era model for its revenue-sharing token AWX. It allows all participants of Aurus Ecosystem to benefit from their activity and makes the whole system sustainable.

Aurus delivered the one-of-a-kind product that allows B2B and B2C actors to enter the precious metals market harnessing the entire set of DeFi era benefits.

For more info visit Aurus.io

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin