With fresh funds, Aurigami (PLY) is poised to release new DeFi instruments previously unseen by Aurora (AURORA) and NEAR Protocol (NEAR) ecosystems.

Aurigami (PLY) closes private sale with $9.5 million raised, top-tier VCs onboard

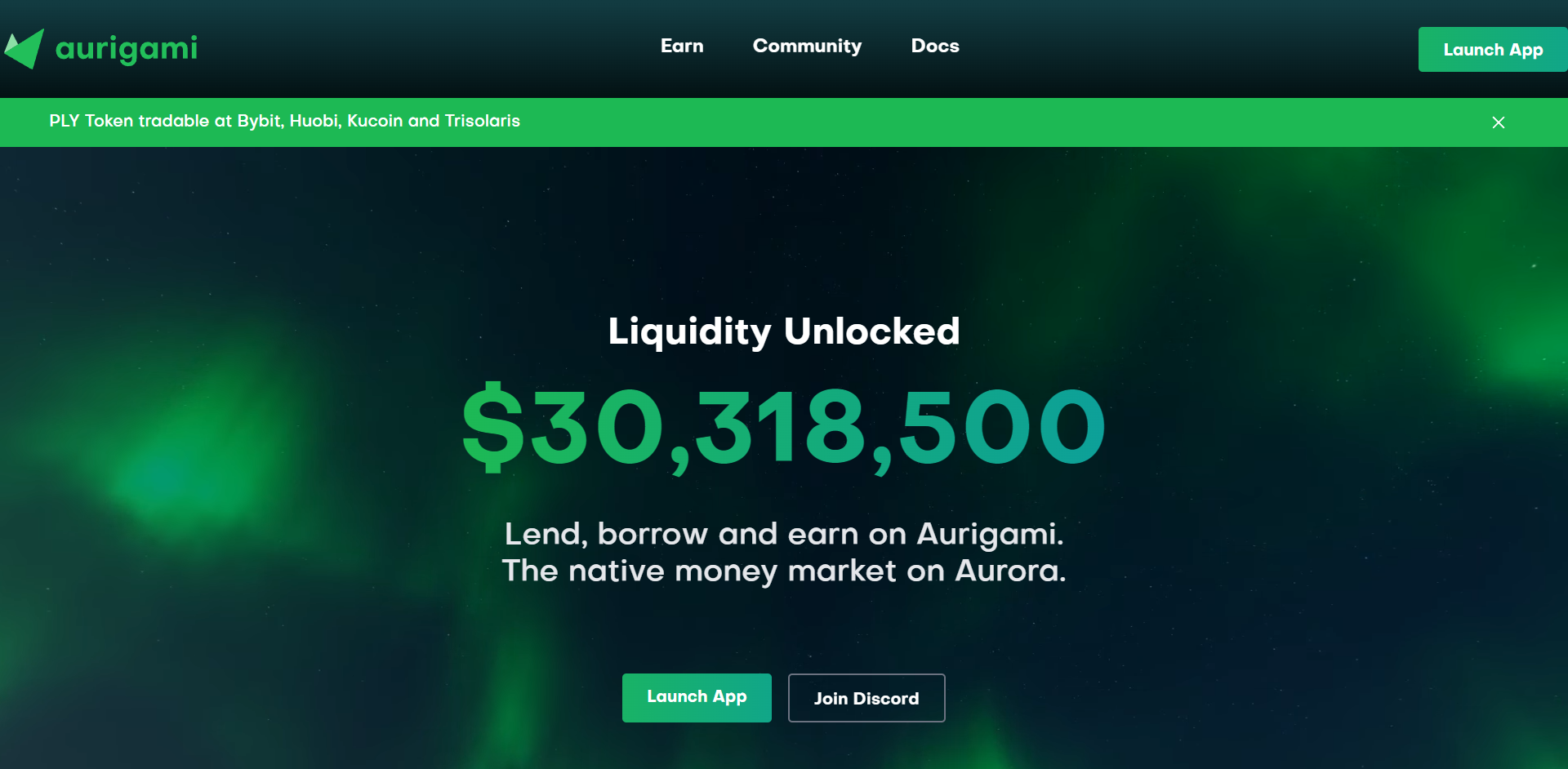

According to the official announcement shared by representatives of Aurigami (PLY) DeFi protocol on Aurora (AURORA), an EVM implementation on the top of NEAR Protocol (NEAR), its two-phase funding campaign has successfully completed.

In total, private sale investors fueled Aurigami (PLY) ecosystem with $9.5 million. The raise yielded contributions by a clutch of heavy-hitting VC teams, including the likes of Mechanism Capital, Amber Group, Coinbase Ventures, Jump Crypto, Alameda Research, Lemniscap and so on.

Web3 investing heavyweights Dragonfly Capital and Polychain Capital were the ones who co-led this funding. Also, the round saw participation of top angel investors, including Aurora's Alex Shevchenko, Ribbon Finance's Julian Koh, CoinGecko's Bobby Ong and TM Lee, Alex Svanevik of Nansen, Etherscan’s Matthew Tan and DeFi veteran Santiago R. Santos.

An excellent triple-phase IEO of $2.5 million on Kucoin, Bybit and Impossible Finance pushed the total sum of funds raised to $12 million. In both rounds, the team sold PLY, Aurigami's native tokens.

Aurigami (PLY) upgrades its liquidity instruments toolkit

Lucas Huang, сo-founder of Aurigami, highlights the importance of this fundraising for his protocol amid a painful recession on cryptocurrency markets:

We're glad to have raised this combined $12M to help support us in building the platform through this crypto winter. With the combined support from the world class investors, and the amazing communities who joined our public sale, we’re here to bring LLTs and gamified DeFi to Aurora users.

Advertisement

Aurigami (PLY) is going to grow its ecosystem of DeFi instruments, including its "Locked Liquid Tokens" (LLT) designed to allow projects to collect liquidity without dangerous selling pressure.

PULP is a "locked liquidity token" for PLY; a combination of PLY and PULP is leveraged by Aurigami for its liquidity mining initiatives. Also, such tokens unlock interesting oportunities for investors and yield farmers.

Arman Shirinyan

Arman Shirinyan Dan Burgin

Dan Burgin Alex Dovbnya

Alex Dovbnya Denys Serhiichuk

Denys Serhiichuk