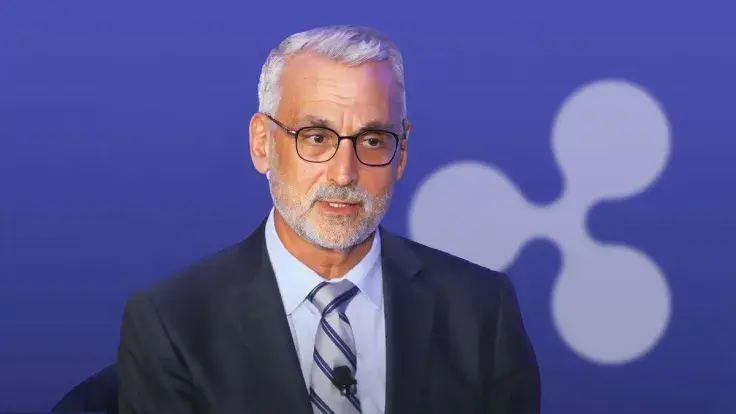

Stuart Alderoty, the General Counsel at Ripple, took to Twitter to heap praise on Ro Khanna, a California congressman, for his role in ensuring the protection of depositors at Silicon Valley Bank (SVB) following its sudden collapse.

Alderoty expressed gratitude to Khanna for his leadership in making SVB depositors whole, adding that the bailout includes startups in various sectors including healthcare, climate change, AI, fintech, national security, and even crypto.

"Thank you @RoKhanna for your leadership to make SVB depositors whole. Some may decry “VCs and tech” but this includes startups tackling hugely important problems within healthcare, climate change, AI, fintech, national security, and yes, sometimes even crypto," Alderoty tweeted.

Ripple's top lawyer argued that accountability and regulatory gaps should be addressed, but depositors and their employees did nothing wrong and placed their cash in a bank that invested in government-backed debt. "This isn't risk-taking, this is conservatism," he added.

As reported by U.Today, Ripple CEO Brad Garlinghouse clarified the company's position on its exposure to SVB. Garlinghouse confirmed that Ripple had some exposure to SVB as a banking partner and held some of its cash balance.

However, he reassured investors that there would be no disruption to the company's day-to-day business as they already held the majority of their USD with a broader network of bank partners.

The recent collapse of SVB has led to panic in the technology industry, with reports suggesting that US officials are considering protecting all deposits at Silicon Valley Bank.

While some have described the intervention as a bailout, officials have stressed that it won't come at taxpayers' expense and will be funded by the fees that banks pay into the Deposit Insurance Fund.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov