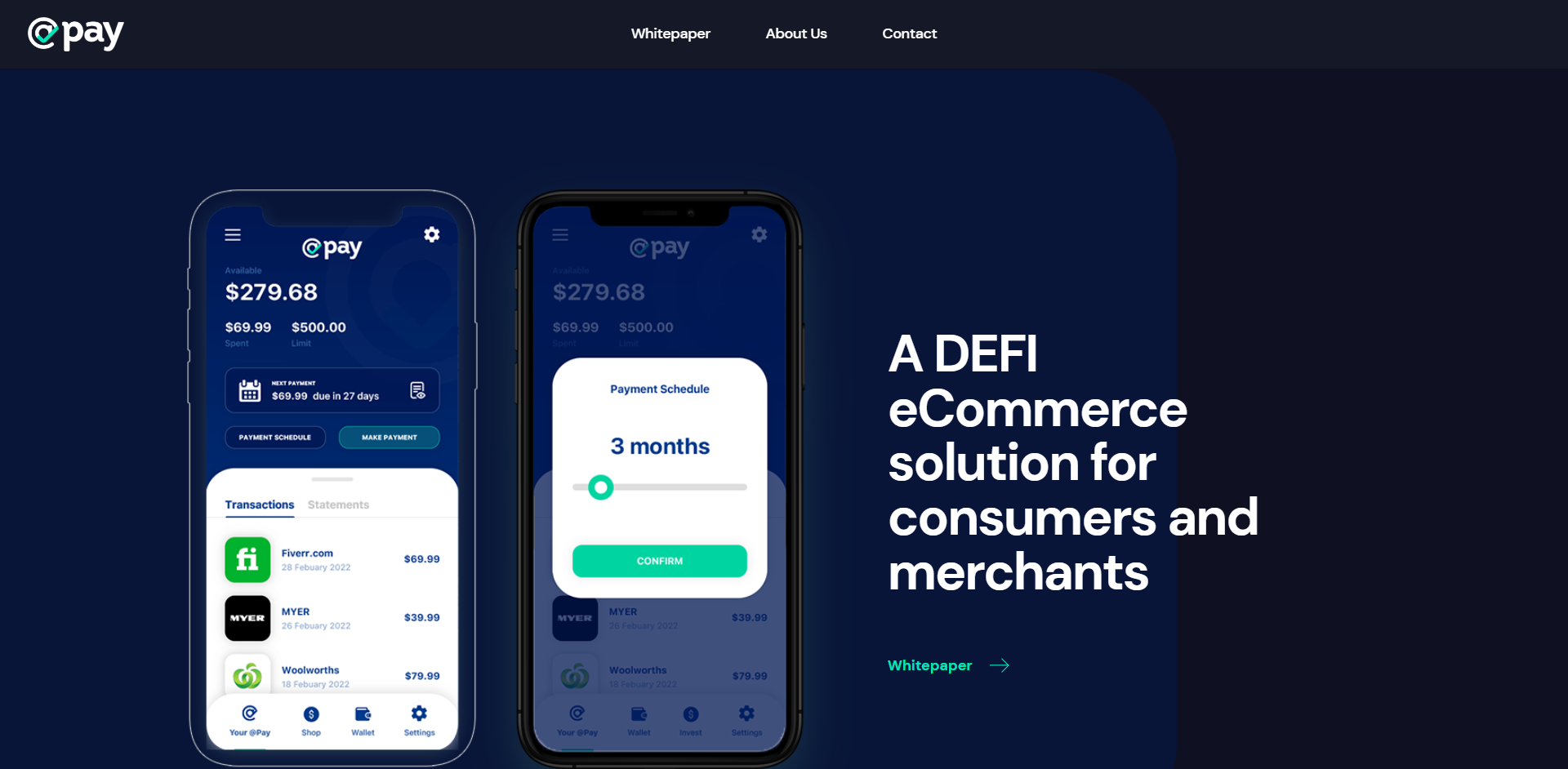

Early-stage cryptocurrency product @Pay addresses the sphere of integrating digital currency instruments into the business processes of retail merchants. At its core, it allows its users to benefit from the “Buy Now Pay Later” (BNPL) model in the epoch of decentralized financial protocols.

What makes @Pay’s suite of services special for merchants, retail customers and all cryptocurrency enthusiasts?

- Pioneering “crypto-native” implementation of BNPL approach, one of the most attractive financial designs in the B2C segment;

- Intuitive integration with all sorts of businesses;

- Easy and profitable staking for a variety of assets, including stablecoin majors;

- User-friendly multi-currency wallet;

- Native token as a core element of the product’s tokenomics.

The @Pay team has developed an all-in-one ecosystem for retail businesses that leverages popular BNPL instruments and the latest distributed ledger practices.

@Pay for e-merchants and retail users: Bringing DeFi to B2B and BNPL to crypto

@Pay promotes itself as an “autonomous DeFi protocol” designed to bridge cryptocurrencies, fiat currencies and “Buy Now Pay Later” instruments. Also, it is an ecosystem that allows all of its participants to benefit from interacting with the @pay cryptocurrency.

@Pay: Ecosystem

@Pay acts as a holistic ecosystem for entrepreneurs, crypto users, merchants, advertisers, stakers, tokenholders and consumers. Users should just install the @Pay application and sign up. Once the application is installed and activated, users can enjoy BNPL instruments when interacting with vendors.

Advertisers can promote their goods and services in @pay to allow them to resonate with the product’s large and passionate audience.

Merchants who enter into partnerships with @pay can instantly start accepting cryptocurrencies in pairs with fiat. Therefore, integration with the product can enlarge a company’s user base and increase brand visibility for their businesses.

Finally yet importantly, stabecoin stakers can earn periodic rewards on their locked assets while holders of native tokens can also be rewarded for holding and using @pay in different ways.

Buying goods and services with @pay

After the registration and activation of an @pay cryptocurrency wallet, users can pay for their e-commerce purchases in two novel ways. First, they can choose approved cryptocurrency stored in their wallet and pay with it in a familiar manner. To increase the value of this offering, @pay attempts to integrate a large and multi-industry network of partners.

Also, users can try the “BNPL” mode and repay the purchase in four equal payments within a 90-day period. These payments can also be conducted with approved cryptocurrencies or fiat currencies (via credit and debit cards). Unlike other BNPL platforms @Pay does not charge interest or any late or default fees.

To access higher purchasing limits, users will be able to use their @pay token rewards allocated. This feature will ensure the constant demand for @pay tokens.

Staking with @Pay: Why is it popular?

Staking typically refers to a process of locking cryptocurrency tokens into centralized or decentralized (on-chain, based on smart contracts) mechanisms in order to receive periodic rewards for doing so.

Staking with @Pay: Basics

Different products offer staking dashboards for a variety of assets, including crypto heavyweights, DeFi “blue chips,” early-stage tokens, the utility assets of mainstream cryptocurrencies services and so on. @pay invites its customers to stake their stablecoins as this method of staking is the most predictable one.

With stablecoin staking, all rewards rates are predetermined and calculated in the asset; these cryptos are pegged to the underlying fiat currency. For example, if you stake U.S. Dollar Tethers (USDT), your rewards will be USD-denominated.

Staking of stablecoins with @pay is a special process; all assets staked are transferred to the lending pool. In an automated way, these coins are moved to a lending pool that is designed to cover “BNPL” needs.

Assets, opportunities, APY

In Q4, 2021, 10 stablecoins were approved by @pay team for its staking module. This list includes the three largest stablecoins, U.S. Dollar Tether (USDT), USD Coin (USDC), Binance USD (BUSD), algorithmically backed stablecoin DAI by MakerDAO and major DeFi-specific stablecoins cUSDT and cUSDC.

Also, it boasts True USD and Huobi USD alongside PAX by stablecoin pioneer Paxos Global.

Finally, it supports EUR-pegged stablecoin EURS by Stasis. USD- and EUR-denominated rewards are distributed in @pay tokens calculated on an annual basis.

@Pay Fiat-to-Crypto ecosystem

Establishing its network of partners, @pay is laser-focused on creating an ecosystem with a seamless transition between fiat and cryptocurrency assets. While its architecture is crypto-based by design, to ensure the maximum level of consumer comfort, all crucial indicators in @pay are fiat-denominated.

After registration and the email verification of the new account, a user is granted a credit of up to $250. This limit can be increased after purchasing @pay tokens.

Also, while monthly “account-keeping” fees are charged in U.S. Dollars (only $6 per month until the loan is repaid in full), upon repayment, users receive @pay tokens as a bonus.

@Pay Wallet: Crypto storage for the DeFi era

Sending and receiving cryptocurrency remains one of the most crucial functions of @pay wallet and its entire ecosystem.

Coins

While shopping with @pay, customers can utilize cryptocurrency heavyweights Bitcoin (BTC) and Ethereum (ETH). The two coins are the first cryptocurrencies with the deepest adoption globally. Integration of Bitcoin (BTC) and Ethereum (ETH) opens the way to the unmatched accessibility of @pay payments.

Also, the native token @pay is added to the suite of supported @pay assets. It can be used for payments and value transfers in a similar manner with major cryptocurrencies.

Instruments

With @pay wallet, users can pay for goods and services, scan QR-codes for instant transactions, track their portfolio, send cross-border transfers to other users of @pay application.

Thus, @pay wallet is an endpoint to the entire ecosystem of @pay opportunities.

Bottom line

Long story short, @pay is a decentralized financial ecosystem tailored for mass adoption of cryptocurrency solutions. It is the first blockchain-based app to implement the BNPL model which is one of the fastest growing areas of the retail segment.

Besides bringing new tools to e-commerce, @pay introduces lucrative staking opportunities for ten stablecoins and a comfortable crypto wallet for users with various levels of expertise in crypto and blockchain.

@pay is a core native utility asset of the product which reflects its mission of mutually beneficial collaboration between all @pay elements.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin