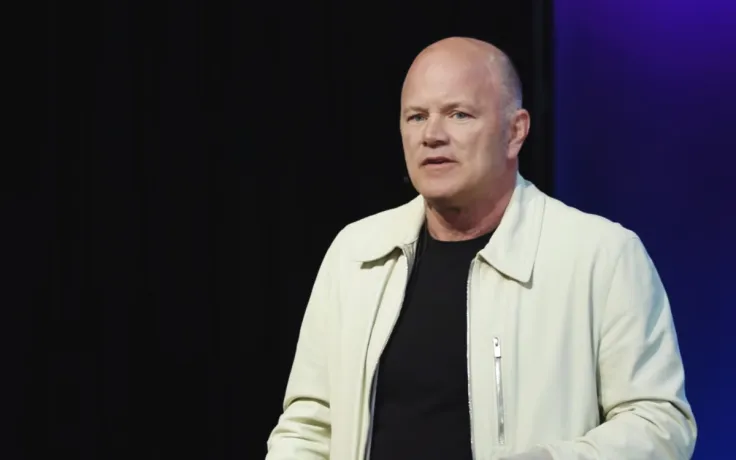

Galaxy Digital CEO Mike Novogratz says that institutional money is now flowing into Bitcoin (BTC) during his recent appearance on CNBC’s “Closing Bell.”

According to the former Wall Streeter, many hedge funds are expected to make announcements about adding the benchmark cryptocurrency to their baskets of assets:

We are seeing lots of new investors in that space. Hedge funds that are buying it. Not just like individuals managers, but they are buying it in their funds. I think you will see some announcements soon.

Gold and Bitcoin are obvious bets

Novogratz claims that he’s bullish on hard assets like gold and Bitcoin in a stagflationary or inflationary environment.

While the U.S. Federal Reserve is printing money, Bitcoin is on the verge of its quadrennial halving that will reduce its daily supply by 50 percent.

In fact, as reported by U.Today, the annual inflation rate of BTC is going to drop below that of gold next Tuesday.

card

The market will remain “nervous”

After an impressive rally in the U.S. stock market, the latest trading sessions were somehow choppy.

Novogratz expects the market to remain nervous because there is no plan on how to handle the coronavirus pandemic. Particularly, he criticized the government for not implementing wide-spread testing:

It’s beyond my comprehension why we haven’t gotten more testing. We need five mln tests per day, we are getting about 300,000.

Advertisement

E-mini stock futures are currently in the green as more states are loosening COVID-19 restrictions.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov