Helio Protocol reinvents the concept of stablecoins with its HAY destablecoin. Its architecture is aimed at eliminating all major risks associated with collateralization and centralized control over stablecoin issuance.

From centralized stablecoins to HAY destablecoin by Helio Protocol: Highlights

Publicly launched in Q3, 2022, Helio Protocol develops HAY, the first-ever decentralized, overcollateralized USD-pegged stablecoin backed by Binance Coin (BNB), the fourth largest stablecoin by market capitalization.

- Helio Protocol went live in mainnet on Aug. 19, 2022; its progress is curated by a heavy-hitting team of blockchain enthusiasts;

- Helio Protocol team pioneered the concept of destablecoin, i.e., fully decentralized overcollateralized soft-pegged cryptocurrency asset;

- Its stablecoin, HAY, can be minted by collateralizing Binance Coin (BNB), a native cryptocurrency of the largest crypto ecosystem Binance;

- Besides stringent internal stress testing, HAY underwent four security audits by independent third-party teams;

- HAY's economic model is balanced and protected from market volatility;

- Cryptocurrency users with no regard to their level of expertise can benefit from minting and staking HAY in a decentralized and secure manner.

From TerraUSD (UST) and Fei (FEI) to HUSD and Neutrino USD (USDN), a number of stablecoins collapsed painfully in 2022. HAY combines the best practices in the industry and employs innovative approaches to address weaknesses demonstrated by its predecessors.

What are stablecoins?

Stable cryptocurrencies, or stablecoins, are digital (blockchain-based) assets with prices pegged to an underlying fiat currency or commodity. Typically, stablecoins are pegged to major world reserve currencies (U.S. Dollar, Euro, Chinese Yuan, Offshore Renminbi) or precious metals (Gold and Silver).

Launched in 2014 on then-new blockchain BitShares (BTS), USD-pegged stablecoin BitUSD was the first cryptocurrency of this type. Aggregated capitalization of all major stablecoins peaked in May 2022: before the collapse of the Terra (LUNA) ecosystem, it had stayed at almost $190 billion in equivalent.

As of February 2023, this indicator sits at $136.2 billion. U.S. Dollar Tether (USDT), USD Coin (USDC) and Binance USD (BUSD) are three dominant stablecoins; in all, they are responsible for over 95% of the segment.

Stablecoins went mainstream as they can be used for value transfer, a medium of exchange and as money storage instruments. Unlike Bitcoin (BTC) and altcoins, they are not volatile, while they retain the same accessibility, liquidity and operability as other cryptocurrencies. Major analysts noticed that stablecoins are used by traders to "park" their money during times of bearish recession.

As such, the increase in the stablecoins cap is always interpreted as an indicator of an upcoming bullish rally.

Centralized stablecoins and decentralized stablecoins: What’s the difference?

In general, all stablecoins can be divided into two large groups, i.e., centralized and decentralized stablecoins. With centralized stablecoins, the process of minting (issuance) of new assets is 100% controlled by the centralized entity behind the stablecoin. For instance, Tether decides on whether the supply of U.S. Dollar Tether (USDT) should be increased or reduced, Circle does the same for USD Coin and so on. Also, the centralized issuer is the only entity that controls the basket of assets every stablecoin is backed by. Typically, to ensure that every stablecoin is backed by reserves, the issuers create a portfolio of cash, commercial paper, treasuries and so on.

Decentralized stablecoins work differently: the balance between the reserves and circulating supply is controlled by the programmatic design of smart contracts. As such, this design automatically reduces the supply of the stablecoin when its price drops below the peg and increases when it surges over the peg. Decentralized stablecoins, therefore, are more flexible and censorship resistant; however, centralized ones are easier to manage.

Introducing HAY, game-changing destablecoin by Helio Protocol

Developed by Helio Protocol, HAY is a novel decentralized stablecoin (destablecoin) that employs the most reliable concepts of DeFi: liquid staking, overcollateralization and so on.

Audited overcollateralized stablecoin on BNB Smart Chain: What is HAY?

Introduced in August 2022 amid a crypto winter, HAY by Helio Protocol attempts to address all roadblocks in the stablecoin segment. HAY is a decentralized stablecoin issued on the top of BNB Smart Chain (previously Binance Smart Chain, or BSC); this blockchain was chosen due to its low fees, high operational speed and EVM-compatibility. HAY is backed by Binance Coins (BNB); to mint and get some HAY, users need to pledge Binance Coins (BNB) as collateral.

The platform works with a safe "loan-to-value" ratio of 66%; to get 66 HAY, users should collateralize $100 in Binance Coin (BNB) equivalent. In total, HAY’s mint cap will never exceed 5% of Binance Coin's (BNB) market capitalization. Such limits are imposed to allow the Helio Protocol team to protect HAY customers from all negative ripples of highly-volatile cryptocurrency markets.

This design underwent four security audits by heavyweight third-party teams, including SlowMist, CertiK, PeckShield and Veridise.

Sustainable yield for liquidity providers

Besides creating all opportunities applicable for the majority of stablecoins, HAY by Helio Protocol can also be used in various "yield farming" activities in BSC-based DeFi protocols. First, the staking operations on Helio Protocol are liquid; instead of locking Binance Coins (BNB) and losing access to them, users can get AnkrBNB tokens and use them in a variety of ways.

Then, every Binance Coin (BNB) locked into Helio Protocol’s mechanisms is automatically converted into AnkrBNB yield-bearing tokens. With AnkrBNB, users can share staking rewards in an automated manner.

Besides that, HAY stablecoin can be used in yield farming initiatives on a number of trusted decentralized exchanges (DEXes). For instance, HAY/BUSD liquidity pool is available on PancakeSwap (CAKE), the largest crypto exchange on the BNB Chain.

Last but not least, Helio Protocol’s native cryptocurrency HELIO will be distributed between HAY owners once HELIO goes live in the coming months. As a result, in total, HAY owners can get over 7% in APY for using this novel destablecoin.

Helio Protocol’s HAY in numbers: Assets, users, collateral

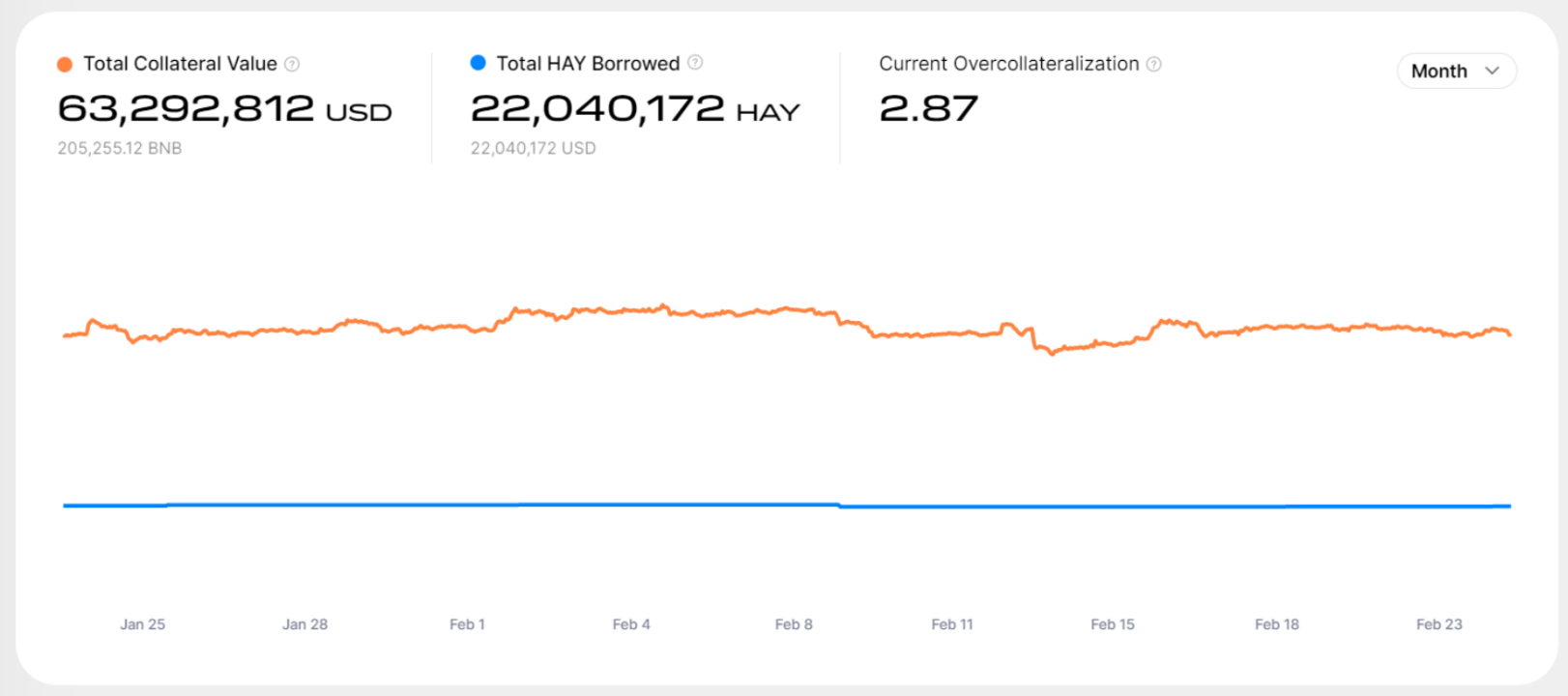

Thanks to its attractive high-performance design and balanced tokenomics, HAY stablecoin by Helio Protocol gained notable traction in its first six months upon release. As of the end of February 2023, the protocol accepted over $60 million in equivalent as collateral.

Users minted and borrowed over $22 million in HAY equivalent at a 2.87 overcollateralization ratio. In total, 1752 borrowers locked their Binance Coins (BNB) in Helio Protocol, while over $101,000 in equivalent is put into its stabilization pool.

Over $6.65 million in liquidity is locked into HAY/BUSD pool on PancakeSwap (CAKE).

Closing thoughts

HAY by Helio Protocol is a new-gen overcollateralized stablecoin backed by Binance Coin (BNB). It can be minted by everyone who collateralizes his/her BNB stake. Besides its use in retail payments and DeFi initiatives, HAY unlocks massive yield farming opportunities, built on PancakeSwap and through internal staking rewards mechanisms.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin