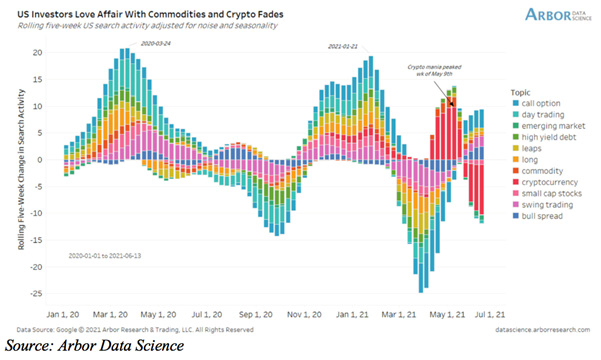

Americans are losing interest in crypto at a rapid pace.

According to data provided by Arbor Data Science, search activity associated with the term “crypto” continues to plunge in the U.S.

Meanwhile, alternatives like “call option” and “bull spread” are rising in popularity, meaning that investor risk appetite is still high.

Based on the aforementioned data, the cryptocurrency mania peaked on May 9 before a cryptocurrency market saw a massive correction due to Tesla suspending Bitcoin payments and China’s clampdown on crypto mining.

The total crypto market cap is down roughly $1.2 trillion (or 45 percent) from the top.

Apart from crypto, Americans have also soured on commodities. Lumber, for instance, has been taking a beating in recent weeks after a massive rally in May.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin