Bitcoin’s mining difficulty is on course to record an 11.18 percent drop, according to data provided by BTC.com.

The network logged two negative adjustments on June 6 and May 30 (-5.30 percent and -15.97 percent, respectively). Difficulty—which measures how hard it is for miners to find a new block and add it to the blockchain—dropped from 25.046 trillion to 19.932 trillion within a month.

The last time Bitcoin had three consecutive negative difficulty adjustments in a row, the cryptocurrency market was in the middle of a miner-induced “death spiral” in December 2018: miners were switching off their equipment en masse as prices were dropping at a disturbingly rapid pace.

Bitcoin bottomed out at $3,125 on Dec. 15, 2018, which marked an 84 percent correction from the December 2017 top.

China is cracking down for real

This time around, China’s Sichuan province halting Bitcoin mining is to blame for the expected difficulty drop. Its National Development and Reform Commission (NDRC) issued a joint order this Friday together with the Sichuan Energy Bureau to “clean up” 26 mining companies. Miners had to switch off their machines on Saturday.

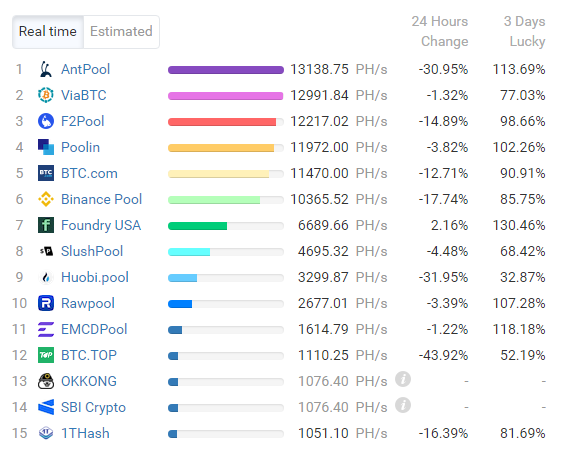

AntPool and Huobi.pool lost over 30 percent of their hashrate overnight, with Foundry USA being the only top mining pool that managed to remain in the green.

Sichuan emerged as the biggest mining hub in the world because of plentiful hydroelectricity, which accounted for over 37 percent of global hashrate back in Q3 2019.

Prior to Sichuan, Qinghai, Yunnan, Inner Mongolia, and Xinjiang also moved to clamp down on the industry.

Bitcoin’s hashrate is down 48 percent from its Apr. 15 peak of 198.514 EH/s.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov