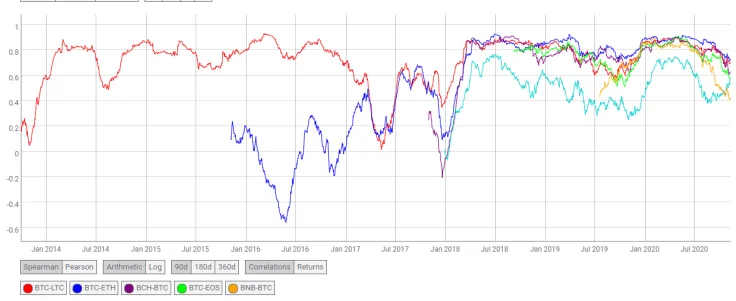

Bitcoin's (BTC) correlation with some of the most popular altcoins is currently sitting at 2020 lows, according to Boston-based cryptocurrency data provider Coin Metrics.

On Nov. 10, the 90-day correlation between Bitcoin and its closest rival, Ethereum (ETH), dipped to 0.71—its lowest level this year.

More altcoins are decoupling

Litecoin (LTC), the silver to Bitcoin's gold, and controversial fork Bitcoin Cash (BCH), also appear to be in the process of decoupling from the crypto king, with their correlations reaching 0.69 and 0.61 on Nov. 6.

EOS's decoupling is particularly notable: EOS-BTC went from 0.90 on May 3 to a fresh yearly low of 0.57 on Nov. 10.

There are some prominent cryptocurrencies that do not tend to zig when Bitcoin zags. Binance Coin (BNB) and Chainlink (LINK) have the lowest correlation to Bitcoin among the non-stablecoin Top 10 currencies (0.41 and 0.56, respectively).

LINK is, however, far off its yearly lows. In August, it approached negative territory after its parabolic rally left Bitcoin in the dust.

Notably, ETH, BCH and LINK were all negatively correlated to the first cryptocurrency in their early days, meaning that they were likely to go up each time BTC went down.

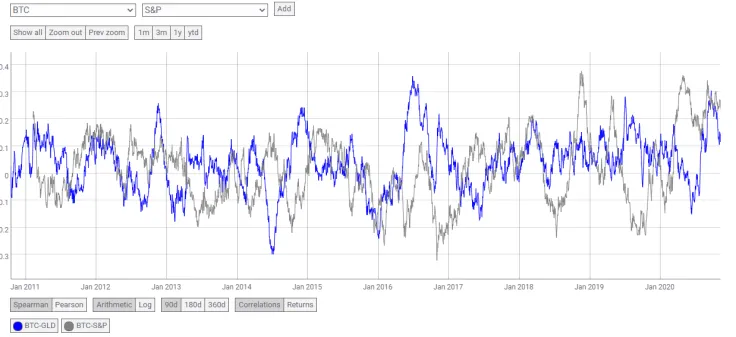

Bitcoin's correlations with traditional finance

When it comes to traditional assets, Bitcoin is evidently struggling to decide whether it wants to perform as a risk-off or risk-on asset.

Throughout this tumultuous year, the ambidextrous cryptocurrency has traded in lockstep with both gold and stocks.

Presently, Bitcoin seems to be more sensitive to the S&P 500 index than the yellow metal (0.23 and 0.14, respectively), but historical data shows that these correlations with legacy finance tend to be rather short lived.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin