Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

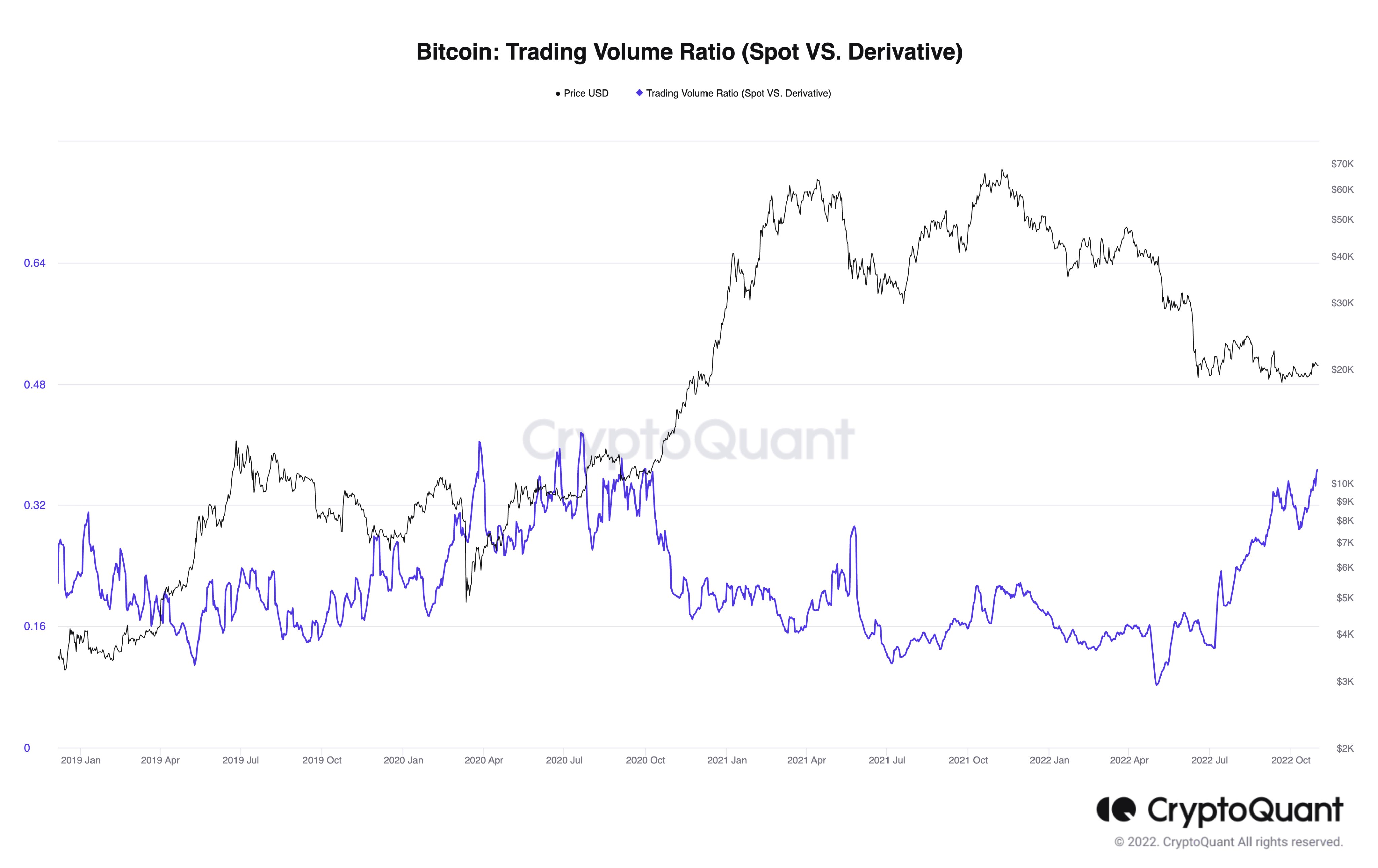

Ki Young Ju, co-founder of cryptocurrency analytics firm CryptoQuant, claims that spot trading volume to derivative ones has reached the highest level in two years.

This indicates that the market is actually overcold, according to Ju.

As reported by U.Today, Bitcoin futures are now being traded mostly by whales, which suggests that the largest cryptocurrency is currently in the middle of another accumulation cycle.

Retail investors have now mostly abandoned the futures market following the recent price crash.

As noted by Ju, people tend to trade futures with higher leverage when the cryptocurrency market gets overheated.

Last month, Bitcoin-denominated futures open interest managed to reach a new peak even though volatility remains low. In fact, for the first time since 2020, the world’s largest cryptocurrency is now less volatile than the S&P 500 stock market index.

The fact that trading volumes remain consistently high sets this bearish cycle apart from the crypto winter of 2018.

In late October, Arcane Research analyst Vetle Lunde suggested that the cryptocurrency market was likely to see “explosive” volatility due to growing futures open interest.

Bitcoin managed to finish the previous month in the green after two red monthly candles in a row. At press time, the largest cryptocurrency is trading at $20,440 on the Bitstamp exchange.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov