Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

On-chain analysts say that the euphoria around Bitcoin (BTC) is starting to dwindle. This comes as the dominant cryptocurrency struggles to rise past its all-time high despite repeatedly testing $20,000.

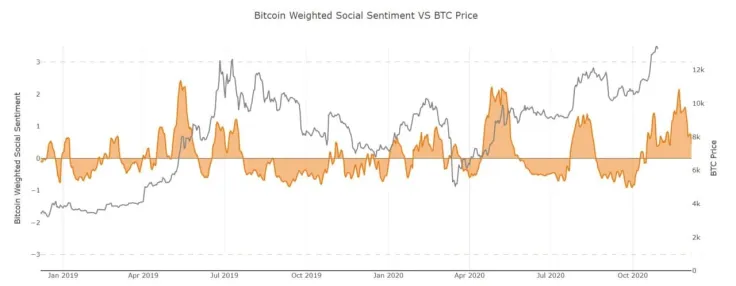

Analysts at Santiment said that the optimism around Bitcoin is above resting average, but is no longer as high as before. They wrote:

“According to the social volume and positive/negative commentary ratio of #Bitcoin on #Twitter, it does appear that the euphoria has died down a bit as market prices came up just short of $20k on previous attempts. But still more optimism than $BTC's normal resting average.”

Why is Bitcoin Market Excitement Declining?

When the price of Bitcoin initially hit an all-time high on Dec. 1, there was a high level of excitement in the cryptocurrency market.

Many anticipated Bitcoin to cleanly surpass $20,000, claim the all-time high as a support area, and see a larger rally. However, BTC immediately rejected the area and has struggled to break above the $19,400 resistance level since.

Alex Saunders, a cryptocurrency analyst, echoed a similar sentiment. He said that the Bitcoin market is “a lot quiter” than 2017, when BTC achieved an all-time high. He wrote:

“If we're about to break $20k it sure feels a lot quieter than 2017. Disbelief? Not sure, but retail excitement is non existent. Lots of talk of insto buying but what you hear is in the past. Many called a top at 12,14,16k, but at 20k they're bulls? I feel I am a lone bear.”

The lackluster social media engagement around Bitcoin likely stems from the stagnant consolidation the dominant cryptocurrency has seen. Although the selling pressure on BTC has generally declined, whales have been selling large amounts of BTC in the past week.

Analysts at CryptoQuant also found that miners have been selling a large amount of BTC in recent weeks. The combination of whales and miners selling in tandem have stirred significant uncertainty in the market.

Although institutions have been aggressively accumulating Bitcoin, data show that the CME BTC futures have been seeing higher levels of short-selling. This could mean that sellers are providing liquidity to institutional buyers, but the level of shorts have risen to a level unseen since March 2020.

On March 12, shortly after the shorts on CME BTC futures reached a local peak, the price of BTC plunged to around $4,000.

What’s Next?

In the past bull cycles, Bitcoin saw a noticeable increase in social media engagement and interest when it broke past major resistance areas.

In the near term, analysts say that this could cause Bitcoin to remain stagnant or consolidate for a while.

Exchange order books and heat maps also pinpoint stacked sell orders near $20,000, which means the all-time high would be difficult to break.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin