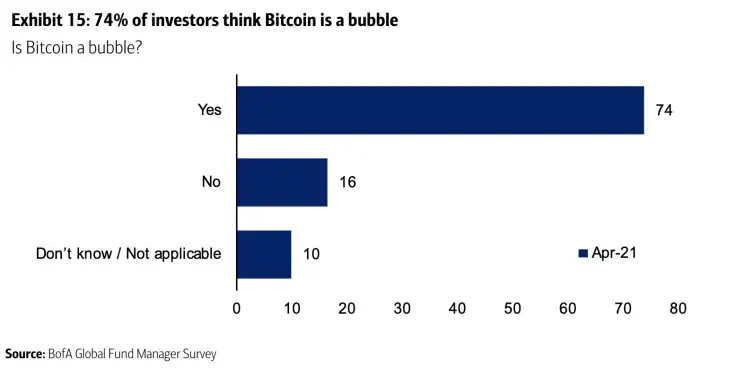

A whopping 74 percent of fund managers think that Bitcoin is in a bubble, according to Bank of America's April survey.

Only 16 percent of the respondents hold the opposite view while the remaining 10 percent do not know the answer.

Notably, only seven percent of the surveyed investors think that the U.S. equities market is in a bubble despite the S&P 500 routinely logging new peaks after topping 4,000 points for the first time on April 4.

As reported by U.Today, Bank of America released a scathing Bitcoin report, which picks holes in the store of value (SoV) thesis and demotes the largest cryptocurrency to a mere tool for speculation.

The "mother of all bubbles" is refusing to pop

Michael Hartnett, Bank of America's chief investment strategist, characterized Bitcoin as "the mother of all bubbles" in early January after BTC eclipsed $40,000 for the first time.

Earlier today, Bitcoin hit a new all-time high of $63,275 ahead of Coinbase's historic public debut that will take place on April 14.

It is up over 800 percent since last April.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin