After years of cryptocurrency proliferation, traditional payment platforms are getting involved in the ecosystem, bringing both their technological know-how and their established customer base to the cryptocurrency movement. Skrill, an online payment platform and money transfer service operating since 2001, is one of the latest players to enter the crypto ecosystem.

Here is the information that you need to know to understand the platform’s context and to participate in their growing product offerings.

Background

Initially operating under the name Moneybookers, Skrill came to fruition alongside PayPal and other prominent online payment platforms. While Skrill never accumulated the traditional market share that PayPal established, it’s foray into cryptocurrency payments and transfers has established the platform as one of the prominent players in the crypto payment ecosystem.

In its early stages, Skrill was popular among international merchants who required multi-currency processing. Now that many payments and money transfers take place online, Skrill’s foray into cryptocurrency is a natural next step that embraces its use-case of the past while ushering it firmly into the future.

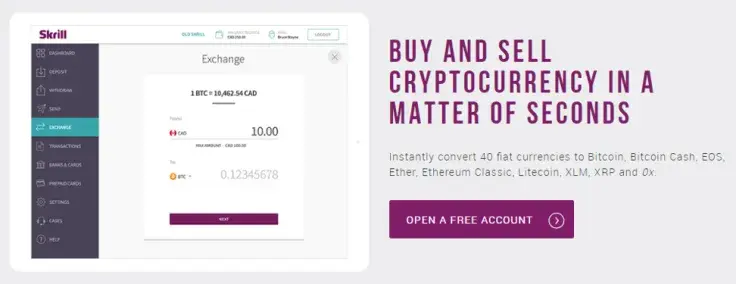

Skrill began offering a crypto gateway in 2018, allowing users to buy Bitcoin and other cryptocurrencies through its easy-to-use buy and sell service. However, the platform recently expanded its offering, and Skrill now enables users to use Bitcoin to buy other cryptocurrencies, something that could both increase the platform’s performance while reducing costs.

Personnel

Skrill is based in London, but the organization maintains offices aren’t the world. From the top, the company is led by Lorenzo Pellegrino, who, before assuming the role of CEO, served as the executive vice president for digital development for Optimal Payments, while also holding other executive-level positions within Skrill. Mr. Pellegrino has been instrumental in leading the company’s foray into the crypto space, and his efforts are bolstered by Rossen Yordanov, Skrill’s VP of consumer and crypto.

With a collective market cap that approaches $200 billion, it’s clear that cryptocurrencies will play a prominent role in the financial system of the digital age, something that will most prominent come to fruition through digital payments.

As Mr,. Pellegrino notes, “This journey begins with partnering with the appropriate payments service provider that offers a merchant account service that includes cryptocurrencies within its available payment methods.”

Platform Offerings

To be sure, cryptocurrencies aren’t new to Skrill. However, in November, the platform announced a significant expansion that will provide a direct crypto-to-crypto gateway where users can buy and sell altcoins using Bitcoin and other traditional payment methods.

Until now, if users wanted to exchange one cryptocurrency for another, they had to sell one holding and use the proceeds to buy another token. Now, users can directly exchange digital currencies by swapping Bitcoin for one of the platform’s supported currencies, including Ether, Litecoin, XRP, and others. In total, users can move seamlessly between eight different cryptos, and the platform plans to add more soon.

Skrill operates as a custody service, which means that users don’t need to worry about a private key or other security functionality. In doing with a reputable service, they can have confidence in their assets’ security. However, it also flies in the face of the decentralized and autonomous ethos that defines the crypto movement.

In the end, Skrill’s upgraded crypto offerings provide both experienced crypto enthusiasts and first-time buyers with an easy way to buy and sell digital currencies through a safe, reputable platform with a history of financial integrity.

How to Participate

Undoubtedly, using Skrill is an intentionally user-friendly experience. The platform offers both personal and business accounts, and while business accounts require an application process, individual users can readily register for an account. After filling out some personal details to create an account, users need to provide their country of residence and preferred account currency.

The platform features many key features, including a prepaid debit card issued by Mastercard, a payment infrastructure, and an international money transfer service. Currently, users have several ways to deposit and withdraw funds, making it a personalized process that can accommodate the preferences of a diverse user base. For instance, for deposits, Skrill accepts:

- Debit/credit card

- Bank transfer

- Bitcoin and Bitcoin Cash

- Neteller

- Paysafecard

- Trustly

- Klarna

Notably, Skrill users incur 0% fees when using their Skrill wallet to make online payments, to receive money, to upload funds, or to send money to email address or other Skrill wallets. This hassle-free experience is what many crypto users are looking for when it comes to practical uses cases for digital currencies.

Skrill charges a withdraw fee that varies depending on the method, and some users will definitely want to tailor their approach to reduce the amount they spend moving money around.

Closing Thoughts

As it stands, there is something for everyone on Skrill, and that’s really the defining selling point for the platform. Whether you are a crypto veteran or a first-time buyer, Skrill is an appropriate landing place, as they are bringing the authority of an established payment company to bear on an emerging sector ripe with opportunity.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov