In a notable market shift, the trading volume of derivatives on the popular cryptocurrency XRP has soared by an astonishing 93% within the last 24 hours, according to recent data from CoinGlass.

This surge is highlighted by a notable increase in turnover of perpetual futures on XRP climbing to $661.08 million. At the same time, the spot market for XRP experienced a 68% increase in trading volume, reaching an impressive $800 million.

This combined activity has propelled the total turnover of XRP on centralized platforms to a substantial $1.46 billion within a single day. With XRP's market capitalization at $28.32 billion, the trading volume now represents approximately 5.1% of its total value, suggesting a significant yet not overwhelming level of trading activity.

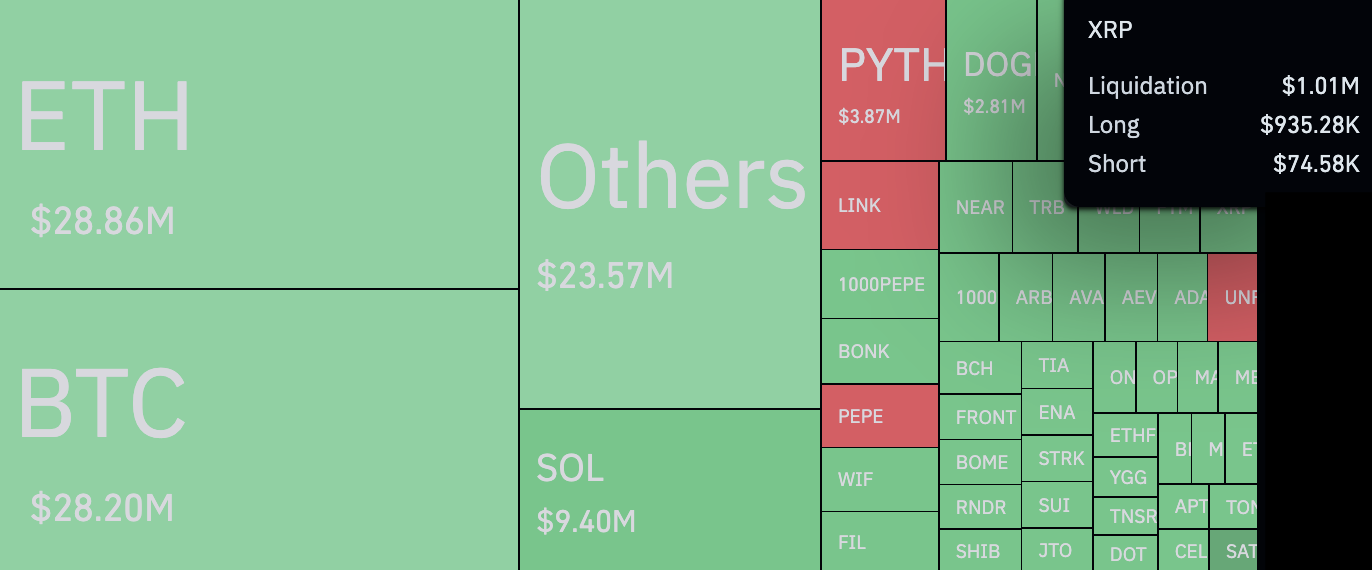

Bulls take L

However, the rise in trading activity has been accompanied by a remarkable surge in liquidations of long positions. Over the past 24 hours, a staggering $935,280 million in bullish positions have been liquidated, in stark contrast to the relatively minor $74,580 liquidated from bearish positions.

This divergence of a staggering 1,254% is quite telling of what is happening on the market right now.

While the increased activity signals strong investor interest, the significant liquidations of bullish positions indicate a painful correction for many traders.

As of now, XRP is priced around $0.50 per token. The chart reveals that the XRP price has been quoting within an upward corridor since May 2023, with the upper dynamic resistance now at $0.80 per token. As the token continues to attract attention with its dynamic performance, the market remains on high alert for potential volatility.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov