Veteran cryptocurrency Litecoin (LTC), the "Digital Silver" and the most successful and popular Bitcoin (BTC) fork, is about to undergo its hotly-anticipated third halving event.

In this guide, U.Today is going to explain how it will affect the Litecoin (LTC) price, technology and the product's road map.

Litecoin (LTC) approaches halving in early August: Highlights

The Litecoin (LTC) halving is among the most anticipated events of 2023 for all enthusiasts of proof-of-work (PoW) cryptocurrencies, traders and investors.

- Litecoin (LTC) is getting closer to the third halving event in its history; the previous halvings happened in 2015 and 2019.

- During its next halving, Litecoin (LTC) is going to have its emission reduced by 50%.

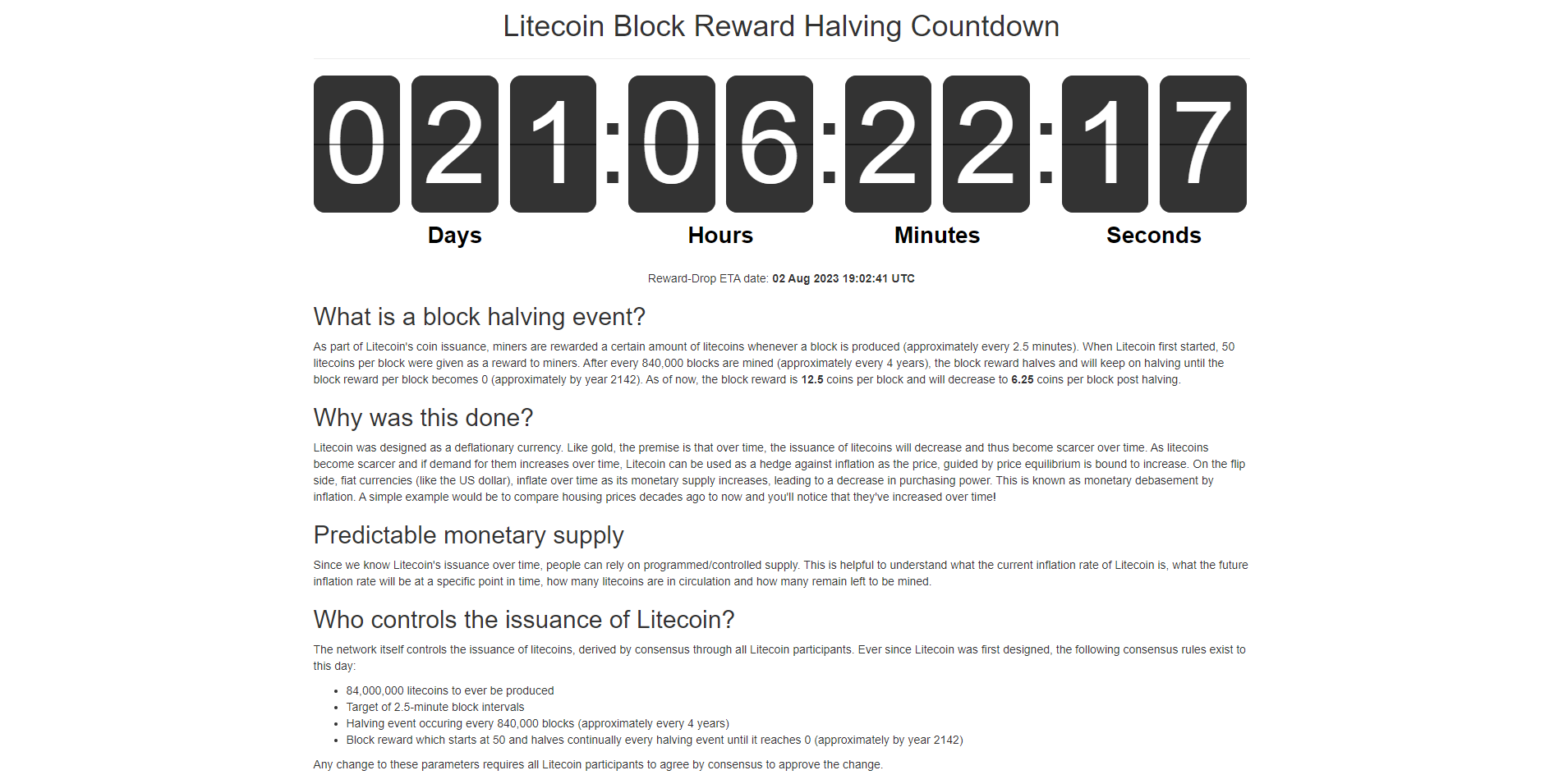

- Currently, Litecoin (LTC) miners are getting 12.5 Litecoins (LTC) per block; after the halving, this reward will drop to 6.25 LTC per block.

- A Litecoin (LTC) halving takes place every 840,000 blocks; the next such event is expected to happen on Aug. 2, 2023, at about 8:35 p.m. UTC.

- Typically, Litecoin (LTC) halving is an event that triggers a bullish cycle not only for the "Digital Silver," but also for Bitcoin (BTC) and all major altcoins.

- The Litecoin (LTC) halving anticipation has already resulted in a double-digit upsurge of the Litecoin (LTC) price, Bitcoin Cash (BCH) price, Bitcoin Cash ABC (XEC) price and other Bitcoin-like cryptocurrencies.

Since Litecoin (LTC) is among the largest altcoins, its third halving event is in the spotlight for cryptocurrency enthusiasts across the globe. Also, it is set to open a new epoch in Litecoin's (LTC) history.

What is Litecoin (LTC)?

Litecoin (LTC) is a cryptocurrency on the proof-of-work (PoW) consensus. It means that it has its decentralized system protected by a distributed ecosystem of miners, i.e., computers finding hashes (solving sophisticated cryptography puzzles) for cryptocurrency blocks.

Litecoin (LTC) was introduced by former Google engineer and early Bitcoiner Charlie Lee in October 2011. Litecoin uses the ticker LTC and the symbol Ł. Unlike Bitcoin (BTC), the Litecoin (LTC) cryptocurrency supply is capped at 84 million coins (4x compared to Bitcoin).

Also, Litecoin (LTC) replaced the Bitcoin (BTC) SHA-256 algorithm with a scrypt one. It also has a 4x lower block time than Bitcoin (BTC): Litecoin (LTC) adds a new block every 2.5 minutes.

Since 2014, Litecoin (LTC) implemented a merge-mining system with Dogecoin (DOGE), the first-ever meme cryptocurrency. It means that Litecoin (LTC) and Dogecoin (DOGE) are mined on the same computational equipment (ASICs and FPGAs).

In 2022, Litecoin (LTC) activated a crucial upgrade, MimbleWimble (or MWEB). After this soft fork, some Litecoin (LTC) transactions can be processed privately.

What is halving?

In proof-of-work systems, miners are rewarded for their contribution (computational resources, electricity, DevOps teams and so on) in native cryptocurrencies of these blockchains. Bitcoin (BTC) miners receive BTC, Litecoin (LTC) miners receive LTC and so on. These "reward" coins should be referred to as the only source of new coins in circulation.

In order to prevent PoW cryptocurrencies from being vulnerable to inflation, the inventors of Bitcoin (BTC) proposed the procedure of halving, i.e., a periodical 50% reduction of miner rewards. Every four years, all PoW networks see their rewards (and, therefore, emission) reduced by half.

What is Bitcoin (BTC) halving?

Halving (or halvening) is an event in the Bitcoin (BTC) network that reduces the BTC issuance by 50%. Bitcoin (BTC) halving happens every four years or 210,000 Bitcoin (BTC) blocks. Bitcoin has its blocks mined in approximately 10 minutes.

Bitcoin (BTC) halvings happened in 2012, 2016 and 2020. In 2012, the number of new Bitcoins (BTC) issued per block dropped from 50 BTC to 25 BTC. In the most recent May 11, 2020, halving, the reward plummeted from 12.5 to 6.25 BTC per block.

As such, in the next halving, which is set to happen in April 2024, the miner rewards will be reduced to 3.125 Bitcoins (BTC).

Why are halvings important for cryptos?

In proof-of-work (PoW) cryptocurrencies, halvings are among the backbone elements of its tokenomics design.

- Motivation of miners. With every halving, the rewards for miners denominated in basic currencies are reduced. As such, only motivated miners continue to protect the integrity of decentralized networks.

- Scarcity of coins. Halving events are designed to keep PoW cryptocurrency assets scarcer. The circulating supply of currencies remains more or less stable, and with every halving, its "moving" part grows slower and slower.

- Cryptocurrency cycles. Typically, Litecoin (LTC) and Bitcoin (BTC) cycles are interpreted as the starting points for crypto capitalization rallies.

As such, every halving is a crucial factor of bullish sentiment across cryptocurrency markets.

Litecoin (LTC) halving: Comprehensive guide

In this part, we are going to demonstrate the most crucial effects of Litecoin (LTC) halvings on cryptocurrency markets.

Litecoin (LTC) halving: Basics

Litecoin (LTC) halving is the event of reduction of LTC emission per block. Every four years, in proof-of-work (PoW) blockchains, miner rewards drop by 50%. This feature is hard-coded into the technical design of Litecoin's (LTC) codebase: Litecoin Core developers cannot adjust the timeline and scale of halving events.

After the third halving event, the aggregated reward of Litecoin (LTC) miners will drop to 6.25 Litecoins (LTC) per block. That said, at the current prices, owners of Litecoin (LTC) mining rigs will earn $607.8 every 2.5 minutes.

Despite the Litecoin (LTC) price action not being associated with its halving cycles by default, typically, it surges a few months after halvings. The first and second halving events triggered triple-digit upsurges of the Litecoin (LTC) price. Besides the LTC price rally, it brings a major change to the economics of Litecoin (LTC) mining. The social sentiment of Litecoiners and other seasoned cryptocurrency holders is also affected by halving events: The interest in Litecoin (LTC) and Bitcoin-like currencies spikes rapidly.

Litecoin (LTC) halving: Date

Like in other proof-of-work (PoW) cryptocurrencies, Litecoin (LTC) halving events are associated with the number of blocks mined, not with the precious date. In Bitcoin (BTC), halvings happen every 210,000 blocks, while in Litecoin (LTC), mining rewards are reduced by 50% every 840,000 blocks. The exact date and time of halving events depend on the actual block speed in this or that blockchain.

While Litecoin (LTC) adds blocks roughly every 150 seconds, its third halving event is expected to happen Aug. 2, 2023, at 8:35:54 p.m. UTC.

Litecoin (LTC) halving: Price impact

By default, Litecoin (LTC) halvings are not directly associated with its price movements. However, the previous two halvings — which took place Aug. 25, 2015, and Aug. 5, 2019 — resulted in massive rallies of Litecoin (LTC).

Image by U.Today

In its first post-halving cycle, the Litecoin (LTC) price peaked 28 months after halving: The LTC price surged from $3.98 to $314, printing an almost 79x rally.

In the second cycle, the "Digital Silver" reached its peak in 23 months and registered its all-time high (ATH). The LTC price rocketed from $95 to $354, which is equal to a 273% upsurge. That said, Litecoin (LTC) always rallied after halvings, but the amplitude of these rallies plunged with the maturation of cryptocurrency markets.

Image by U.Today

The aggregated capitalization of the cryptocurrency segment also followed a similar trajectory. Within 29 months of the first post-halving cycle of Litecoin (LTC), the crypto sphere capitalization increased from $4.8 billion to $848 billion. In the second post-halving cycle, the net crypto market capitalization rocketed from $248 billion to almost $3 trillion in 27 months.

Litecoin (LTC) halving: Ecosystem effects

Litecoin (LTC) halvings are usually associated with an increase in attention to Litecoin (LTC) and other Bitcoin-like cryptocurrencies. As such, developer and community activity are also likely to increase.

In the first post-halving cycle, Litecoin (LTC) activated support for sidechains and started researching opportunities for Lightning Network payment channels and other major scalability solutions.

In the second post-halving cycle, Litecoin (LTC) performed a multi-year research on MimbleWimble, a privacy mechanism for transaction obfuscating that was previously implemented in the Beam (BEAM) blockchain. MimbleWimble (MWEB) was activated as a soft fork in 2022. Also, in 2023, Litecoin (LTC) finally activated support for commercial Lightning Network (LN) channels.

Then, amid the euphoria around Bitcoin Ordinals, a subclass of primitive NFTs on the Bitcoin (BTC) blockchain, Litecoin (LTC) developers also added support for this type of data in Q2, 2023.

As such, we can notice that the most crucial tech upgrades for the Litecoin (LTC) blockchain typically happened either months before halving or soon after its confirmation.

Litecoin (LTC) halving: What is next for Litecoin (LTC)?

Once Litecoin (LTC) activates its third halving, its miner revenue will be cut by 50%. After the next such event, Litecoin (LTC) network participants will be earning 3.125 Litecoins (LTC) per block, and so on.

Block rewards will keep declining in the future; they will be reduced to zero in approximately the year 2142. After the last halving event, all 84 million Litecoins (LTC) will be released into circulation. Supporters will only be able to buy them from each other, mining computer owners will never influence its economics any longer.

Closing thoughts

Litecoin (LTC), the largest Bitcoin (BTC) fork and a top-10 cryptocurrency by market capitalization is set to undergo its third halving event on Aug. 2. It means that the rewards for Litecoin (LTC) miners will be reduced by 50%: During the next four years, they will share 6.25 LTC per block.

Litecoin (LTC) halving events are among the key events that typically preceded rallies of Litecoin (LTC), Bitcoin (BTC) and all major cryptocurrencies.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov