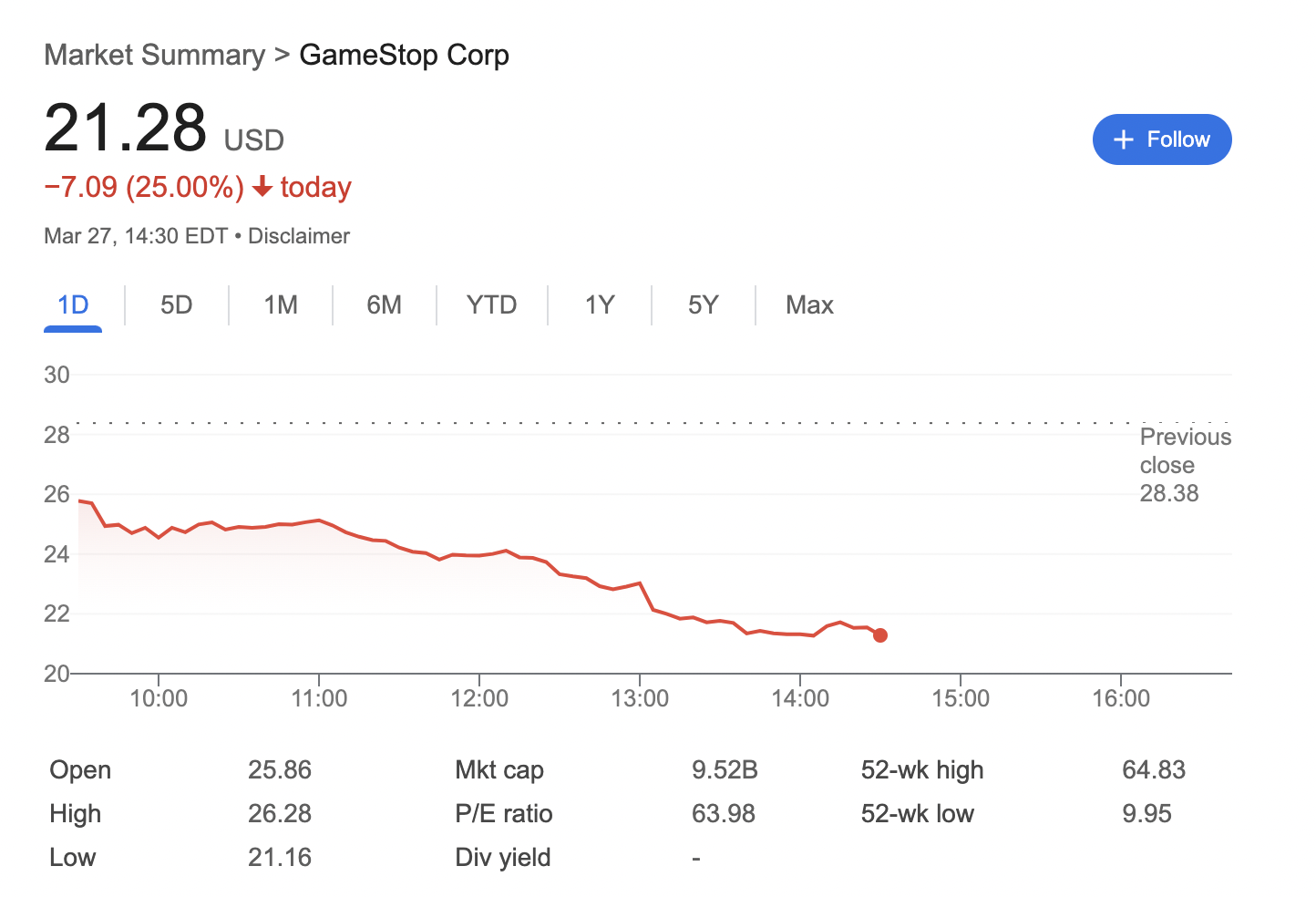

The shares of GameStop (GME) have already collapsed by more than 25% this Thursday.

This comes after the controversial videogame retailer announced a $1.3 billion convertible note offering in order to buy Bitcoin.

The company has copied Strategy's debt-for-bitcoin playbook (colloquially known as the "infinite money glitch").

However, many have criticized the move, with billionaire Clifford Asness recently lambasting the company as a scam. Some of GameStop's shareholders are also disappointed by the move, which is obvious based on the relentless plunge of the company's shares.

Vertical Research Advisory managing partner Kip Herriage believes that GameStop should put at least $2.5 billion into Bitcoin. Herriage has predicted that GME could ultimately surge to $100.

The shares of the videogame retailer are currently trading at $21.33. During the peak of the GameStop mania in early 2021, its shares surged to $81.25.

It is unclear how many Bitcoins GameStop intends to buy. With a total of 506,000 coins, Strategy is currently the biggest Bitcoin holder by an enormous margin. Mining giant Marathon Digital is currently in second place with 46,000 coins.

In a recent post, Strategy said that "MARA may have some competition soon," potentially hinting at GameStop taking its place with massive Bitcoin purchases. However, there are also some

Fold co-founder and CEO Will Reeves claims that the GME plunge is not necessarily a bad thing. "Just like 2021: game flippers got replaced by revolutionaries. Now, some sell because the revolution just got bigger and they don’t understand it yet," he said.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov