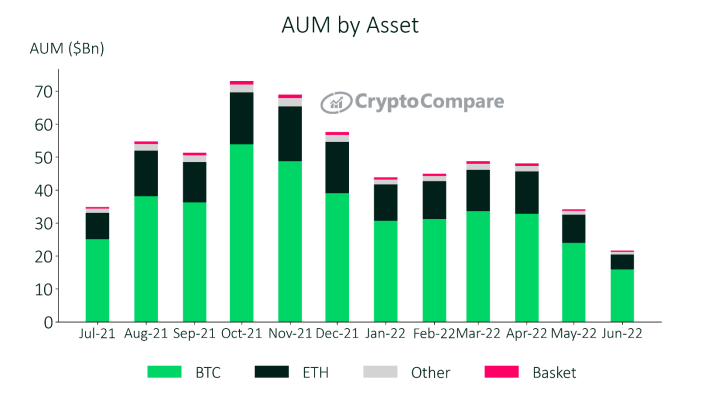

According to a report recently published by cryptocurrency analytics firm CryptoCompare, Ethereum investment products' assets under management collapsed 46.7% in June to $4.54 billion.

For comparison, Bitcoin's AUM shrunk by roughly 33.6% over the same period of time.

Ethereum recently recorded its worst quarter ever, plunging by a whopping 67% since April. On June 18, the price of the second-largest cryptocurrency collapsed to as low as $881. Meanwhile, Bitcoin logged its worst quarter since 2011, with its value declining by more than 68%.

Grayscale, the world's largest crypto asset manager, accounts for more than 77% of the total AUM.

Overall, weekly net outflows logged a new record high average of a whopping $188 million, which shows that institutional investors soured on crypto due to rapidly falling prices.

ETF-linked AUM plunged by more than 52% last month due to worsening market conditions.

Meanwhile, short Bitcoin products benefited from the crypto carnage, adding $33.2 million on average per week.

Trading volumes remain relatively steady

In the meantime, trading volume across cryptocurrency investment products fell by 7.16% last month. Grayscale Bitcoin Trust (GBTC) was, as expected, the most traded one, recording $125 million in average daily volume. In fact, GBTC's trading activity grew more than 18% last month. On the other hand, Grayscale's Ethereum trust logged a 25% drop in trading volume, failing to buck the trend.

While the overall drop is relatively modest, digital investment products still recorded their lowest trading volume since November 2020.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin