Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

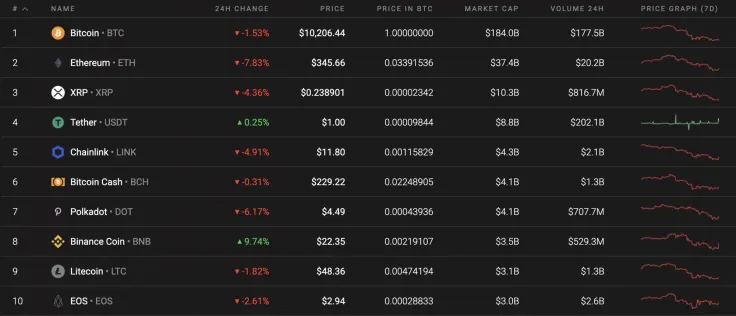

On the last day of the week, the market remains bearish as the majority of the Top 10 coins are in the red zone. Binance Coin is the only crypto that is green, rising by 9.74%.

The main data of Bitcoin (BTC), Ethereum (ETH), XRP, Litecoin (LTC) and Bitcoin Cash (BCH) today:

|

Name |

Ticker Advertisement

|

Market Cap |

Price |

Volume (24h) Advertisement

|

Change (24h) |

|

Bitcoin |

BTC |

$189,229,937,831 | $10,239.15 | $49,901,577,782 | -0.96% |

|

Ethereum |

ETH |

$39,090,211,958 | $347.51 | $36,061,057,301 | -6.04% |

|

XRP |

XRP |

$10,804,925,313 | $0.240049 | $2,304,110,654 | -3.69% |

|

Litecoin |

LTC |

$3,161,912,031 | $48.35 | $2,832,324,749 | -0.57% |

|

Bitcoin Cash |

BCH |

$4,252,085,233 | $229.72 | $3,430,509,576 | 2.04% |

BTC/USD

The passing week has been bearish for Bitcoin (BTC). The rate of the chief cryptocurrency has declined by 12% over the last 7 days, however, it is almost unchanged since yesterday.

On the 4H chart, Bitcoin (BTC) may have completed its fall and be about to make a reversal. Although it is early to consider a continued bull run, a slight correction may occur.

The low selling volume, as well as the liquidity, also consider the high possibility of upcoming growth. To summarize, the local resistance is located around $10,550.

Bitcoin is trading at $10,226 at press time.

ETH/USD

Ethereum (ETH) is the top loser from our list. The rate of the leading altcoin has gone down by 6% over the previous 24 hours.

Ethereum (ETH) is also more bullish than bearish on the daily chart. The Relative Strength Index indicator is forming a bullish divergence, which considers the short-term rise of the altcoin. In this case, the main target of the slight rise is $372.

Ethereum is trading at $350.04 at press time.

XRP/USD

XRP has also faced a deep correction. The price drop was not as profound as in the case of Ethereum (ETH); however, the third most popular crypto has lost 13% over the last week.

XRP is neither bullish nor bearish on the 4H time frame. The lines of the Bollinger Bands indicator are going down; however, the high buying trading volume means that bulls may seize the initiative in the short-term perspective. In this regard, the coin may locate in the area of $0.24-$0.25 until mid-September.

XRP is trading at $0.2388 at press time.

LTC/USD

The rate of Litecoin (LTC) is unchanged since yesterday. However, the price change over the last week has been -18.56%.

On the weekly chart, the "digital silver" has confirmed the upcoming bearish mood as buyers could not get to the crucial $70 level. The lines of the MACD indicator are about to change to red, which confirms the presence of sellers. However, Litecoin (LTC) may make a retest of the $54 mark followed by a further decline.

Litecoin is trading at $48.53 at press time.

BCH/USD

Bitcoin Cash (BCH) has recovered the fastest among the Top 10 coins. However, in terms of weekly analysis, the decline has constituted 15.70%.

On the daily chart, Bitcoin Cash (BCH) has already made a reversal, having confirmed the short-term rise potential. The high liquidity level above the current prices supports the ongoing correction. If bulls keep pushing the rate higher, local resistance at $246 may be reached shortly.

Bitcoin Cash is trading at $232.13 at press time.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin