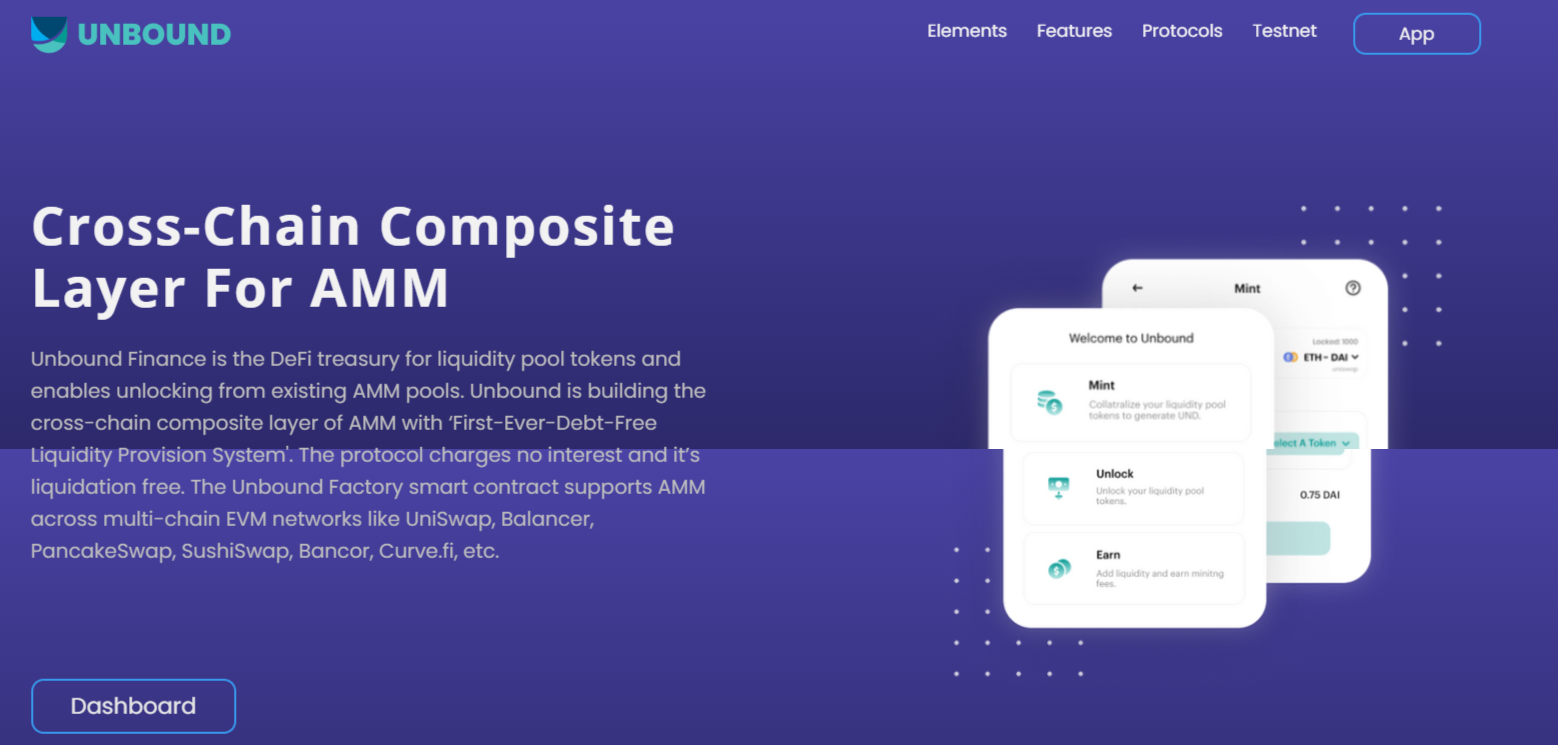

The platform is focused on building instruments for interest-free loans when the liquidity pools' tokens can be pledged as collateral. It also brings the stablecoins into the cross-chain segment.

$5.8 million raised from Pantera Capital, Arrington XRP Capital and others

According to a press release shared with U.Today, Unbound Finance successfully completes its strategic funding round. The net amount of funds raised is estimated at $5.8 million.

Pantera Capital, Arrington XRP Capital, CMS Holdings and other premier-league venture capitalists took part in the latest funding round for Unbound Capital.

Dan Morehead, CEO of Pantera Capital, stresses that putting liquidity tokens to work is an unexplored corner of the DeFi segment, so the progress of Unbound Finance looks impressive:

Unbound has great potential to play a lead role in the DeFi space by focusing on liquidity pool tokens. We're excited to support the Unbound team as they build the key tools to capitalize upon this untouched part of the DeFi ecosystem.

Also, this round was supported by a number of well-known angel investors. One of them, Polygon's COO and co-founder Sandeep Nailwal, outlines the importance of Unbound Finance's solutions for DeFi users' experience:

Unbound's dedicated development team has created something that makes all AMMs efficient and will make interesting money legos in the space further.

Advertisement

Unbound Finance nears first-ever decentralized cross-chain stablecoin and Uniswap v3 contracts

Funds raised will fuel the next stage of development for Unbound Finance. The protocol will enable the users of Ethereum-based AMMs to collateralized idle liquidity providers' tokens against the UND cross-chain decentralized stablecoin.

Then, Unbound Finance will expand to Ethereum-compatible blockchains like Binance Smart Chain, Polygon and Harmony to integrate leading AMMs PancakeSwap and DFYN.

Unbound's "DeFi Treasury for Liquidity Pool Tokens" is now undergoing Zeta testnet. Unbound will be among the first projects to launch aggregator contracts for concentrated liquidity provision on Uniswap v3.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov