Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

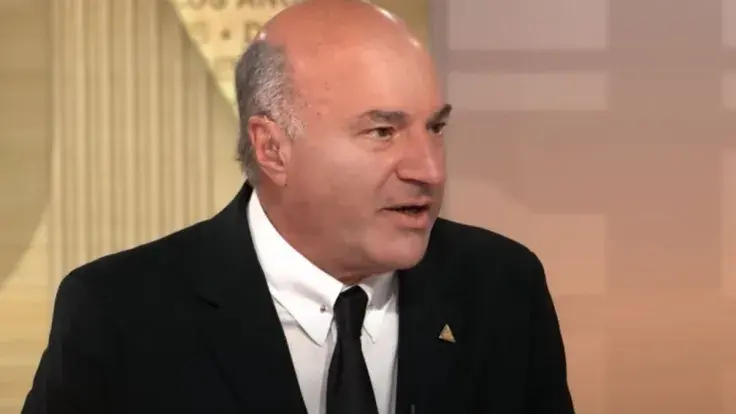

Founder of CryptoLaw.US John Deaton has slammed venture investor, businessman and TV personality Kevin O'Leary for showing his support for Sam Bankman-Fried, the founder of the recently collapsed FTX exchange and for his recent prediction of the future of unregulated crypto platforms.

The fall of this crypto giant sent waves of shock all over the crypto market, pushing the Bitcoin price below the $17,000 level, with altcoins following BTC in plunging.

In a recent interview with TraderTv live, Kevin O'Leary, also known as Mr. Wonderful, shared his view on the future of regulated and unregulated cryptocurrency exchanges.

Unregulated exchanges to be crashed by regulators: O'Leary

Kevin O'Leary shared with the host what he believes to be a good thing about the situation with FTX after it went bankrupt at the start of November 2022. He mentioned that, since then, Genesis crypto lender, which belongs to Barry Silbert's Digital Currency Group, filed for bankruptcy too.

Every week, O'Leary stated, another crypto company goes down to zero. He also mentioned the recent attack of the SEC against U.S.-based Kraken exchange when the regulator fined it for $30 million and forced it to shut down its staking service in the U.S.

Venture investor O'Leary believes that despite the FTX exchange ending up bad, unregulated exchanges keep issuing worthless tokens or offering services, like Kraken. He pointed out that U.S. senators, who are also dealing with the financial sphere and crypto regulation, are growing tired of seeing yet another crypto company collapse and go out of business, along with its customers' money.

The SEC is eagerly waiting to go at yet another crypto platform to make it follow the rules, as O'Leary stressed.

To sum up, he believes that regulated crypto exchanges are going to rise in value over the next few years. In the meantime, unregulated ones will be crashed by regulators.

Deaton reminded the audience that O'Leary was one of the main investors of FTX, and when the collapse took place, he was the one who suggested giving Sam Bankman-Fried a second chance — to rebuild FTX and try to pay back the money lost by investors and clients.

Deaton stated that believing O'Leary is right about exchanges would be far from correct.

Kevin was Mr. Crypto and literally said the only place he believed crypto was safe was on @FTX_Official with @SBF_FTX. And after Kevin’s good buddy stole customers’💰, he said SBFraud deserved a 2nd chance. You would have to literally be a moron or imbecile to listen to Kevin. https://t.co/NnMe0TOGpV?from=article-links

— John E Deaton (@JohnEDeaton1) February 21, 2023

Binance put FTX out of business: Mr. Wonderful

In December 2022, O’Leary went to a hearing with the Senate Banking Committee regarding the FTX situation. There, he claimed that it was the Binance exchange that had orchestrated the collapse of its major rival, FTX.

He said that the two platforms were at war with each other, so Binance managed to put FTX out of business intentionally. Now, according to Mr. Wonderful, Binance has become "a massive unregulated global economy."

Back then, as reported by U.Today, Ripple's chief technology officer David Schwartz also posted a tweet, in which he slammed O'Leary for making claims "against the entire weight of an absurdly massive amount of evidence."

As a reminder, when FTX first found itself in a great lack of liquidity, Binance offered to buy it. However, FTX then backed off from the deal with CZ, stating that its problems are beyond the help that Binance can offer.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin