The Bitcoin Fear & Greed Index, an indicator utilized to display whether social media users are, on the whole, optimistic or pessimistic about the short-term dynamics of the crypto king, shows signs of recovering.

Fear & Greed Index recovers from seven-week bottom

According to data shared by the Alternative.me web portal, the Bitcoin "Fear & Greed" Index started recovering after losing 50% in three days.

Bitcoin Fear and Greed Index is 43. Neutral

— Bitcoin Fear and Greed Index (@BitcoinFear) November 20, 2021

Current price: $58,426 pic.twitter.com/9289nug9n3

While it is still in the sub-50 zone that refers to "Fear" territory, it inches closer to "Neutral" and now sits at 43/100.

Yesterday, on Nov. 19, 2021, the index bottomed out at 34/100, its lowest level registered since early October. As such, it managed to avoid plummeting to the "Extreme Fear" zone.

Only ten days ago, on Nov. 9, 2021, the Index revisited its eight-month high at 84/100. This upsurge is associated with Bitcoin's rally to its all-time high.

On Nov. 10, 2021, the flagship cryptocurrency spiked over $69,000 for the first time in its entire history on the news of the record-breaking inflation jump in the U.S.

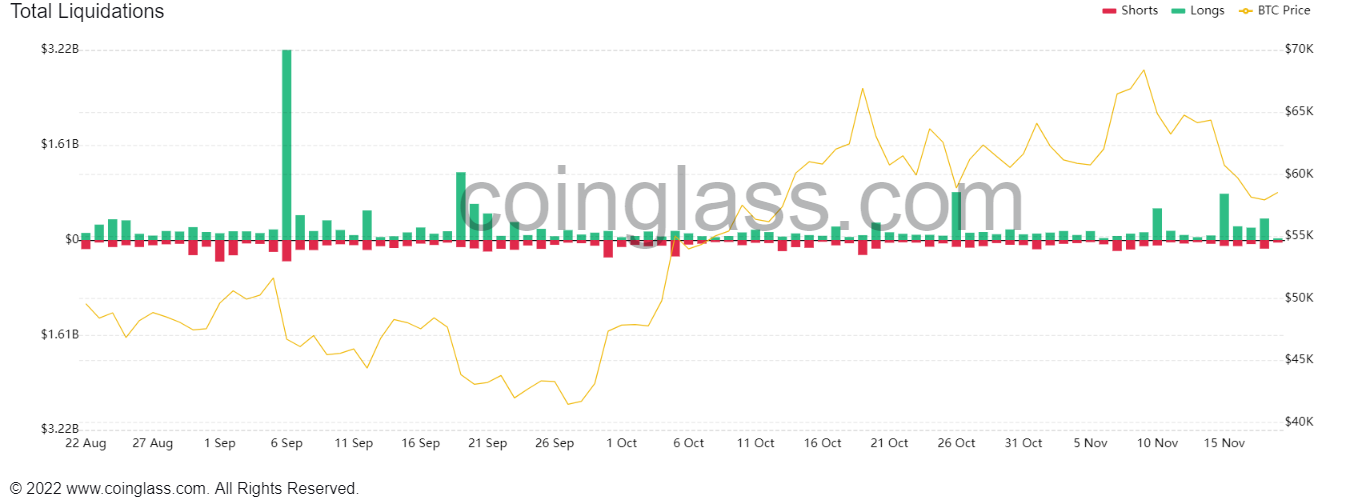

$1.1 billion in shorts and longs liquidated in three days

However, this splendid run was replaced by a painful correction. Bitcoin (BTC) erased all of its gains since mid-October in hours, plunging to $56,500.

These rollercoasters resulted in massive liquidations for all major crypto trading pairs.

According to data shared by analytical dashboard Coinglass (formerly Bybt), crypto traders lost more than $1.12 billion between Nov.16 and 18.

The vast majority of positions liquidated were opened by Bitcoin and Ethereum bulls.

Dan Burgin

Dan Burgin U.Today Editorial Team

U.Today Editorial Team