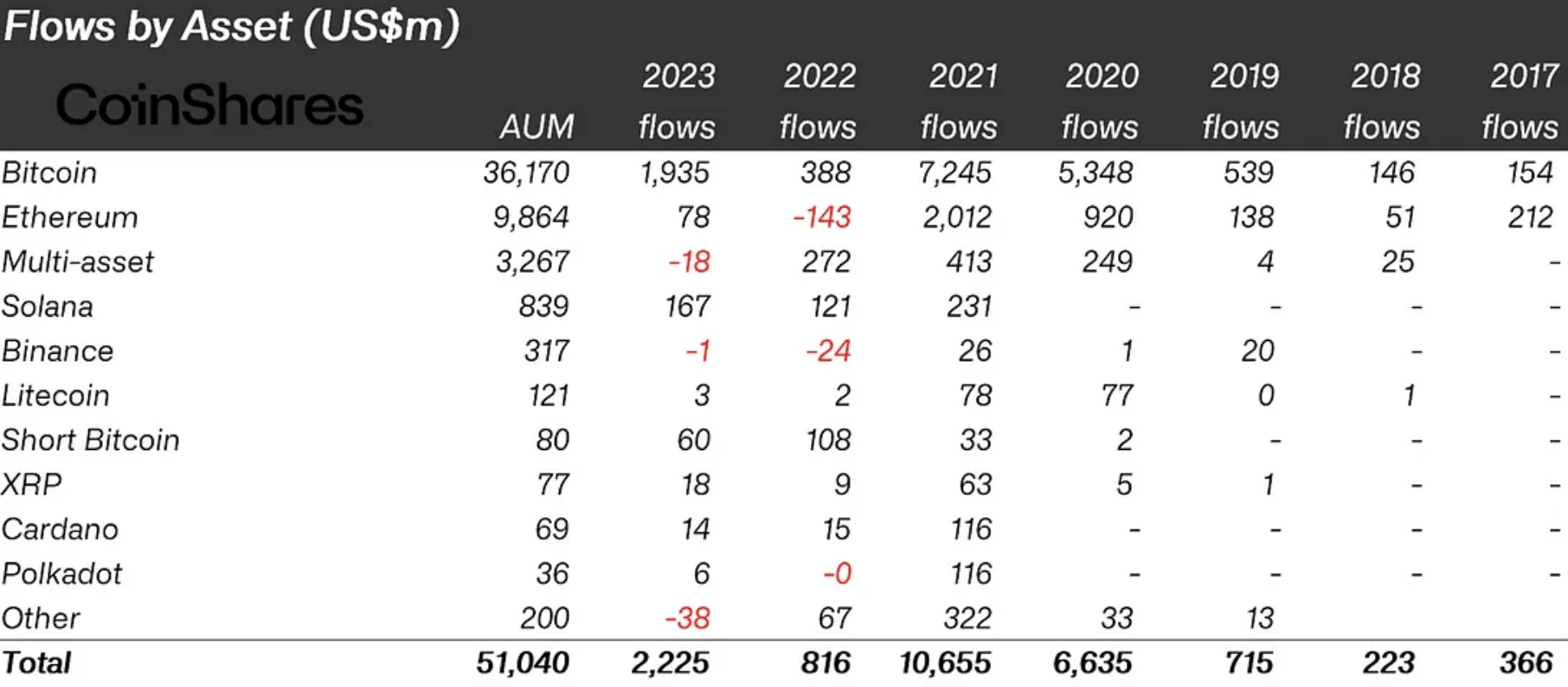

In a remarkable surge, digital asset investment products witnessed an impressive $2.2 billion in inflows for 2023, positioning it as the third-largest year on record, trailing only the extraordinary highs of 2020 and 2021.

A recently published annual report by CoinShares sheds light on the substantial growth within the XRP-focused exchange-traded products (ETPs) sector. In a doubling of inflows compared to the preceding year, XRP ETPs concluded 2022 with $8 million, skyrocketing to an impressive $16 million by the close of 2023.

Among altcoins, XRP ETPs secured the third spot, trailing behind Solana (SOL) and Ethereum (ETH). Notably, XRP assets under management reached a substantial $77 million.

Despite this surge, the $18 million garnered by XRP ETPs in 2023 falls short of the pinnacle reached in 2021, where the figure soared to an impressive $63 million. It was a year etched in memory for many as cryptocurrencies attained an all-time high, resulting in a significant influx of funds into investment solutions like ETPs.

What's in store for 2024?

Looking forward to the new year, the landscape appears promising yet uncertain. The lingering question remains: Can XRP surpass its previous records?

With multiple XRP-oriented investment products currently available in the market, including GXRP from ETC Group, AXRP from 21Shares and the eagerly anticipated Valour Ripple XRP ETP, the stage is set for potential breakthroughs.

While 2023 showcased an impressive 100% increase in fund inflows for XRP, industry experts are keenly observing how the coming year unfolds, awaiting signs of whether the digital asset can eclipse its previous heights or if it will encounter new challenges.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov