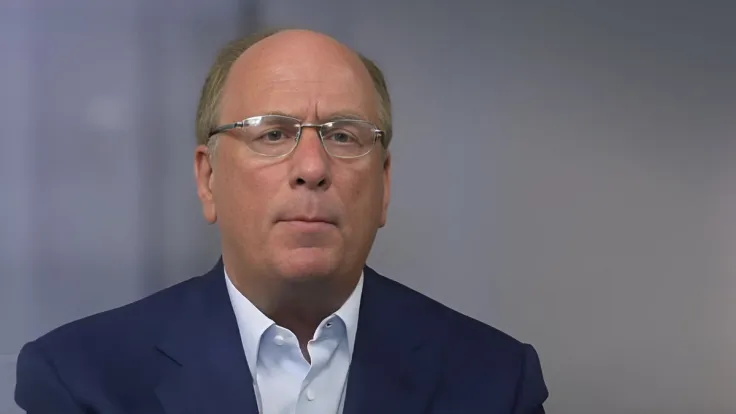

During a recent appearance on CNBC, Larry Fink, the CEO of financial giant BlackRock, said that he was a "major believer" that there was a role for Bitcoin in portfolios.

Fink recalled that he was initially a Bitcoin skeptic in the past. However, after learning more about the popular cryptocurrency, he realized that he was wrong.

The boss of the world's largest asset management firm now claims that Bitcoin is "legitimate" despite acknowledging that there are some misuses of the leading cryptocurrency.

Fink praised Bitcoin's diversification properties during the interview, arguing that it makes it possible to have "uncorrelated" returns. Furthermore, he believes that Bitcoin could protect investors from currency debasement. "I believe that you have countries where you are frightened of your everyday existence. And if you have an opportunity to invest in something that is outside of your country's control, then you have more financial control," he added.

Fink went on to describe Bitcoin as "digital gold" after previously drawing parallels between the largest cryptocurrency and the lustrous metal.

As reported by U.Today, Fink argued that Bitcoin could be another store of wealth back in 2021.

The Bitcoin community went on to underscore the significance of Fink's statements. "Larry Fink believes in Bitcoin," MicroStrategy CEO Michael Saylor said on X social media.

"Huge. Also Fink emphasizes bitcoin is a conservative, cautious investment, de facto replacing the old Wall Street sales pitches about bonds and real estate. This cycle = bitcoin’s mass adoption phase!" Bitcoin evangelist Tuur Demeester said in a social media post.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin