Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

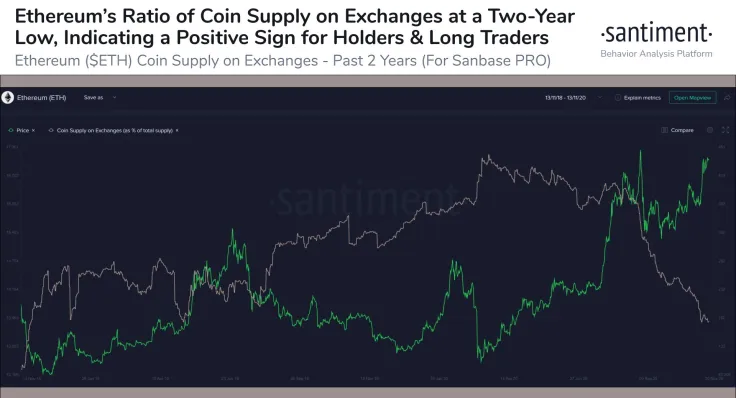

According to the data from Santiment, the percentage of ETH held on exchanges dropped to a two-year low. This indicates that there is lower selling pressure on Ethereum as its price holds stable above $450.

There are two key reasons why ETH on exchanges is declining. First, ETH 2.0 is nearing with an expected mainnet launch in December 2020. Second, it shows that the appetite to sell Ethereum at the current price level is relatively low.

Why ETH 2.0 is causing supply on exchanges to drop, strengthening Ethereum momentum

ETH 2.0 is a critical network upgrade for Ethereum because it expands its capacity to process transactions.

Currently, the Ethereum blockchain is processing around 15 transactions per second. With ETH 2.0, the chances of 3,000 transactions per second increase, with the potential to reach 100,000 in the long term.

It is important for Ethereum to reach a higher transaction capacity because unlike Bitcoin, it primarily handles decentralized applications. When the user activity of decentralized applications increases, ETH fees could spike to unsustainable levels. This makes it difficult for users to send transactions.

The ETH 2.0 upgrade is causing the supply of exchanges to drop because of the concept called “staking.”

The upgrade features a mechanism known as staking, which essentially allows users to deposit 32 ETH into Ethereum. Users that stake 32 ETH can process Ethereum transactions on the blockchain. In return, they receive around 15% return every year on their ETH holdings.

When users stake, they move their holdings into the eth2 deposit address. Although users can pull out of staking at any time, if they want to receive the yield, they need to continue staking. During staking, they cannot send or spend the 32 ETH.

But for ETH 2.0 to commence, the eth2 deposit contract has to receive 453,733 more ETH by December 1. Currently, the address has 70,555 ETH. The continuous inflow of ETH from various addresses to the eth2 deposit contract is likely causing exchange reserves to drop.

Large whale sell-off unlikely as a result

Analysts at Santiment said that this trend shows a major sell-off is becoming unlikely as a result.

Since there is a noticeable dip in ETH exchange reserves, there is a lower probability that whales would lead to a massive market pullback. They wrote:

“The percentage of total ETH being held on exchanges today (13.35%) has not been this low since November 23, 2018. The almost exact two-year milestone is a positive sign for Ethereum holders, who have historically benefited when supply held off of exchanges is kept low. It indicates that large whale selloff probabilities will remain limited.”

For now, ETH is remaining relatively stable above $450, a level that saw sharp rejections in the past.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin