Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

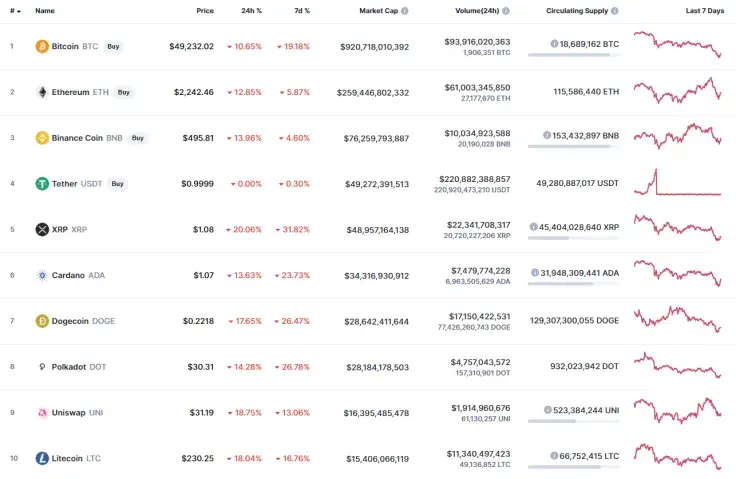

The market has again entered a correction wave as all top 10 coins are located in the red zone.

The crucial data for Bitcoin (BTC), Ethereum (ETH), XRP, Cardano (ADA), Binance Coin (BNB) and Polkadot (DOT):

|

Name |

Ticker |

Market Cap |

Price |

Volume (24h) |

Change (24h) |

|

Bitcoin |

BTC |

$920,718,010,392 | $49,431.02 | $93,916,020,363 | -9.83% |

|

Ethereum |

ETH |

$259,446,802,332 | $2,255.38 | $61,003,345,850 | -12.35% |

|

XRP |

XRP |

$48,957,164,138 | $1.09 | $22,341,708,317 | -17.91% |

|

Cardano |

ADA |

$34,316,930,912 | $1.08 | $7,479,774,228 | -12.45% |

|

Binance Coin |

BNB |

$76,259,793,887 | $495.70 | $10,034,923,588 | -13.20% |

|

Polkadot |

DOT |

$28,184,178,503 | $31.06 | $4,757,043,572 | -12.05% |

BTC/USD

Even though the market may have entered the correction cycle, Bitcoin (BTC) is the top "gainer" as the rates of altcoins have gone down much deeper.

On the daily chart, Bitcoin (BTC) has touched the support zone at $48,800. However, no bounceback has occurred, which means that the rate of the main crypto might head lower. In this case, the next support is around the zone of $45,000.

Bitcoin is trading at $48,948 at press time.

ETH/USD

The rate of Ethereum (ETH) has faced a more profound drop, as the drop has made up 12.35%.

Etherum (ETH) has also entered the bearish zone, and there are no prerequisites for a long-term bullish trend.

As a more likely scenario, one may expect a retest of the MA 50 that refers to the level around $1,950.

Ethereum is trading at $2,218 at press time.

XRP/USD

XRP is the top loser today as the rate of the coin has declined by 17% since yesterday.

On the daily time frame, XRP is also on its way to testing the MA 50 that is located around the area of $0.82. There may be a short-term bounce-off from that area.

XRP is trading at $1.0736 at press time.

ADA/USD

Cardano (ADA) is not an exception to the rule, falling by 12.45% over the last 24 hours.

Cardano (ADA) has tested the level of $0.98. However, bulls are unlikely to hold as the bears keep pressing. In this regard, there is a good chance of seeing a retest of the next level of $0.70 shortly.

ADA is trading at $1.0838 at press time.

BNB/USD

Binance Coin (BNB) is the second-most falling coin today as its rate has gone down by 13.20%.

Despite the decline, Binance Coin (BNB) is trading above $500, which means that bulls are not going to give up so easily. As a more likely scenario, traders might expect a sideways trend in the range of $480-$500.

BNB is trading at $506 at press time.

DOT/USD

The rate of Polkadot (DOT) has decreased by 12% over the last day.

Even though Polkadot (DOT) has followed the decline of Bitcoin (BTC), its short-term scenario is bullish. The selling trading volume is at its peak, which means that sellers may have fixed their positions. In this case, there are chances of seeing DOT at the level of $37 soon.

DOT is trading at $31.10 at press time.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin