Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

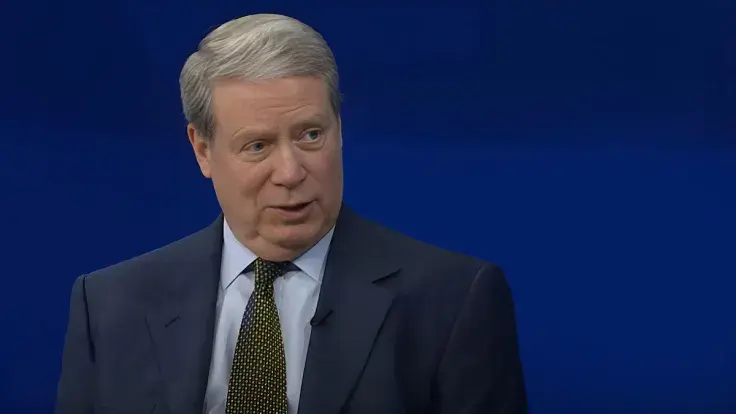

Billionaire investor Stanley Druckenmiller recently revealed that he has taken a short position on the U.S. Dollar, anticipating that the Federal Reserve will soon have to cut interest rates in response to an economic downturn. This move could prove highly beneficial for cryptocurrencies like Bitcoin, Ethereum and XRP, as a weakening U.S. Dollar often results in increased interest in alternative assets.

Druckenmiller's decision to short the dollar comes as the U.S. economy faces growing uncertainty, with inflationary pressures mounting and the Federal Reserve potentially needing to take action to mitigate the effects of an economic slowdown. As interest rates decrease, the value of the dollar is likely to decline, making alternative investments more attractive to investors seeking higher returns and a hedge against inflation.

The cryptocurrency market, currently in the process of a long-term recovery, could stand to gain significantly from a weakening U.S. dollar. Bitcoin, the largest cryptocurrency, is attempting to breach the $30,000 threshold, while Ethereum is consolidating around the $2,000 mark.

A weaker dollar could lead to increased investment in cryptocurrencies for several reasons. First, as traditional investments such as stocks and bonds may underperform in a declining dollar environment, investors may seek alternative assets like cryptocurrencies. Secondly, a falling dollar can drive up the price of commodities, including digital assets like Bitcoin, which are often perceived as a store of value and a hedge against inflation.

Moreover, as cryptocurrencies are decentralized and not directly tied to any single economy or central bank, they may be viewed as a safer investment option during times of economic uncertainty. This perception could result in increased demand for cryptocurrencies and drive up their prices, benefiting existing holders and attracting new investors.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov