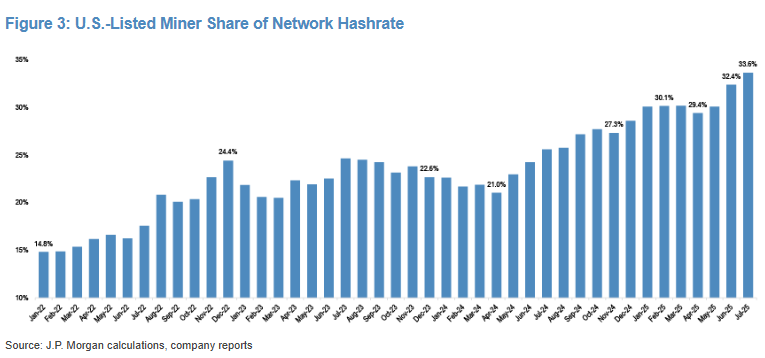

The share of Bitcoin's total network hashrate attributed to publicly listed U.S. miners has surged to nearly 34%, according to recent data shared by analysts at banking giant JPMorgan.

Notably, their hashrate dominance has more than doubled since January 2022 (when it stood at roughly 15%).

However, this growth was rather uneven. Their share of the global hashrate kept fluctuating between 20% and 23%.

They finally reached the 30% milestone by November, and this growth has steadily continued throughout 2025.

"Access to US capital markets is a meaningful differentiator for miners," Matthew Sigel, head of digital assets at VanEck, said while commenting on the most recent milestone.

Last month, JPMorgan analysts revealed that publicly listed miners managed to score one of their best quarters to date, with roughly $2 billion worth of gross profits.

MARA Holdings (formerly Marathon Digital) remains the leading U.S. Bitcoin miner. Last month alone, the company produced 950 BTC. Its total holdings are now close to surpassing the 50,000 BTC milestone.

U.S. share of global hashrate

According to the Hashrate Index, the U.S. currently accounts for a total of 36% of the global hashrate. The estimate is based on mining pool data and ASIC trading flows.

China, which used to enjoy absolute dominance in the Bitcoin mining sector with nearly 75% of global hashrate due to cheap coal and hydro power, lost its lead after its government initiated a full-fledged mining ban in 2021.

Despite the ban, China still accounts for 17% of global hashrate, which puts it in third place.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin