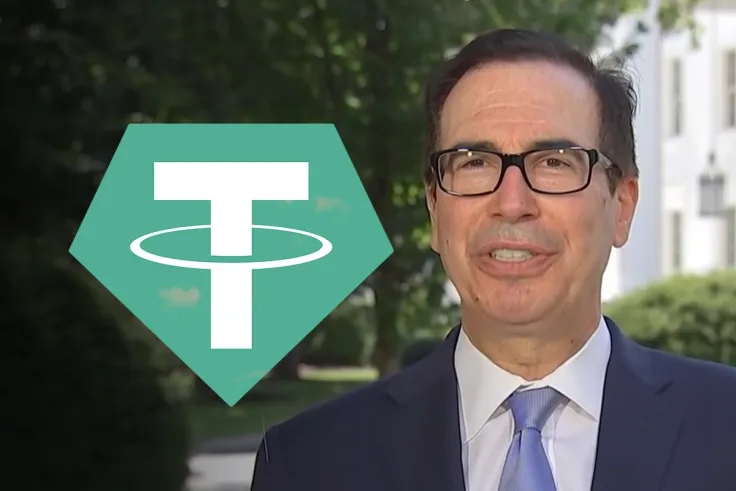

Steve Mnuchin, who used to be the secretary of the U.S. Treasury and is now a founder of Liberty Strategic Capital private equity fund, has spoken to Bloomberg TV and shared his take on stablecoins, and Tether in particular.

Mnuchin's fund likes payments via blockchain and stablecoins

While answering the questions of Bloomberg TV host David Westin, the former U.S. Treasury Secretary said that his new fund, Liberty Strategic Capital, is focused on technology—cybersecurity, national security, privacy, as well as fintech.

In particular, Mnuchin stated that "we like the payments space," when the host asked him to identify investment opportunities in this industry. He mentioned that the biggest opportunities in this area lie within real-time cross-border payments. And here, Mnuchin sprang to the subject of blockchain-based stablecoins.

Mnuchin reckons that stablecoins should most likely be regulated. They should easily transferrable, which means backed by real U.S. dollars that are held in a secure custodian bank.

Tether has 68 billion USDT in circulation, here's Mnuchin’s comment

Mnuchin also shared his take on stablecoins, and Tether in particular. The Bloomberg TV host stated that, according to a Bloomberg article published earlier today, Tether has over $68 billion USDT, and $48 billion of those were issued in 2021, seemingly doubting that Tether can hold that much cash anywhere.

According to Mnuchin, stablecoins must not be "like casino chips." People should always have the opportunity to exchange the dollar-backed stablecoins they hold for real U.S. dollars at any time. And these dollars that back stablecoins have to be held in a regulated bank, in a trust account.

The former U.S. Treasury secretary thinks that stablecoins should be invested in the U.S. Treasury or something "that looks like U.S. Treasuries"—i.e., money markets of highly liquidity-backed investments.

"They shouldn't be like casino chips - if you are going to issue a stablecoin the actual money should be held in a regulated bank and people who hold stablecoins should be able to exchange those for real dollars at any time." Former Treasury Sec. @stevenmnuchin1 #BloombergInvest pic.twitter.com/hpRkgXHkzj

— Bloomberg Live (@BloombergLive) October 7, 2021

Stablecoins to be regulated as fiat payment platforms

As reported by U.Today earlier, global regulators, such as the Bank for International Settlements and IOSCO security regulators, believe that stablecoins like Tether have to be regulated in the same way as traditional financial payment providers like Western Union and PayPal.

However, this proposal will be discussed by the public before it gets finalized next year.

Gamza Khanzadaev

Gamza Khanzadaev Yuri Molchan

Yuri Molchan Arman Shirinyan

Arman Shirinyan Alex Dovbnya

Alex Dovbnya