Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

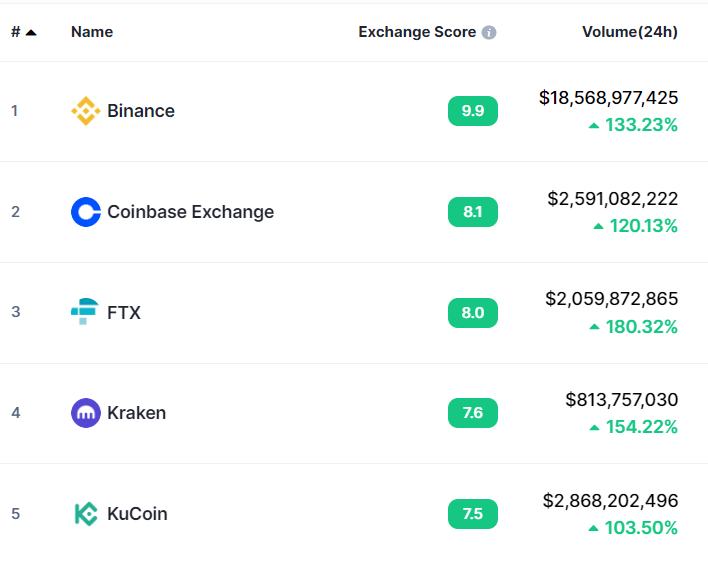

The crypto market has seen a remarkable spike in trading activity in the last 24 hours. On the day, several of the top-ranked crypto exchanges recorded double and triple-digit percentage increases in trading volume according to data from CoinMarketCap.

Decentralized exchanges (DEXs) leading the trading volume gains pack include dYdX (over $770 million worth of transactions), Kine Protocol (over $274 million), and Uniswap (over $264 million). These volumes represent a 143%, 9.2% and 122.3% increase in trading volume on the DEXs, respectively.

The world's largest crypto exchange by trading volume Binance led the charge among centralized exchanges (CEXs). Binance recorded a 127.9% 24 hours increase in trading volume — conducting transactions worth over $18 billion. Binance was followed by Coinbase — with over $2.5 billion traded showing a 120% 24 hours increase.

What has been driving the pump?

The trading activity spike comes on the back of the announcement of crucial Consumer Price Index (CPI) data which the market had been anticipating. The announcement saw the price of Bitcoin (BTC) swing trade, first dropping to a two-week low of $18,304, then rising to currently trading at around $19,400.

Citing data from Santiment, U.Today reported that the crypto market price has been felt most strongly in the derivatives market. Short traders have bagged massive liquidations as the market has failed to conform to the crowd's expected outcome of a price dip following bearish inflation news. Meanwhile, DEX utility tokens appear to have started the trend when they recorded a 55.7% percentage price increase yesterday.

Arman Shirinyan

Arman Shirinyan Alex Dovbnya

Alex Dovbnya Dan Burgin

Dan Burgin