Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

September is considered one of the worst months for the cryptocurrency market and Bitcoin in particular. The average profitability of BTC is -6.18% and the median is -4.43%. Historical trends are rarely reliable for cryptocurrencies, but considering the fact that Bitcoin is a $1.2 trillion asset with over 11 years of trading on the exchange, its price history is something to rely on.

However, the experts at Spot On Chain refuse to just accept the high probability of a negative September and offer five key reasons why this time could be different for BTC.

Funnily, one of the main arguments is based on historical patterns that may not always be relevant. Thus, Spot On Chain points out that nearly 43% of years with negative Augusts have been followed by positive Septembers. This suggests that the market could see a rebound, despite the usual negative sentiment.

Sellers out, holders in

Another big factor is that key players have been selling less recently. The German government, Mt. Gox and Genesis Trading have already sold a lot of Bitcoin, with their combined sales reaching over 170,000 BTC in July and August.

It is also worth mentioning that the U.S. government still holds over 203,000 BTC, but has been cautious in its recent movements, opting for over-the-counter sales that minimize market impact. This reduction in selling pressure could help keep the market stable.

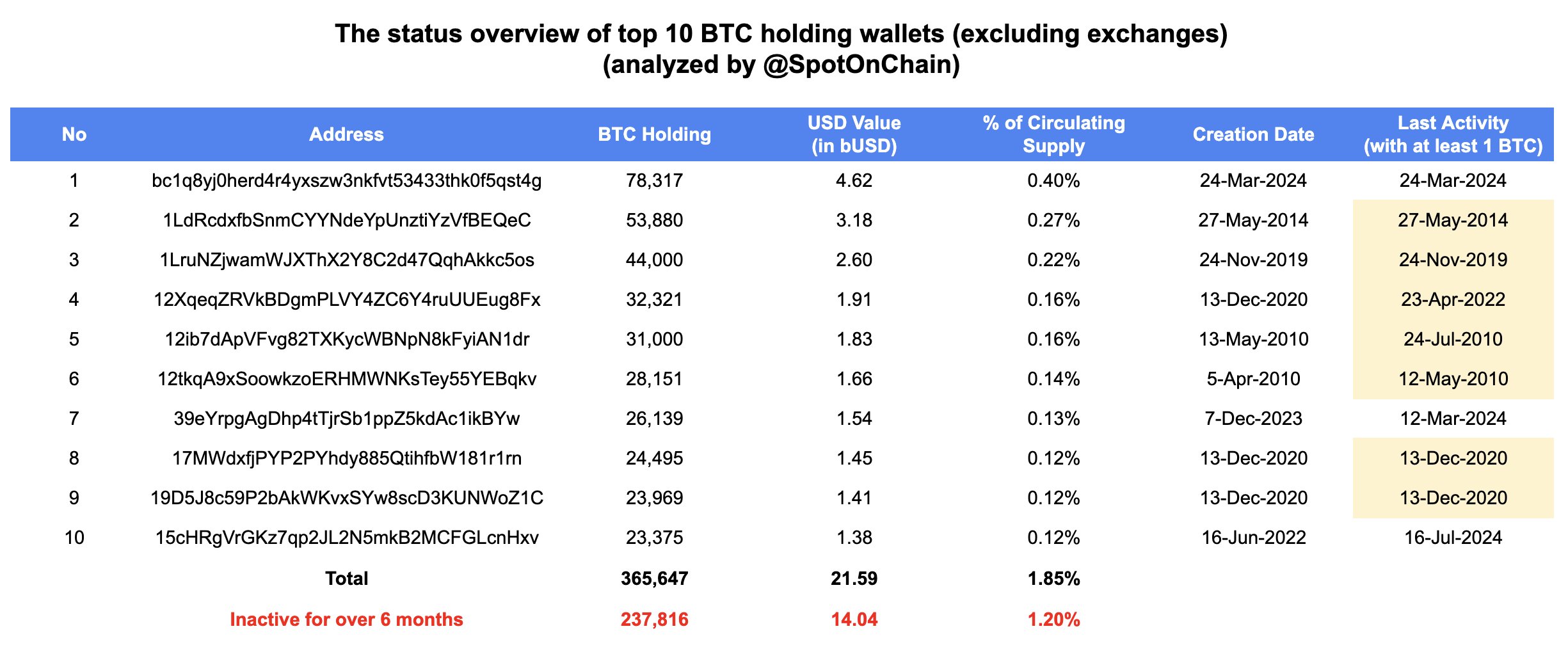

Furthermore, long-term holders remain strong, adding 262,000 BTC to their positions in August. These holders now control 75% of the total supply, signaling confidence in the asset's future. Top anonymous wallets, holding significant amounts of Bitcoin, have also remained inactive, further reducing the likelihood of sudden sell-offs.

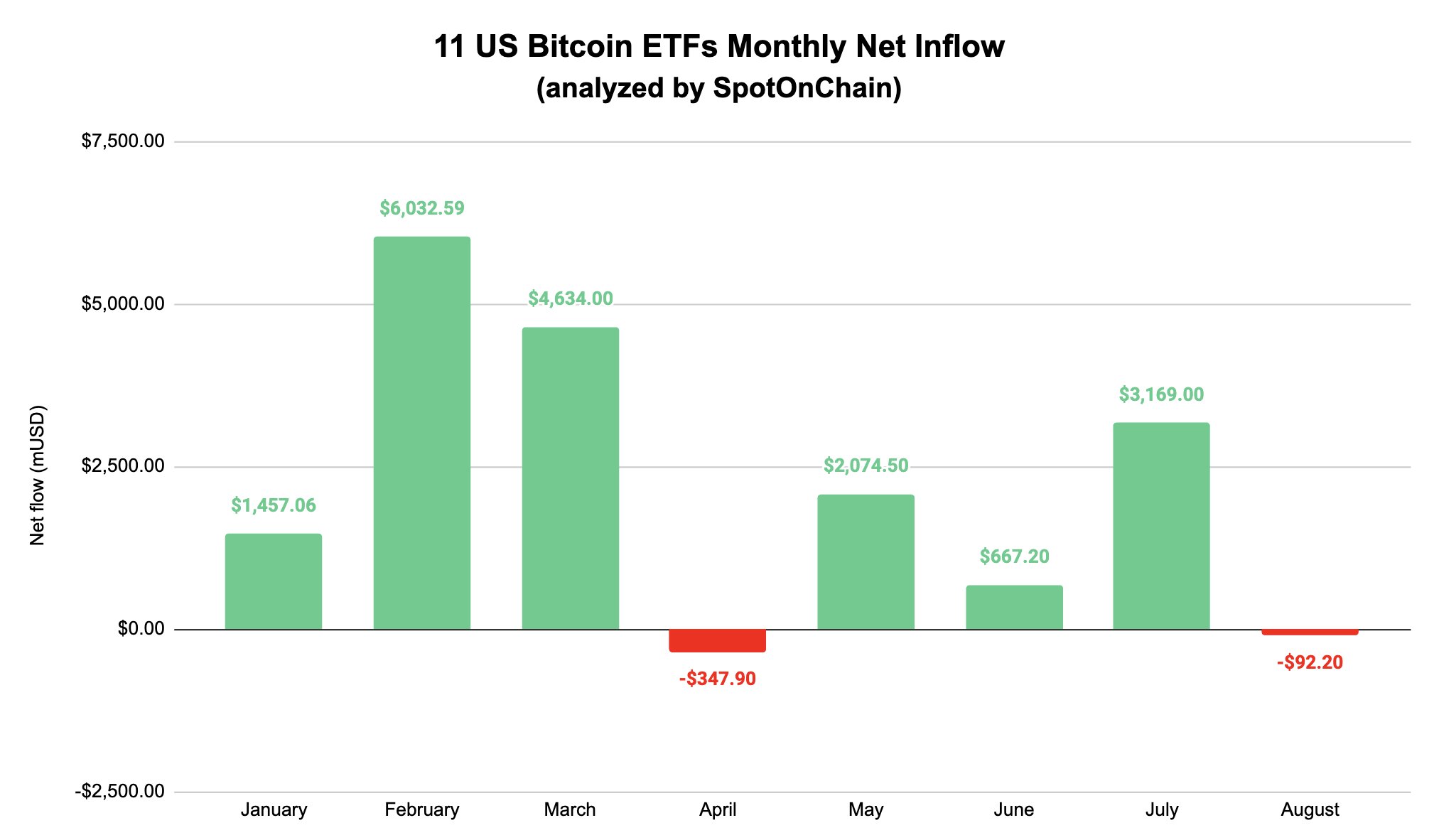

Bitcoin ETF inflows expected

There is also the possibility of a new wave of investment in Bitcoin ETFs, which adds to the bullish case. After a slight dip in net flows in August, September could see a positive inflow between $500 million and $1.5 billion, based on historical patterns of alternating positive and negative months.

There are other things that could affect the market too. With the Federal Reserve possibly cutting interest rates and FTX paying back $16 billion in cash, there could be more demand for Bitcoin. Also, growing political support for favorable cryptocurrency regulations in the U.S. could make investors more confident and give Bitcoin another boost this September.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov