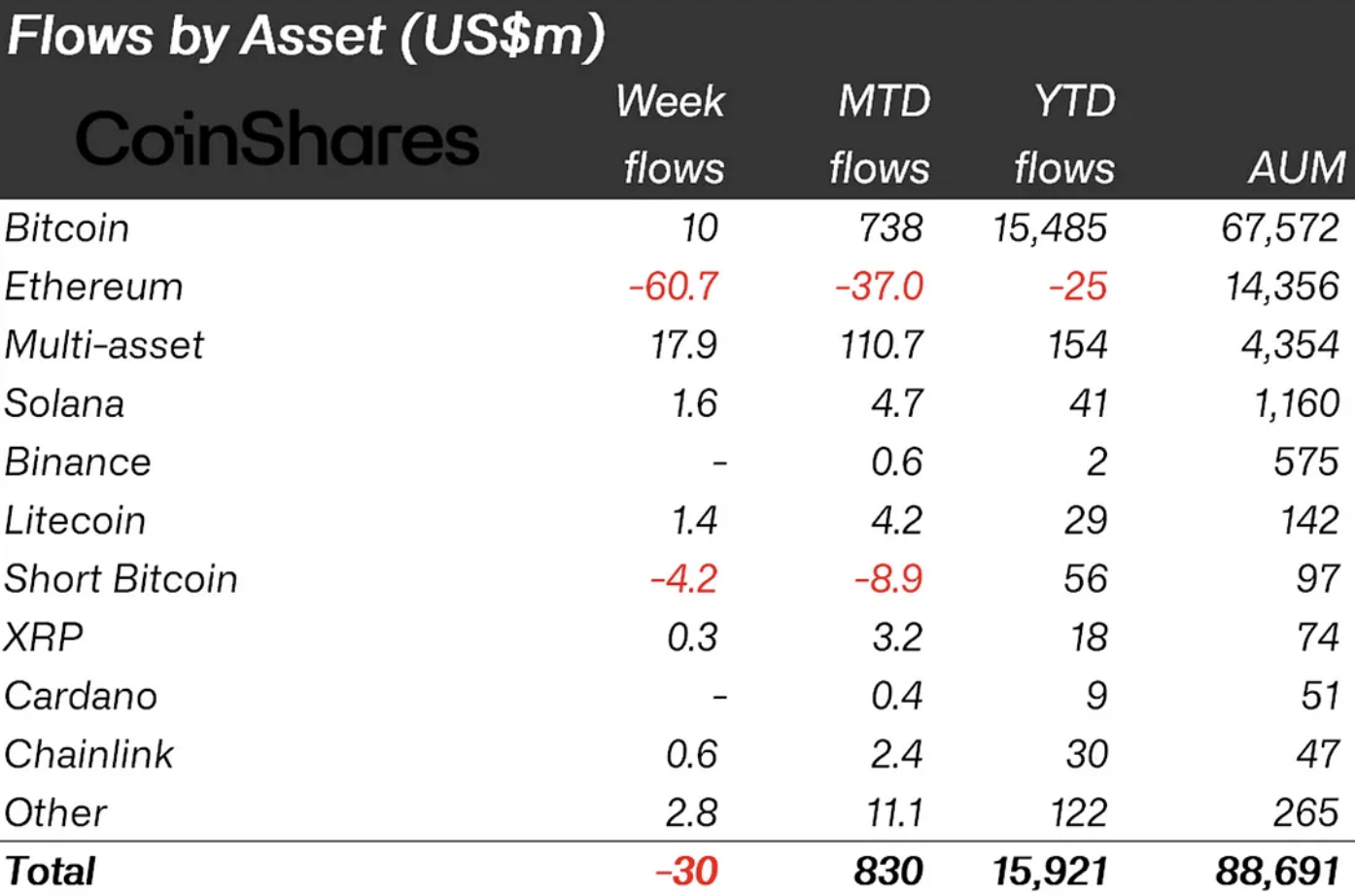

Inflows into XRP-focused investment products are on the rise again, according to a new report from CoinShares. According to the data, the volume of injections into such exchange-traded products increased by more than $300,000 last week.

This brings the total to $3.2 million since the beginning of June and $18 million since the beginning of the year. XRP-related investment products are at the top of the list, along with those for Solana (SOL), Litecoin (LTC) and Chainlink (LINK).

Moreover, XRP is also outperforming the leading altcoin crypto market in this metric, with ETPs seeing $25 million in outflows since the beginning of the year.

You can also note that inflows into investment products tied to XRP have been growing for weeks, as opposed to total outflows. This clearly signals a positive attitude toward the popular cryptocurrency on the part of investors from traditional financial markets.

Is XRP ETF possibility?

The idea of an XRP ETF has been a topic of discussion among enthusiasts this whole year. ETP inflows often precede or accompany discussions of potential ETF offerings. Such products could provide institutional and retail investors with easier access to XRP, potentially further increasing its market appeal.

While regulatory hurdles and market conditions remain factors to consider, the growing interest in XRP through ETPs suggests a growing appetite for more accessible investment opportunities on the crypto market.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov