Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

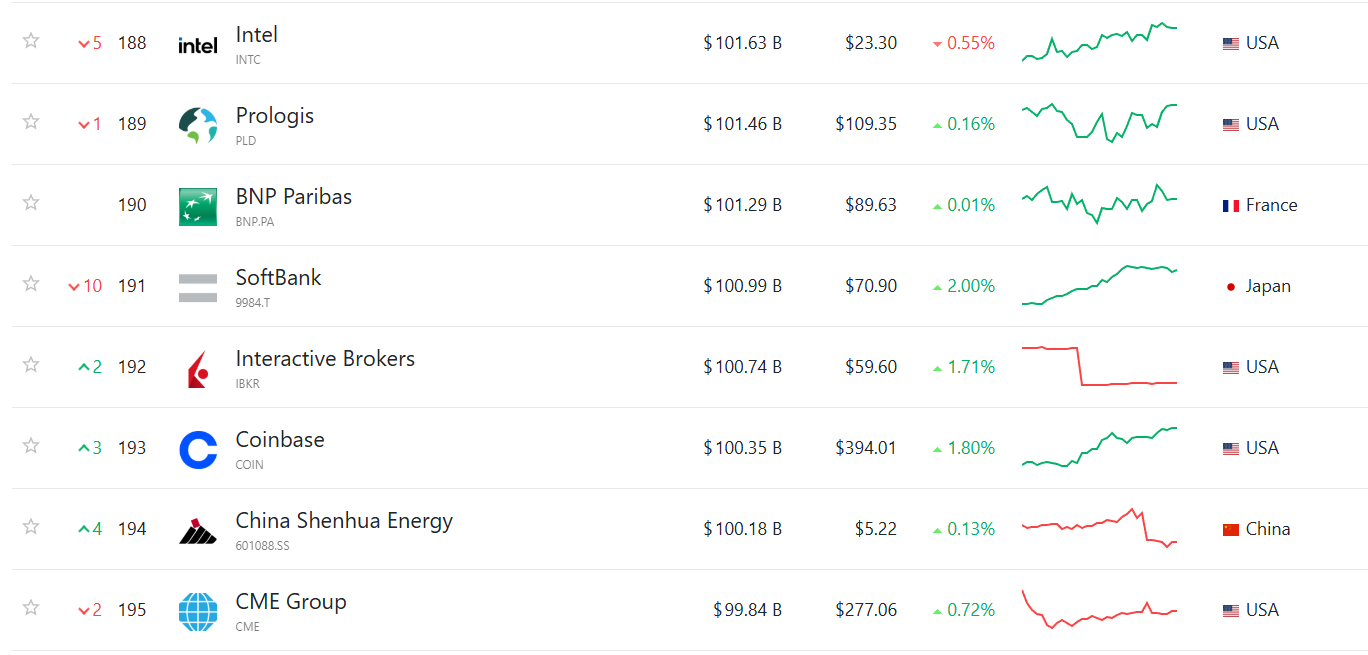

With its market valuation surpassing that of established behemoths like Nintendo, Dior, Siemens and BNP Paribas, Coinbase has formally entered the $100 billion club. With its share price hovering around $394, this milestone not only emphasizes Coinbase's own comeback but also the general upturn in the cryptocurrency industry as a whole.

Coinbase's rise appears to be parabolic, but it is actually the result of a fundamental change in public opinion. A year ago, Coinbase was trading below $60 due to declining volumes and regulatory uncertainty. With the help of redoubled institutional involvement and consistent spot Bitcoin ETF inflows, the company has now made an almost unbelievable comeback. The main player in this dynamic has been Bitcoin itself.

Before a recent cooling-off to about $117,000, Bitcoin surged from the $97,000 range to highs above $122,000 during the previous quarter. For Coinbase the enormous surge in Bitcoin has resulted in increased trading volumes and transaction fees, which have restored profitability and increased investor confidence.

The Bitcoin daily chart offers a clear illustration of this correlation: the final leg of Coinbase's valuation spike nearly coincided with the breakout from the $110,000-$112,000 range. This moment is also unique because of how decisively Coinbase has surpassed more established companies. To put things in perspective, Prologis is valued at about $101 billion, Siemens is in the same range and Nintendo is close to $99 billion.

Coinbase's victory over these well-established businesses is more than just a show of support; it is an indication that investors are prepared to place significant bets on the continued widespread acceptance of cryptocurrencies. This rally, according to skeptics, is merely excessive speculation.

In addition, the RSI levels for Coinbase's stock and Bitcoin both point to overbought conditions that might invite a correction. Beyond the headlines, however, this performance serves as a reminder that Coinbase is more than just another exchange; it has emerged as a predictor of the viability of cryptocurrencies as an asset class.

Coinbase may consolidate this valuation and possibly challenge even larger names in the S&P 500 in the upcoming quarters if Bitcoin sustains support above $110,000 and overall cryptocurrency liquidity keeps increasing.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov