Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

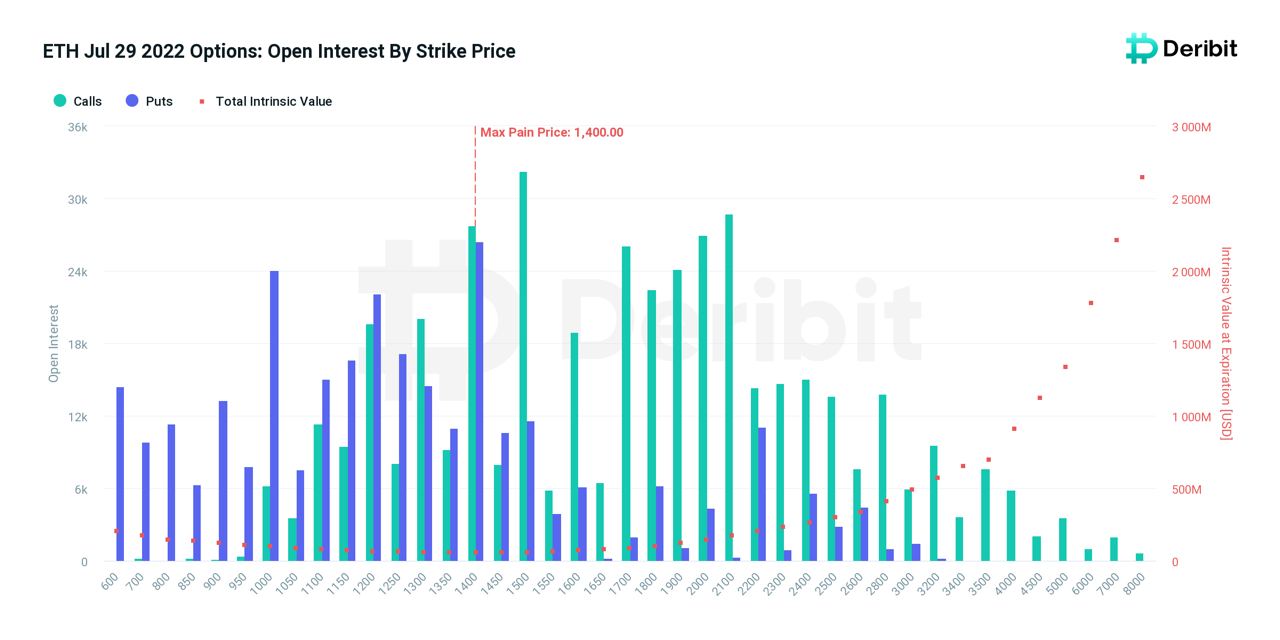

On July 29, almost $1.2 billion worth of Ethereum options are going to expire at the max pain price of $1,400. The put/call ratio is 0.67, so most derivatives traders and investors are betting on the Ethereum price increase. But the max pain price suggests that we will see the second biggest cryptocurrency plunge in the upcoming days.

With most options open around $1,400, most bulls and bears are aiming at Ethereum to drop further and the end of the reversal rally that started a few weeks ago. While some traders might be using options to hedge their spot positions, Ether's rally further up is questionable, considering the lack of inflows and technical resistance it faced on the weekly timeframe.

The highest call options volume on the chart suggests that the majority of bulls believed in Ether reaching $1,500. The lack of orders placed at extremely high price levels suggests that the short-term value increase did not fool the market and acted rationally, instead of placing bets on ETH reaching extreme highs like $2,000.

Ethereum rally is fading

According to the technical situation on the chart, Ethereum's rally is struggling as the coin fails to break the 200-week moving average that acts as a main barrier for assets in a bearish trend.

In addition to facing an extremely strong resistance level on a long-term chart, Ethereum painted a "dangerous" candlestick pattern called "hanging man," which usually appears at the top of any short or mid-term rally and indicates that the buying power is no longer present and the asset's price is going to reverse.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov