Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

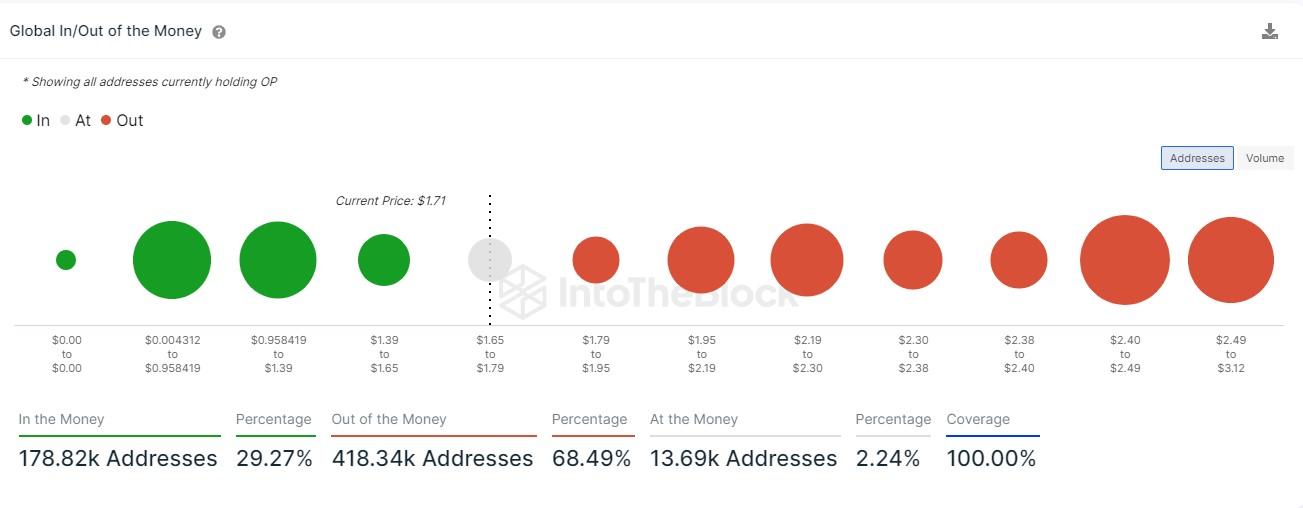

Ethereum-based Layer 2 protocol Optimism (OP) is brandishing a metric that shows its relative dimming. According to data from IntoTheBlock, the total number of Optimism addresses in profit has slumped to just 29.27%.

Optimism address by the numbers

According to the data insight, this percentage equals approximately 178,820 addresses. This figure was negated by the total wallets or OP holders that are in losses at this time. This figure topped 418,300, and it represented a total of 68.49% of all addresses hosted on the Optimism chain.

Optimism entered into the digital currency ecosystem as a high flier with the perfect innovation to help scale transactions on Ethereum by a mile. With its optimistic rollup technology, Optimism emerged to outcompete Polygon, the de facto L2 scaling pioneer on Ethereum.

The emergence of other Layer 2 protocols like Arbitrum, Polygon zkEVM and zkSync have brought unwarranted competition to Optimism. By sharing relevance among users, the luster of OP as a token for utility and investment has tapered off significantly.

The token is worth $1.7528, down by 2.69% over the past 24 hours and by more than 16% over the past week. The slump in valuation leading to massive addresses in loss was predicated by the 61.74% drop from its all-time high (ATH) attained about a year ago.

Potential short-term remedy

Besides being thrilled by the prospects of the utility that a protocol like Optimism embodies, investors are also interested in the inherent price performance of its underlying asset over time. At the moment, the focus of most retail investors hinges on the meme coin hype that has pushed the likes of PEPE to unimaginable heights.

While Optimism is on track with its long-term growth push, in the short term, creating or hosting meme coins on its chain might be a fast way to refocus attention on the protocol and drive the bullish sentiment of the OP token.

Though this solution may prove effective, the sustainability of meme coins makes it appear not to be.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin