Triggered by the collapse of FTX crypto exchange and its associated trading firm Alameda Research, the bloodbath on the digital assets markets pushed Bitcoin (BTC) and Ethereum (ETH) to two-year lows. Meanwhile, funds are migrating to reliable exchanges amid panic-selling.

MEXC cryptocurrency exchange witnesses increased trading volume

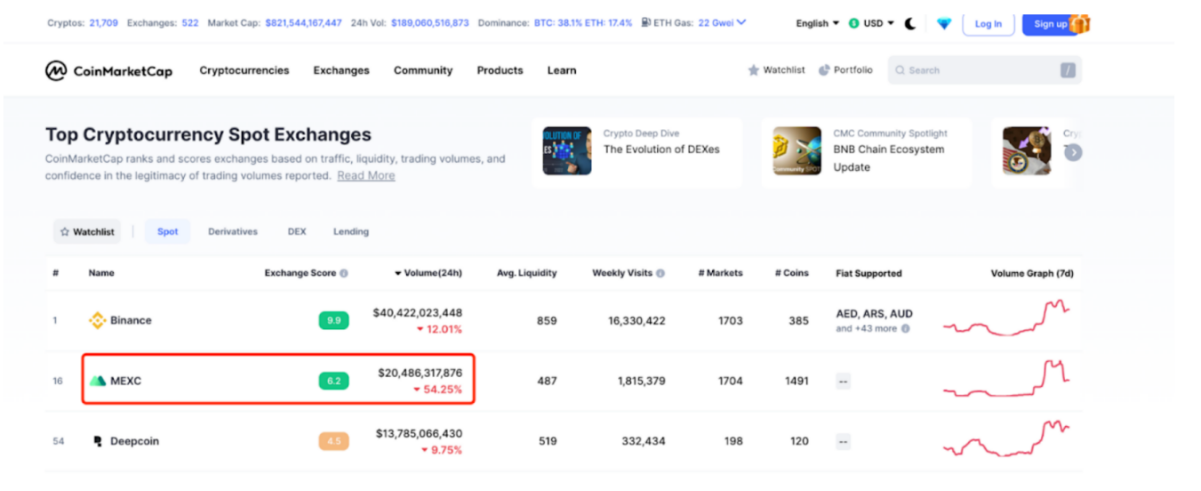

According to a statement shared by MEXC Global, its trading system witnessed a new record 24-hour volume. In terms of both spot and derivatives trading, MEXC is ranked #2, surpassed only by the largest crypto heavyweight, Binance.

MEXC’s 24-hour trading volume in the spot section nets $20.4 billion, second only to Binance’s $40.4 billion. At the same time, MEXC’s derivatives segment registered $67.1 billion in 24-hour trading volume. Binance totaled $134.2 billion.

The MEXC team attributed this success to the long-term focus of its team on ensuring the best possible user experience ever:

Ensuring the safety of user funds and 100% redemption is the most basic bottom line of the industry. We have always adhered to the service tenet of "Customer First" and have established a strict user reserve system at the beginning. We will never misappropriate user assets to conduct risky businesses such as wealth management, DeFi mining, and pledge loans on other platforms. We will also support large amounts of withdrawals and quick transfers to ensure 100% safe payment of user assets.

As covered by U.Today previously, in Q3, 2022, MEXC made headlines by adding a fiat-to-crypto exchange module.

With this module activated, MEXC Global users can seamlessly buy crypto with credit and debit cards.

Crypto traders are moving to MEXC

Also, MEXC is the only centralized exchange from the top league that witnessed an increased positive net inflow of funds.

1/3 The market has fluctuated violently in the past two days, and users have clearly realized that there are not many centralized exchanges that are truly trustworthy. Indeed, the user's choice is the best vote of confidence. pic.twitter.com/oXsykexqhp

— MEXC Global (@MEXC_Global) November 10, 2022

As of Nov. 10, 2022, MEXC witnessed over $15 million in net inflow of funds. MEXC is also one of the first exchanges to implement a transparent publicly visible proof-of-reserves scheme.

This instrument is designed to employ the Merkle tree to demonstrate the status of reserves of centralized exchanges.

The introduction of proof-of-reserves modules is a landmark achievement in Web3 progress for its massive adoption.

Dan Burgin

Dan Burgin Alex Dovbnya

Alex Dovbnya Denys Serhiichuk

Denys Serhiichuk Caroline Amosun

Caroline Amosun