The largest crypto asset manager Grayscale Investments has tweeted that the fiat value of the total amount of crypto it holds has diminished slightly ($0.3 billion).

However, recent analytics data shows that inflows into the company’s altcoin trusts have resumed.

Over the past weeks, Grayscale has acquired all crypto from its assortment, except Bitcoin, Ethereum and Ethereum Classic.

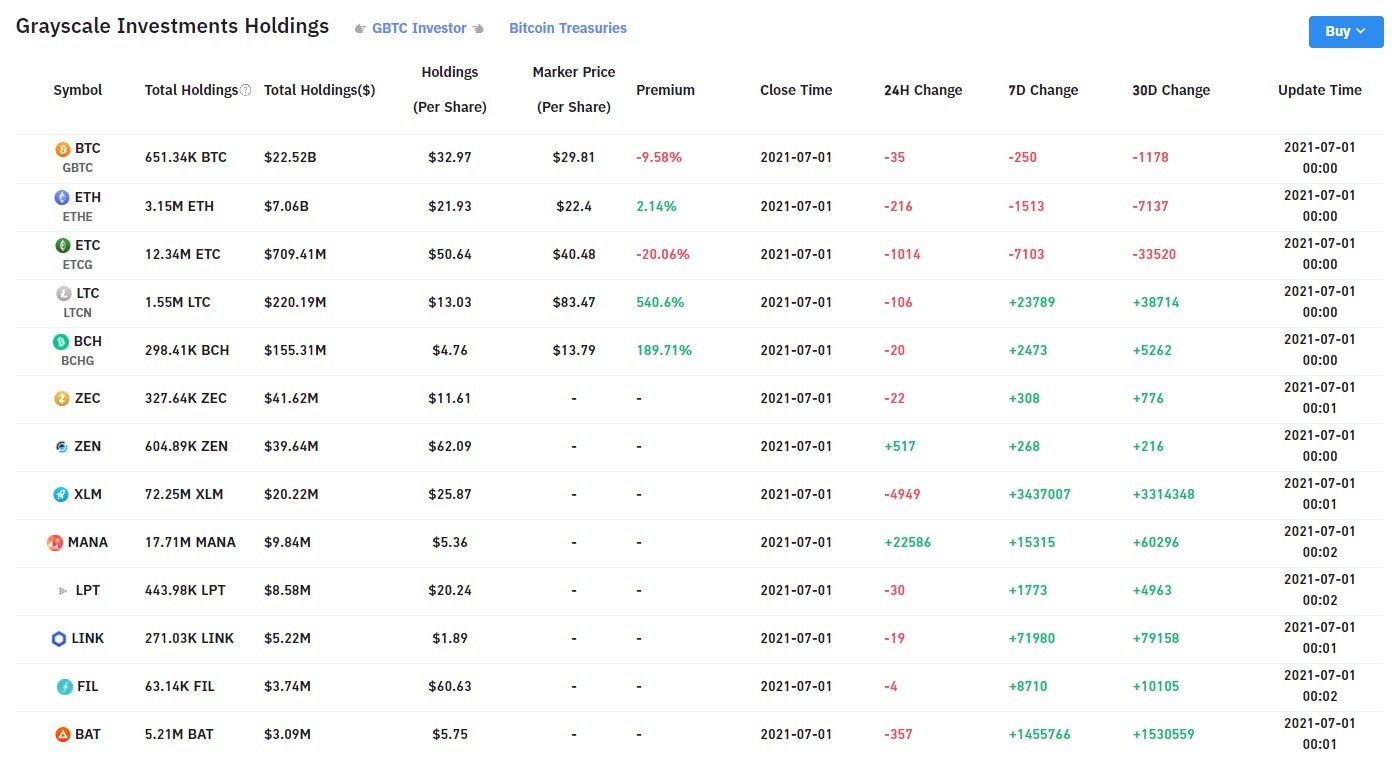

Data provided by the Bybt analytics website, shows that weekly and monthly inflows have been registered both into old and new altcoins trusts of the company: LTC, XLM, MANA, LPT, etc.

Stellar’s XLM figures are the biggest in the Grayscale table: 3,437,007 XLM acquired over the past week and 3,314,348 XLM have been bought in the past thirty days.

The analytics service has also noted ZEN and MANA inflows over the past 24 hours - +517 and +22,586 respectively.

Overall, as of June 30, Grayscale holds a total of $31.2 billion worth of cryptocurrency assets.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin