Ki Young Ju, CEO and founder of blockchain analytical platform Cryptoquant, explains the difference between the ongoing Ethereum (ETH) rally and the bull run of early 2018.

Ethereum (ETH) is leaving exchanges—even over $4,000

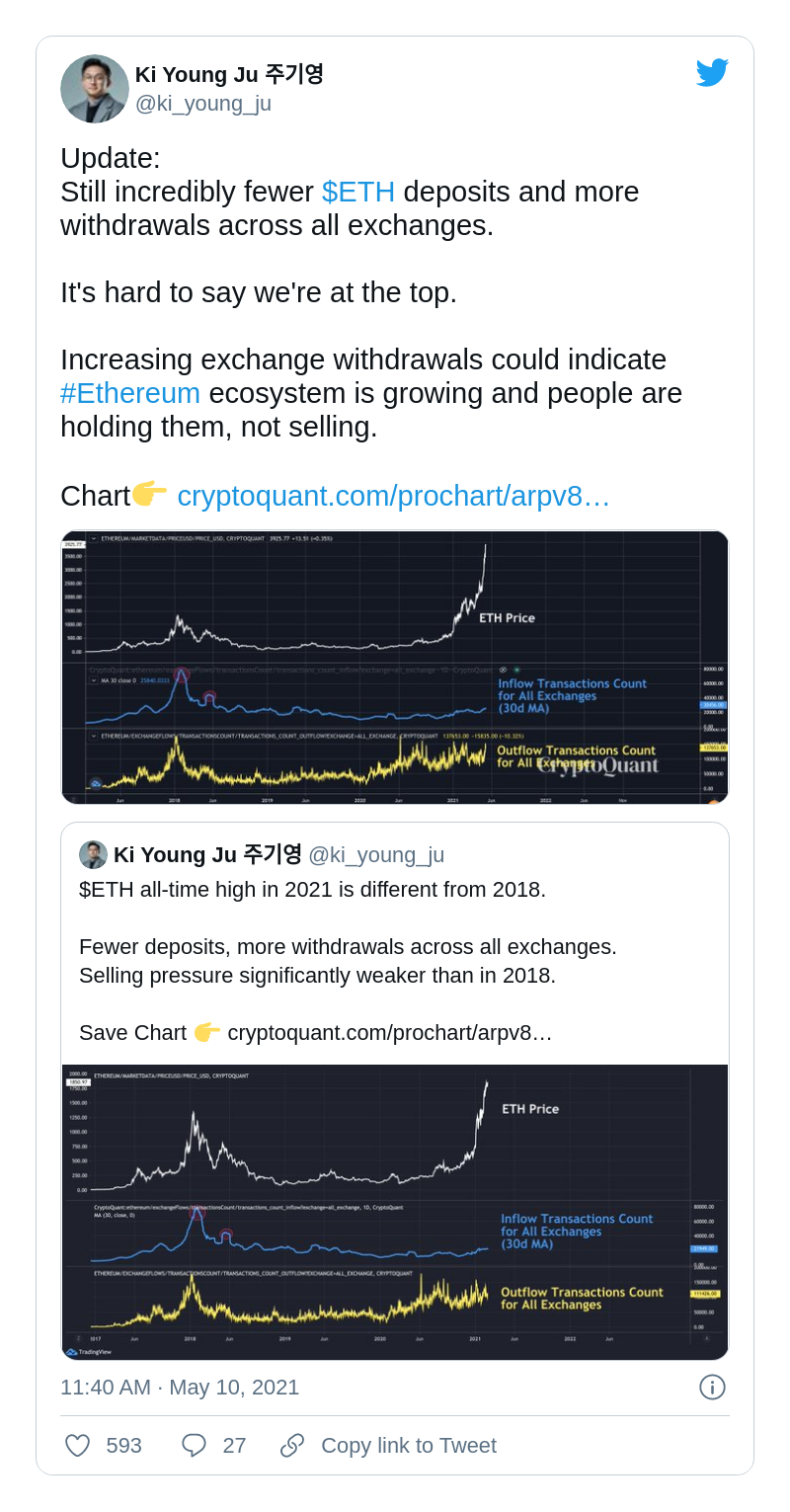

Mr. Ki Young Ju has noted two processes that are dominant for the current Ethereum (ETH) markets. First and foremost, outflows from all major exchanges are increasing day by day.

At the same time, inflows across centralized platforms remain stagnant and have begun decreasing. As a result, the quantity of Ethers (ETH) available for selling on exchanges has plummeted.

The analyst treats the discrepancy as a powerful bullish signal for the second-largest cryptocurrency. Ethereum positions are gaining strength due to solid fundamentals:

Increasing exchange withdrawals could indicate #Ethereum ecosystem is growing and people are holding them, not selling.

As covered by U.Today previously, Ethereum (ETH) printed a new all-time high today, May 10, 2021. The Ether price spiked over $4,100 on major spot exchanges.

Markets might be nowhere near the top

Mr. Ki Young Ju noticed that this situation looks quite different from that of early January 2018. The selling pressure is significantly weaker today than it was 40 months ago.

Besides general "altcoins season" vibes, the Ethereum (ETH) price may be catalyzed by two powerful drivers. As the Ethereum (ETH) community inches closer to the ETH2 release, more and more Ethereans are considering joining staking processes. That requires them to obtain 32-ETH minimum stakes.

Also, the much-anticipated EIP-1559 implementation is expected in July 2021. It will turn Ether into a deflationary asset with its dynamic fees structure and periodic destroying of fees.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov