Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Shiba Inu (SHIB), once a shining beacon in the world of meme-inspired cryptocurrencies, seems to be stumbling. The digital asset, famous for its dog mascot and astronomical growth, has been in the midst of an anemic run for 23 consecutive days, marking a troubling period for its holders.

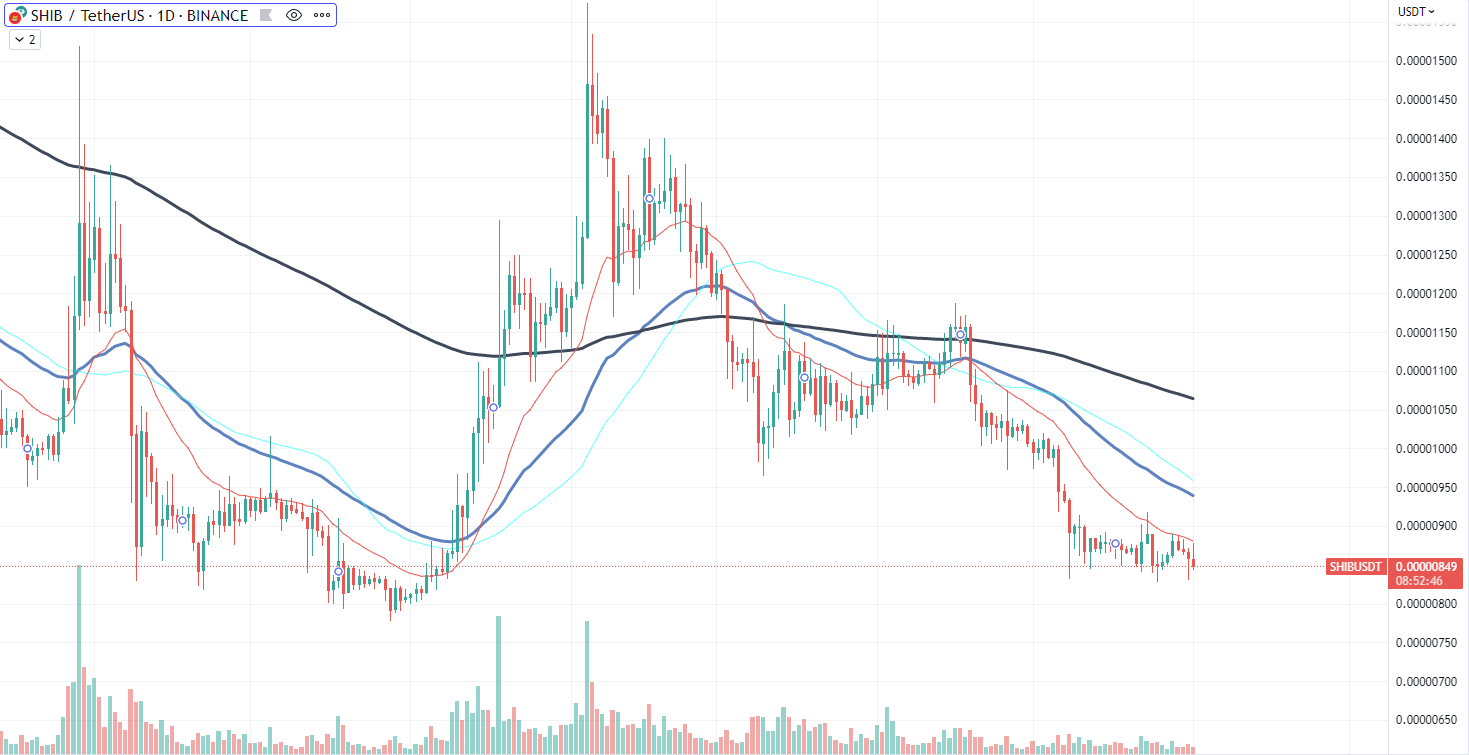

The coin is currently trading at $0.0000084, a level that, considering its past performance, highlights the dip in its demand and market momentum. Several factors seem to be weighing down SHIB's once stellar performance, chief among them being liquidity issues, decreased demand for first-generation meme coins, subdued volatility and low trading volume.

There has been a considerable decline in the liquidity of SHIB, making it harder for traders to enter or exit positions without impacting the market price. This lack of liquidity can deter potential investors, further lowering demand.

Simultaneously, it appears that old-gen meme coins like SHIB are falling out of favor. Investors are seemingly turning their attention toward the next generation of meme coins, such as those built on the Cardano network. This shift in focus is further diminishing the demand for SHIB, suppressing its price.

Subdued volatility is another concerning aspect. While high volatility often translates to more risk, it also creates opportunities for traders to profit from price swings. The current low volatility of SHIB indicates a lack of investor interest and market activity.

XRP faces correction

XRP is currently facing a setback after having broken through the psychological resistance level of $0.5. However, the coin was unable to maintain this bullish trajectory and promptly reversed course, falling back down below the aforementioned price level, pointing to a possible period of price correction or consolidation.

Despite making a commendable effort to overcome the $0.5 threshold, XRP's failure to sustain the momentum has become a source of concern for its investors. The $0.5 price point represents a significant level of psychological resistance, and the currency's inability to break through it suggests that a robust bullish trend may not be on the horizon.

Interestingly, the price reversal at $0.5 coincided with a noticeable spike in trading volume. This increase in volume could be a reflection of traders initiating short positions at this level, aiming to profit from the anticipated drop in price. This high volume of shorting can accelerate the decline of XRP, further exacerbating the downward pressure on its price.

While this reversal might appear concerning to some, it is crucial to remember that such retractions are not unusual on the cryptocurrency market. Price reversals often represent market sentiment and can present traders with opportunities for strategic entry or exit points.

Meme coins are blossoming on Cardano

The recently emerged Snek (SNEK) meme coin is gaining more traction on the cryptocurrency market as, according to recent data from CoinMarketCap, the Cardano-based meme coin is one of the most trending assets on the market, reflecting the broader surge of interest in meme cryptocurrencies.

In less than 24 hours, SNEK has leapt onto the top 10 list of the most trending assets, while previously skyrocketing by more than 300% since being listed as a separate Uniswap pair.

The surge in SNEK's value coincides with a period of intense debate within the Cardano community. Members have been discussing the impact and role of meme coins on their blockchain. The debate is framed by contrasting views, with some highlighting the beneficial effects such as increased volume and network activity, while others worry about potential drawbacks such as liquidity drains and the risk of scams and exploits.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov