Fortunately, yesterday’s price decline of the whole cryptocurrency market has stopped or at least postponed; all top 10 coins are in the green zone. The top gainer is Bitcoin Cash, whose rate has increased by around 3%, while the price of XRP has grown by only 0.9%.

Against all this, the BTC market share has risen and now constitutes 57%.

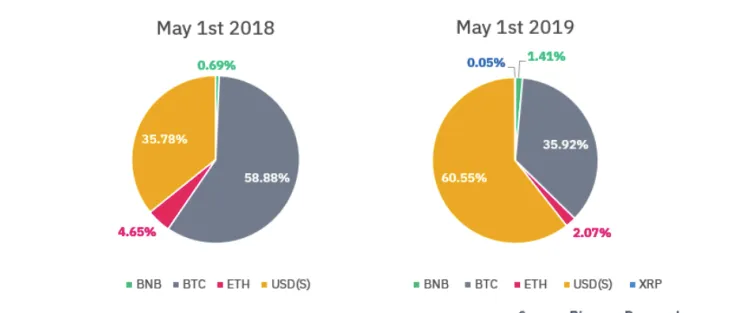

However, it is too early to get rid of altcoins, as they are expected to show good growth. According to Binance Research, a comparison with the previous year and the volume of 24-hour quotes this year shows the growing popularity of altcoins and stablecoins.

As a result, BTC pairs lost almost 40% of their market share. The reason for this is the introduction of several pairs of stablecoins with new assets.

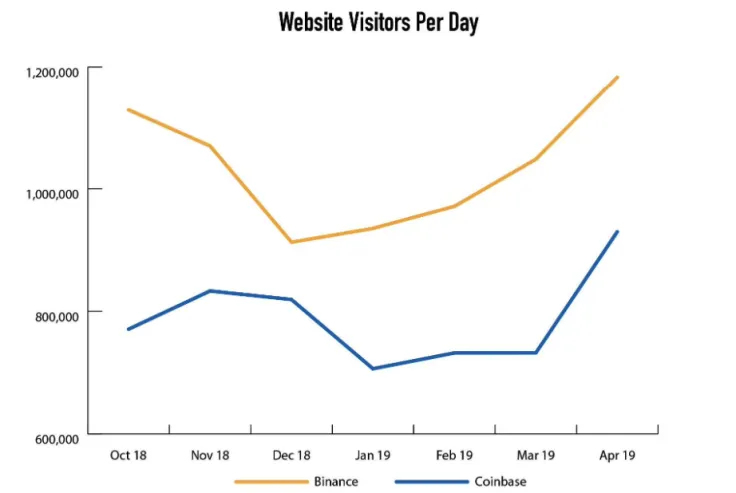

What is more, the number of views on websites related to Bitcoin is growing. Over the past 90 days, popular cryptocurrency sites have had significantly more visitors.

Leading cryptocurrency exchange Binance is in 911th place in the world, which is 233 places higher than three months ago. Coinbase, a major US cryptocurrency exchange, has risen by 288 positions and now ranks the 1,236th website.

Now, let’s switch to technical analysis.

BTC/USD

Our Bitcoin prediction made earlier is coming true, and the scenario of reaching $8,000 and above until the end of May remains relevant.

On the hourly graph, Bitcoin is looking positive, and there are no vivid reasons for a further decline below $7,500. The asset may still decrease to $7,700; however, the $8,100 resistance level is supposed to be attained in the end. The bullish MACD indicator supports such a course of events.

The price of BTC is trading at $7,830 at the time of writing.

ETH/USD

Ethereum is trying to keep up with Bitcoin; however, it is losing around 1% in correlation to BTC. Even the positive news background could not push the price of a leading altcoin to $250.

Cryptocurrency asset manager Grayscale Investments received the listing of the securities of its Ethereum trust (ETHE) in the over-the-counter trading system of OTC Markets.

Regarding the technical forecast, Ethereum is following our price prediction, and reaching $250 is just a matter of time. Despite being traded sideways for around a week, a further price dump is not noticed on the chart. Both MACD and RSI show positive sentiments, and Ethereum holders might see the price at $260 till May 31.

The price of ETH is trading at $244.36 at the time of writing.

XRP/USD

Ripple is looking the worst out the top 3 coins – its rate has increased only by about 1% overnight. The quotes are moving in the opposite direction compared to Bitcoin and Ethereum.

Even though Ripple is located in the green zone now, the short-term forecast is not promising. The decreasing trading volume, along with the bearish MACD indicator, may push the price down to the support level at $0.3650 shortly.

The price of XRP is trading at $0.3742 at the time of writing.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin