Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The crypto market starts the session with Bitcoin trying to reclaim the same $93,000 line it lost at the start of December, pulling sentiment back into recovery mode. XRP ETFs continue the streak with no single red day since launch. SHIB prints a bottom signal that looks stronger than anything it showed in months. BTC’s monthly Bollinger Band setup still treats $125,000 as the main scenario, not a fantasy number.

TL;DR

- XRP ETFs approach $1 billion in less than a month.

- SHIB hints at a 29% move to the weekly midband.

- Bitcoin regains $92,000 and carries a clean $125,000 upper-band setup.

XRP nears first $1 billion in ETFs

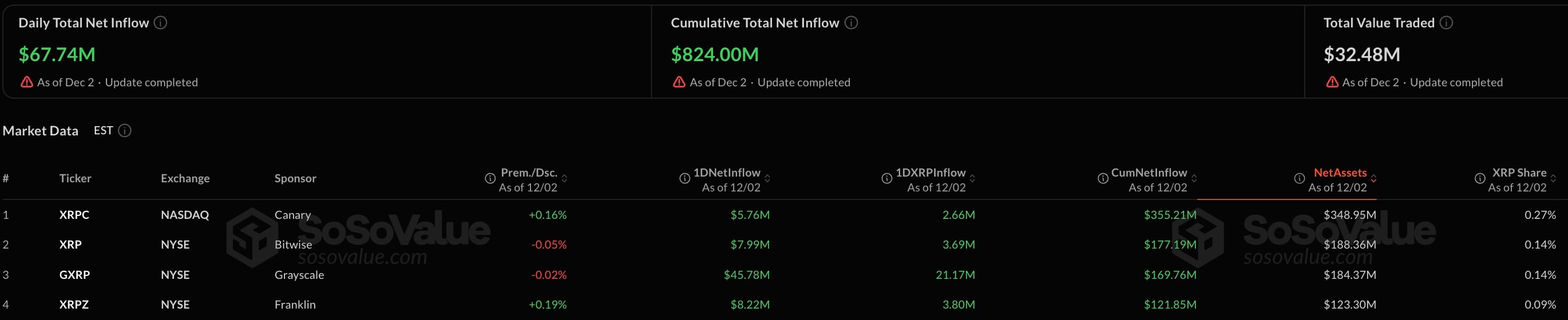

Full-fledged spot XRP ETFs launched only on Nov. 13, and barely 30 days have passed — yet they already pulled $824 million in cumulative inflows as of Dec. 2. The pace did not slow with time, it accelerated. This week alone — and we are only two days in — already added $157 million, according to SoSoValue. If this trend keeps its shape, crossing the $1 billion line this week can become a very real outcome, with three trading days still left.

The other part that stands out is the uniformity: not a single red day from launch. Every session ended with inflows, across all issuers — Canary, Bitwise, Grayscale, Franklin Templeton — and the daily dashboard on Dec. 2 added another $67.74 million, pushing total net assets to $844.99 million.

No, these inflows still are not strong enough to recreate what ETFs did for Bitcoin — that effect was built on a very different supply dynamic — but the current scale looks strong enough to hold XRP above $2 even in weaker market windows.

With Bitcoin recovering and giving the whole market a boost, XRP finds itself among the altcoins best positioned to ride this environment. For a token that spent years under a regulatory cloud because of SEC v. Ripple, pulling $1 billion in flows in in under a month is not something you can ignore.

Shiba Inu (SHIB) on the verge of 29% price rise

Shiba Inu (SHIB) seems to be benefiting massively from the latest market rebound. According to TradingView, the coin added more than 11% in the last 10 days, which is actually big for an asset that many had already declared "dead." SHIB holders never left, and the chart looks about ready to reward them with a clean upside push.

The weekly Bollinger Bands make the setup simple: SHIB printed what looks like a bottom reversal right at the lower band. If the market stays green, the next natural stop is the midband at $0.00001134.

From the current region near $0.00000881, that is a 29% move. The structure supports it: SHIB spent months drifting under its range, volatility was compressed and now even moderate inflows can produce outsized reactions.

If market conditions do not slip, SHIB’s 29% window is not speculation — it is the logical extension of its weekly performance.

Bitcoin to $125,000 closer than you think: Bollinger Bands

Bitcoin once again defies the usual expectations. If you did not sell into the early-December fear, congratulations — the price is back to where it was at the close of November. BTC fought through several violent swings but still ended up right in the $92,000-$93,000 zone, which remains the most stubborn resistance level in the whole structure.

What happens above that is the real story. The monthly Bollinger Bands already point at the upper band around $125,000 as the main scenario. BTC defended the midband perfectly and reversed from it, which is exactly how strong cycles behave. Even John Bollinger himself acknowledged how clean the W-bottom is, even if he is not fond of the risk/reward for fresh entries. The pattern is still the pattern.

A confident break of $93,000 would open a straight path toward the low $100,000s, with the $125,000 band acting as the natural magnet. Everything else in the market is wired to follow this move.

Crypto market outlook

Watch how Bitcoin handles the $93,000 ceiling this week because a clean breakout flips the entire market into $100,000-plus trajectory, accelerates ETF-driven flows into XRP and gives SHIB the green backdrop it needs to complete its 29% move.

- Bitcoin (BTC): Pushing into $93,000: Above this level, the next pocket sits around $102,000-$108,000, with $125,000 as the upper-band target.

- XRP: $2.10-$2.20 range holds with ETF flows acting as the main stabilizer.

- Shiba Inu (SHIB): Weekly midband target at $0.00001134 teases a 29% upside.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov