Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

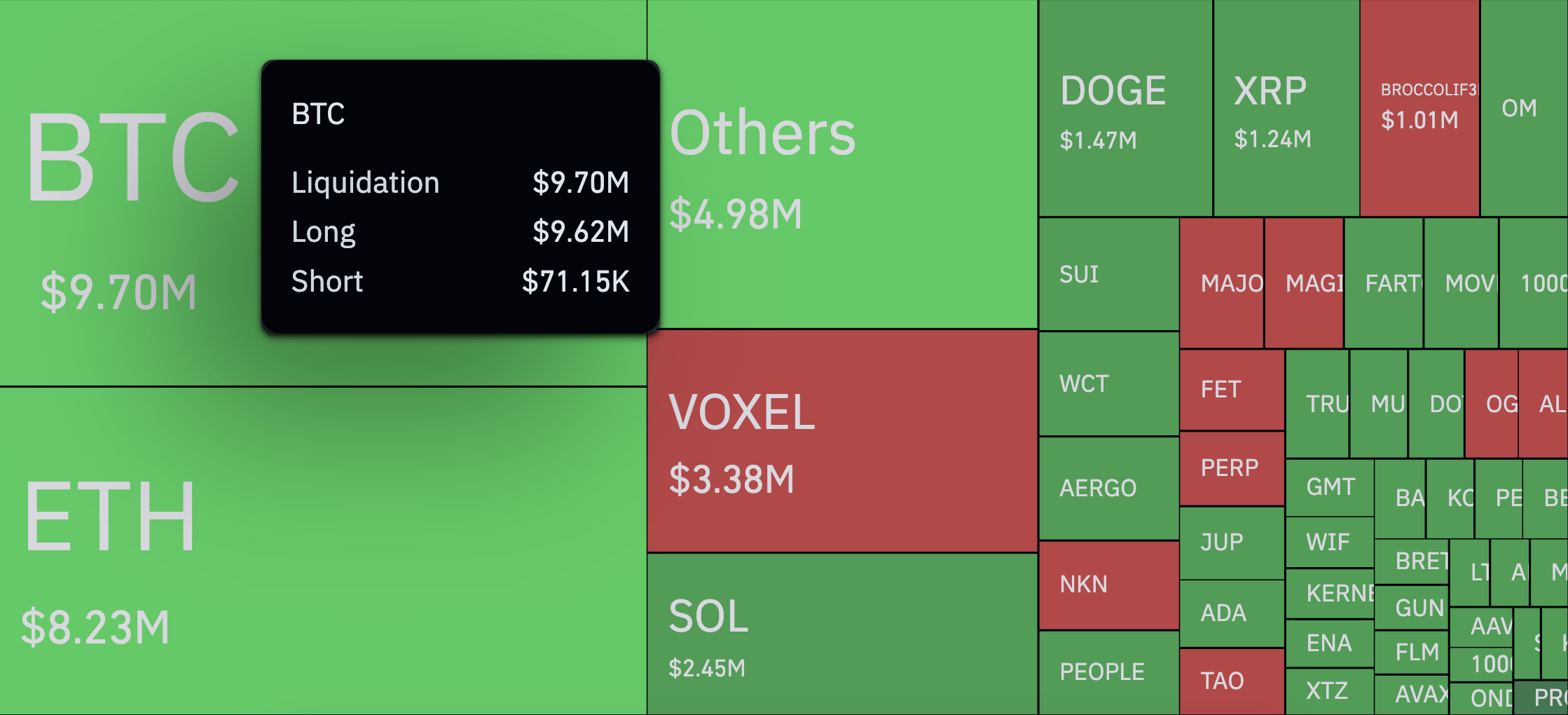

It's not the kind of Easter surprise traders were hoping for, as over the past four hours, Bitcoin (BTC) has seen a massive 13,520% long-to-short liquidation imbalance, with $9.62 million in longs wiped out compared to just $71,000 in shorts. The move came amid a sharp drop in the price of BTC to lows near $83,800 before a mild bounce to the current level of $84,453.

The sell-off triggered a total liquidation of $35.35 million across the market in the same four-hour window, with 83.6% of the damage coming from longs.

BTC alone accounted for the largest chunk at $9.7 million, followed by ETH at $8.2 million and SOL with $2.45 million in liquidated leverage.

The magnitude of the imbalance speaks for itself. While long liquidations are common in rapid pullbacks, this kind of one-way flush — over 130 times more long positions were liquidated than shorts — shows just how exposed the market had become heading into the weekend. The volatility was enough to drive a total of $165.1 million in liquidations over the last 24 hours, affecting over 119,000 traders.

The biggest single liquidation order? A $5.95 million BTC/USDC position on Binance, according to CoinGlass.

If you look at Bitcoin's price chart, you will see that the move was steep but quick. After spending some time at around $85,400, Bitcoin took a dip and hit a low of about $83,800. The quick reversal points to short-term overselling, but the damage to overleveraged long positions was already done.

Traders came into Easter Sunday thinking the market was going to go up. What they got was a brutal reminder: When everyone is going the same way, even a little push in the other direction can lead to a total wipeout.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov U.Today Editorial Team

U.Today Editorial Team