Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

At first glance, Shiba Inu’s recent price action appears brutal, but the behavior of the asset on the market reveals that the panic is premature and the most likely outcome for the asset is stabilization, rather than bear market acceleration and a further downtrend.

Shiba Inu stays down

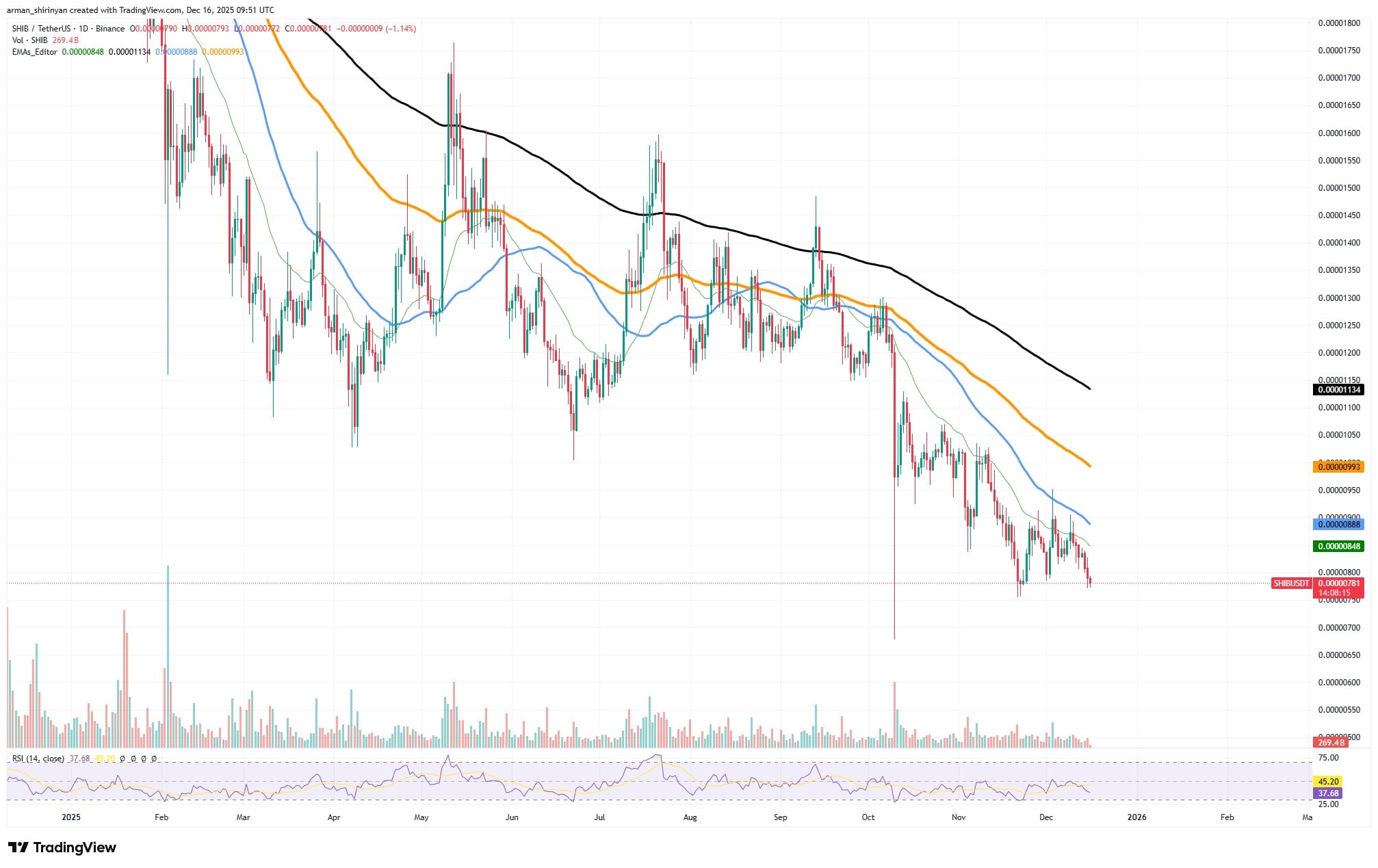

For months, SHIB has been in a steady decline, trading below all significant moving averages and steadily declining with few rallies. Nevertheless, the nature of the sell-off has altered, and this change is more significant than the level of prices. The panic phase seems to be almost over.

Compression, smaller candles and decreasing downside momentum followed the earlier sharp vertical dump that flushed liquidity. This is typical behavior following a panic. Sellers continue to be aggressive, and volatility increases when assets are still falling. The current situation is the opposite: the price is stabilizing close to a local floor rather than rapidly declining, volatility is decreasing and volume has returned to normal.

Why SHIB will not hit 0

Crucially, the notion of SHIB going to zero is not grounded in reality. Zero denotes total desertion, which includes no bids, no liquidity and no participation. SHIB is still listed on all major exchanges, trading with enormous volume and rotating its capital every day. Buyers are stepping in around the current range, even in weak conditions, absorbing supply instead of allowing the price to drop out of control.

Technically speaking, SHIB appears to be creating a local bottom zone. For a considerable amount of time, the RSI has been in extremely neutral-to-oversold territory, which frequently comes before a relief bounce or protracted sideways consolidation. Seller fatigue may be indicated by the price’s lack of aggressive lower lows. This indicates that the downside is getting more costly for bears, but it does not guarantee a reversal.

Nevertheless, the bottom has not yet been confirmed. A new wave of selling pressure, such as a wider market breakdown or a fresh spike in distribution volume, would be necessary for SHIB to move significantly lower from this point. It becomes statistically more difficult to continue to much lower levels in the absence of that catalyst.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov