Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

As fresh new data proves, Shiba Inu coin is not reacting to news, memes or sentiment right now. It is reacting to leverage.

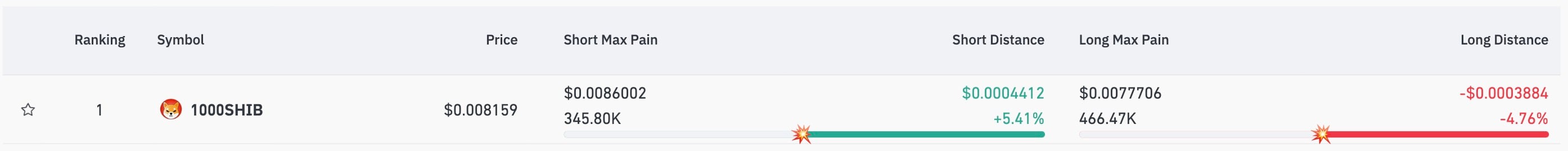

According to CoinGlass, the level causing the most damage to SHIB bulls sits near $0.00777, while the level that hurts shorts is higher, near $0.0086. With the price trading around $0.00816, the downside liquidation zone is simply closer. That matters because the price often moves toward the nearest group of traders who can be forced out.

This is not a prediction or a theory. It is how leveraged markets behave when volume thins and conviction weakens. In SHIB’s case, a drop of less than 5% can trigger long liquidations. A move up needs more than 5% and stronger buying pressure to start hurting shorts.

So, the only thing evident about the Shiba Inu coin right now is an imbalance, where downside pressure is easier to activate than upside pressure.

Shiba Inu (SHIB) price chart reflects trend

Since mid-November, SHIB has failed to hold rebounds. Each bounce has been sold earlier than the previous one. The area above $0.009 rejected the price multiple times, and no durable support has formed above recent lows.

This setup does not mean SHIB must collapse. What it means is simpler: leverage needs to be resolved. If the price briefly dips into the $0.0077-$0.0078 zone and selling dries up quickly, weak longs are cleared and price can stabilize. That is how short-term bottoms often appear. If price slides into that zone slowly, pressure can extend lower as liquidations keep feeding selling.

The bottom line is that SHIB is not ready for a clean upside move yet. It is sitting in a zone where longs are the first stress point.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin