Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The second week of January is off to a rough start, with a strong reminder that leverage is still the name of the game. XRP's minor price drop led to one of the most extreme liquidation events ever recorded, catching bulls 760,000% offside in just one hour.

Meanwhile, Ripple co-founder and longtime CTO David Schwartz spoke out on his retirement from his day-to-day post, saying he feels fine and happy. And Coinbase CEO, hot off a record 2025, hints at even bigger things to come in 2026.

TL;DR

- XRP bulls wiped out by a 760,456% long-short liquidation imbalance on a 2.4% dip.

- Ripple CTO David Schwartz says he is fine and happy after retirement.

- Coinbase CEO outlines a push for 2026 dominance after a historic 2025 finish.

XRP bulls walk into 760,456% liquidation trap

XRP lost just over two cents in price during a late-session hour — a modest 2.41% pullback from $2.29 to $2.235 — but that small move was enough to wipe out millions in long positions and generate one of the most imbalanced liquidation metrics seen since the start of 2026.

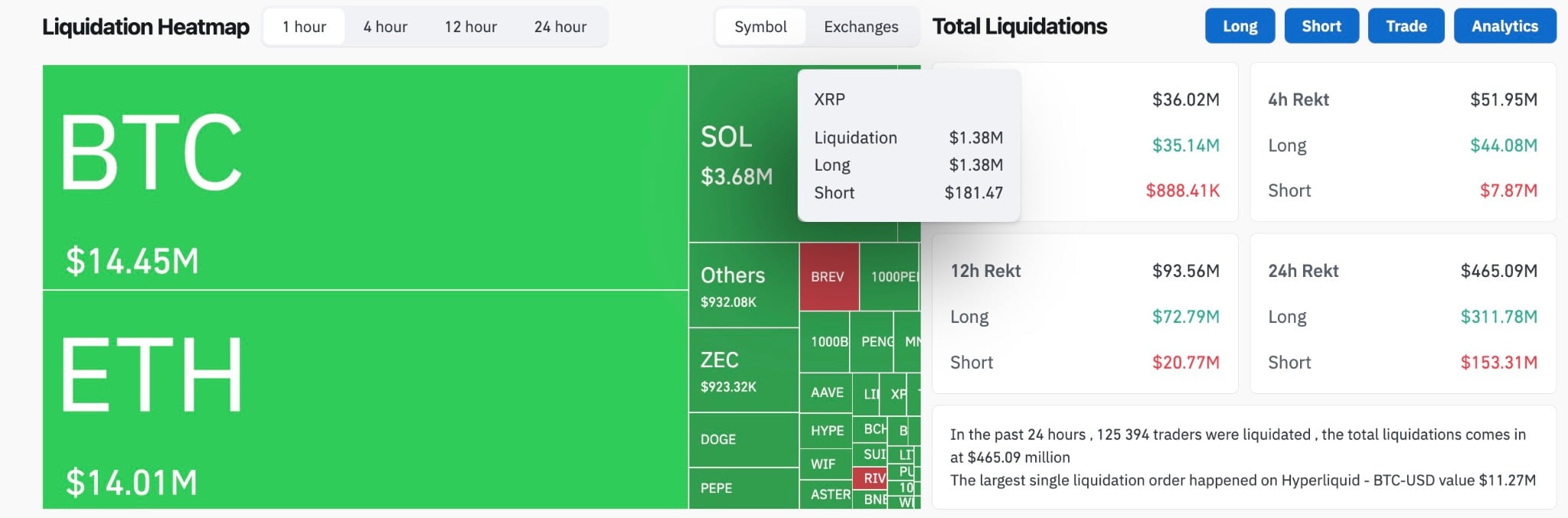

Total XRP long liquidations for the period came in at $1.38 million, as per CoinGlass, while short positions were barely touched, with under $200 in margin calls. The result was a 760,456% liquidation imbalance, which is not just due to chart shape, but also from a lot of concentrated leverage in one direction.

XRP has since stabilized just above $2.24, but the damage is structural. A lot of long positions that were loaded in above $2.28 are gone now, while shorts still lack the momentum or range to capitalize. What's left is a market that is pretty much neutral, with not a lot of conviction and even less flexibility in how it is positioned.

Across the rest of the board, 24-hour total liquidations hit $465 million — with $311 million of that going to the long side. BTC and ETH both took a hit for over $14 million each, but XRP's imbalance ratio was the star of the show on the heat map.

"I feel fine": Ex-Ripple CTO Schwartz breaks silence on retirement

This week, David Schwartz broke his silence with a simple message: he is happy and doing well after stepping back from his role as Ripple’s chief technology officer.

This was not a new position change. As of Jan. 1, he had transitioned into a non-operational role and was listed as CTO emeritus, while remaining on Ripple’s board. Although the transition was made quietly, the lack of direct comment from Schwartz sparked outside speculation. One post even tried to frame the farewell as a postmortem.

His response shut that down. It was just a clear signal that he is comfortable with the shift and not looking back.

Elsewhere, Ripple also closed the door on IPO talk, at least for now. In an interview this week, company president Monica Long said that Ripple has no plans to go public. She pointed to the company's strong financial standing and said that Ripple is focused on product development and private acquisitions rather than public listings.

Both updates have the same calm tone. Schwartz is fine. Ripple is not changing course. Any noise comes from outside, not inside.

Coinbase CEO Armstrong unveils big 2026 bet

Coinbase had a huge 2025, and Armstrong wants 2026 to be even bigger. This was the message in his response to Coinbase’s recap post, which highlighted a year of milestones, including:

- 24/7 CFTC-regulated futures trading

- U.S.-style perpetuals and spot/futures cross-margin trading

- $300 billion in assets under custody, becoming crypto’s largest custodian

- Inclusion in the S&P 500 — the first ever crypto-native company to join

These numbers are not just for show. Coinbase is not just dealing with regulation — it is using it to its advantage. CFTC recognition, perpetual rails and cross-margin provide U.S. users with true institutional-grade derivatives access.

Armstrong's brief statement about Coinbase's ambitious goals for 2025, with an even more significant target set for 2026, appears less like a marketing stunt and more like a challenge directed at competitors, regulators and TradFi institutions, all at once.

The 2026 expansion is probably going to focus on options markets, cross-border flow tools and maybe even tokenized assets custody. These are areas where Coinbase can use its licensing and custodial skills to beat out both traditional finance and newer crypto competitors.

Crypto market outlook

Derivatives data shows that long liquidations are still leading short pressure by nearly 2:1. This points to a bullish bias that has not been completely eliminated. XRP's liquidation imbalance is an extreme case, but several altcoins showed similar stress on the long side during the same session, especially mid-cap names with thin trading volumes and aggressive funding rates.

There has been no narrative shift yet. This week, ETF flows are neutral, meme coins are losing dominance again, and capital rotation into higher-beta assets is stalling. The next leg — if there is one — will require new fuel.

Key levels to watch:

• XRP: $2.23 must hold — any break below that level will bring the next floor closer to $2.18. The upside is capped at $2.29 unless selling momentum fades.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin