Prominent commodity trader Peter Brandt has predicted that Bitcoin could crash all the way back down to $25,240 now that its parabola has broken down.

The cryptocurrency is currently struggling to gain a foothold above the $90,000 level.

Exponential decay

Brandt’s main thesis is that Bitcoin's explosive growth is slowing down over time. It is not dying, but it is maturing. This essentially means that each "bull cycle" is less powerful than the last.

In 2011, Bitcoin might have gone up 100x. In 2013, roughly 50x. In 2017, 20x. In 2021, 10x. The implication is that investors expecting the same wild 100x returns as the early days are mistaken (sorry, Michael Saylor). The "thrust" or energy of the market is decaying exponentially.

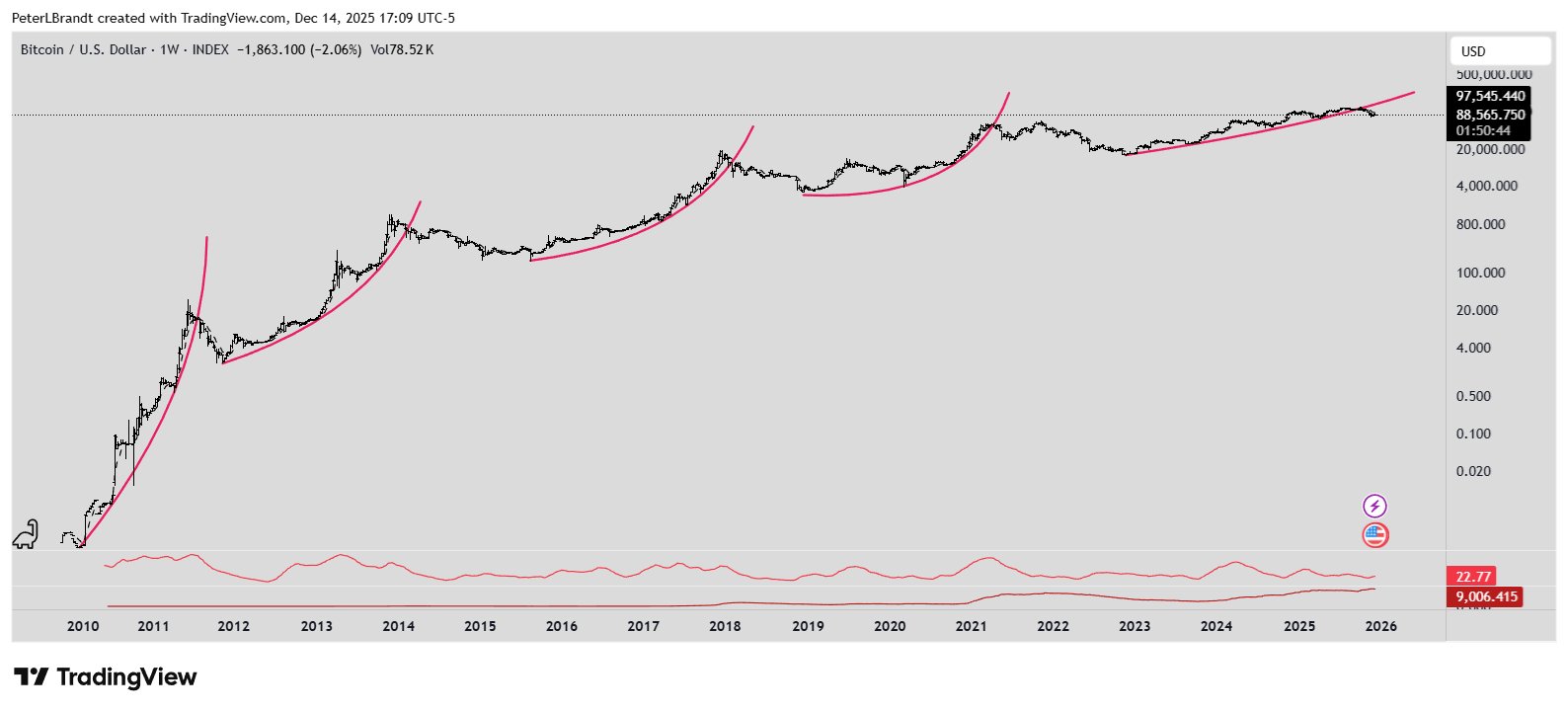

The chart shows the price of Bitcoin on a logarithmic scale over its entire history (2010–2025).

The four pink curved lines represent Bitcoin's parabolic advances. A parabola is a curve that gets steeper and steeper as time goes on. Brandt identifies four distinct cycles where the price went vertical.

At the end of the 4th pink curve, the price has crossed below the pink line. When an asset price falls below a parabolic support line, the trend is considered "violated" or broken. Every time in history (2011, 2013, 2017) that Bitcoin broke its parabolic curve, it crashed by 80% or more. In 2018, for instance, BTC dropped from $20,000 to $3,200.

Bitcoin will lose 80% of its value, leaving it with only 20% of its All-Time High (ATH) value, which is $25,240.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin